As per the latest communication shared by the income tax department, eligible tax refunds will be only issued digitally. Further, tax refunds will be made only to the bank accounts which are linked with PAN.

The new guidelines regarding the tax refunds will be effective from March 1, 2019. E-refund of income tax means that tax refund will be made directly to the bank account. Therefore, in order to claim the tax refund, you are required to pre-validate your bank account with the income tax department’s e-filing portal. In case your bank account is integrated to the e-filing portal then pre-validation can be directly done using the Electronic Verification Code (EVC) method or net banking otherwise, the income tax department will validate your bank account using the details filled in by you.

Also Read: e-Filing Income Tax Return Online

If your PAN is not linked with your bank account, you should provide the PAN details to link your bank account to receive the tax refund.

Also Read: How to Link PAN with Bank Account

Here is how you can pre-validate bank account at Income tax e-filing portal:

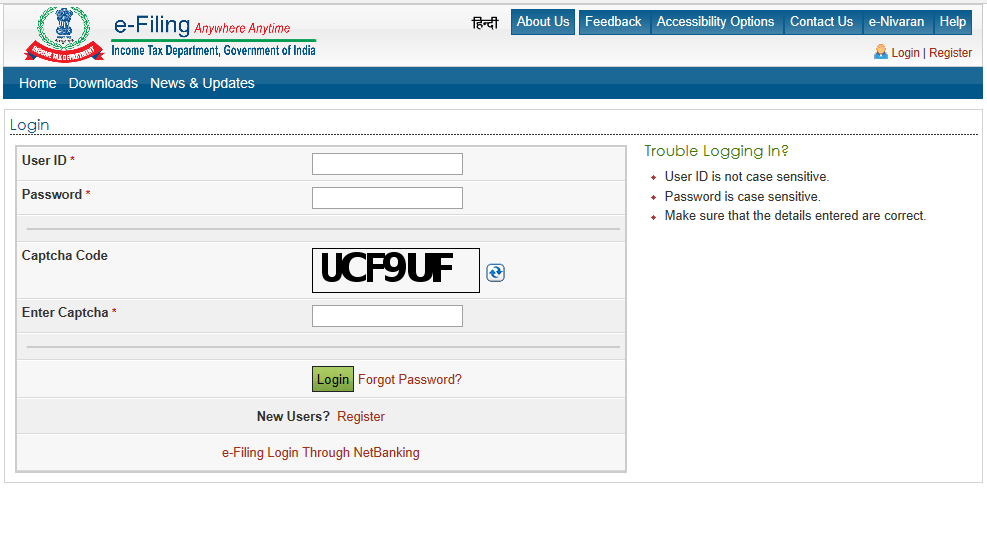

- Login to your account at Income tax e-filing portal using your user id and password. Your PAN acts as your user id.

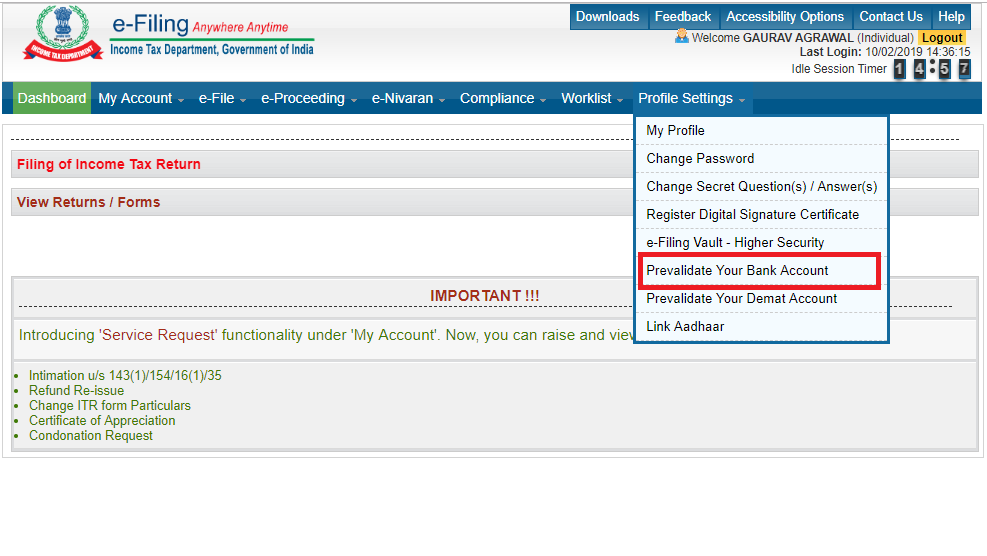

- Once logged in, click on the ‘Profile Setting’ option shown in the top menu bar and select ‘Prevalidate your bank account’ option from the drop-down menu.

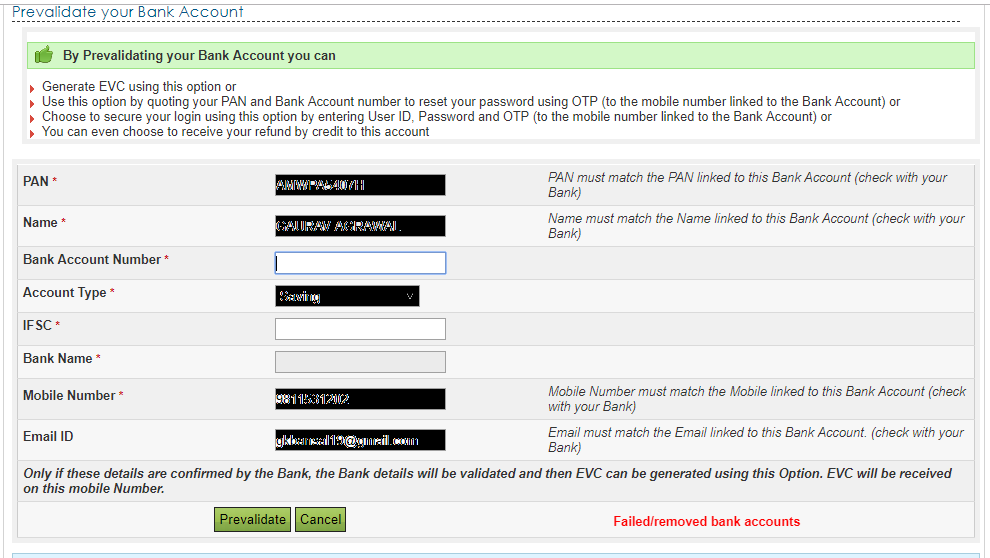

- Please enter the required details such as bank account number, IFSC code, bank name, mobile number and email id.

- Click on ‘Pre-Validate’ button.

- A message will be displayed on your screen which will read as “Your request for pre-validating your account has been submitted. Status of your request will be sent to the registered mobile number and email id.”