The UMANG App is designed to be a single unified portal for availing a range of government services. UMANG full form is Unified Mobile Application for New-age Governance and the UMANG mobile application was developed for Android and iOS by MeitY (Ministry of Electronics & Information Technology) and NeGD (National e-Governance Division) jointly.

The key goal of the UMANG App is to help drive digitization of services across India by promoting mobile governance across the country. Some of the key government services available through this mobile application include EPFO, Income Tax payment, Digilocker, NPS, Aadhaar, PAN and much more.

How to Access the Pay Income Tax Service on UMANG App

After you have completed UMANG App Registration, you can log into your UMANG App account using your registered phone number and log in credentials. Once you have logged into the UMANG application, you can access the “Pay Income Tax” module from the home page or using the search bar at the top of the UMANG App home page.

Step By Step Guide to Income Tax Payment using UMANG

The following are the key steps for making Income Tax Payment using UMANG App:

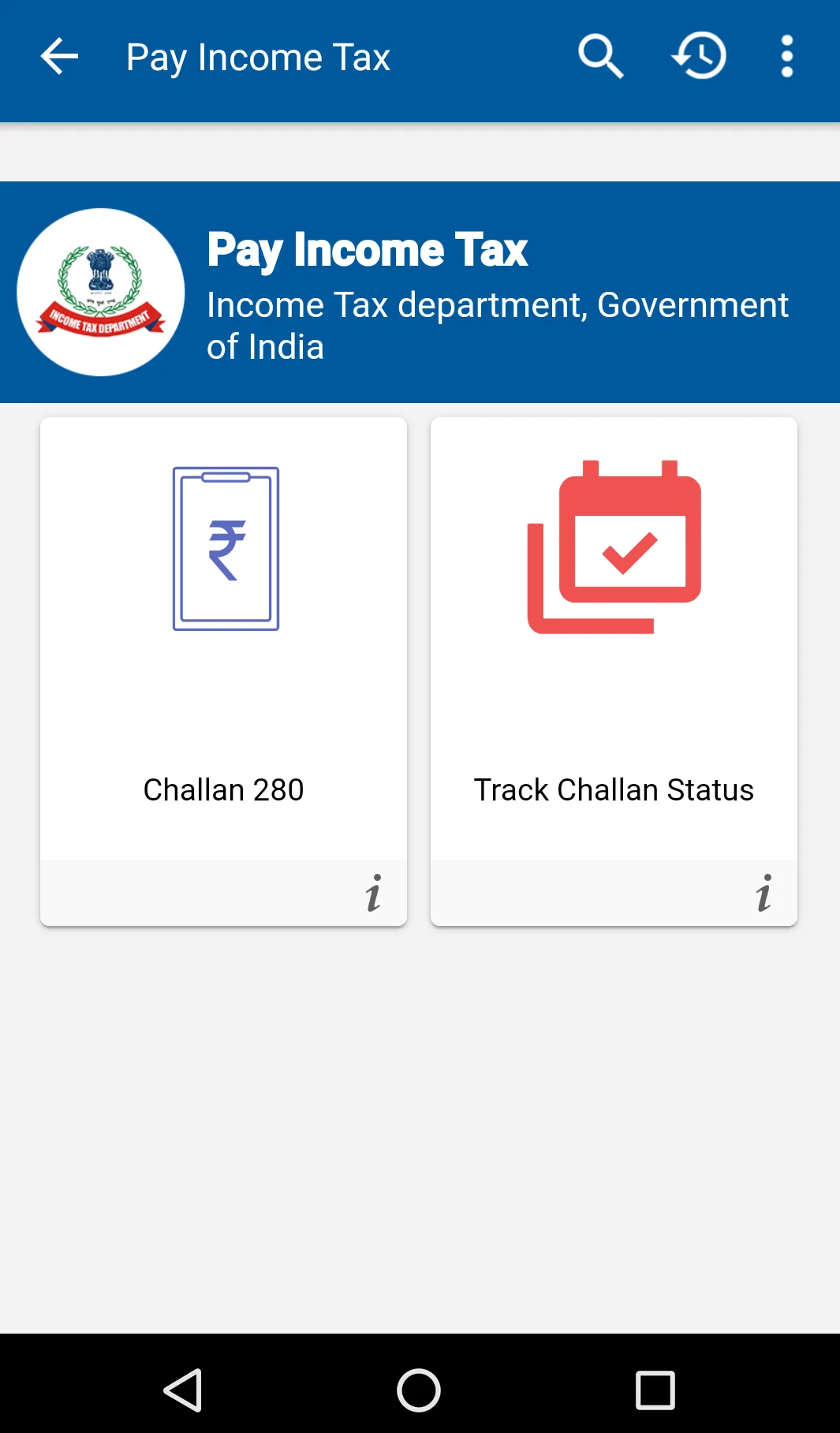

Step 1 – Once you click on the “Pay Income Tax” tile on the UMANG App Main page, you can get access to two options – “Challan 280” and “Track Challan” as shown below:

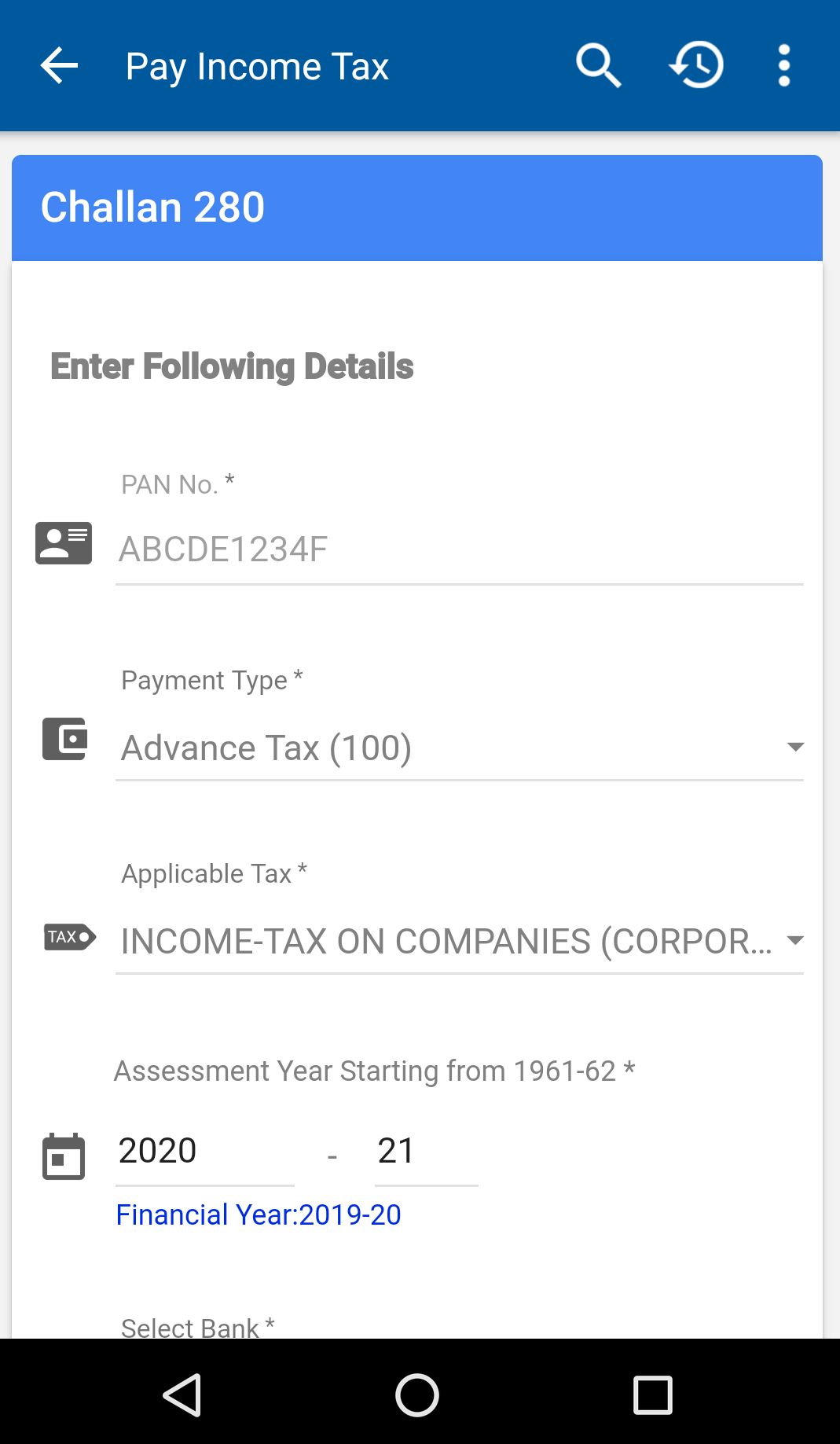

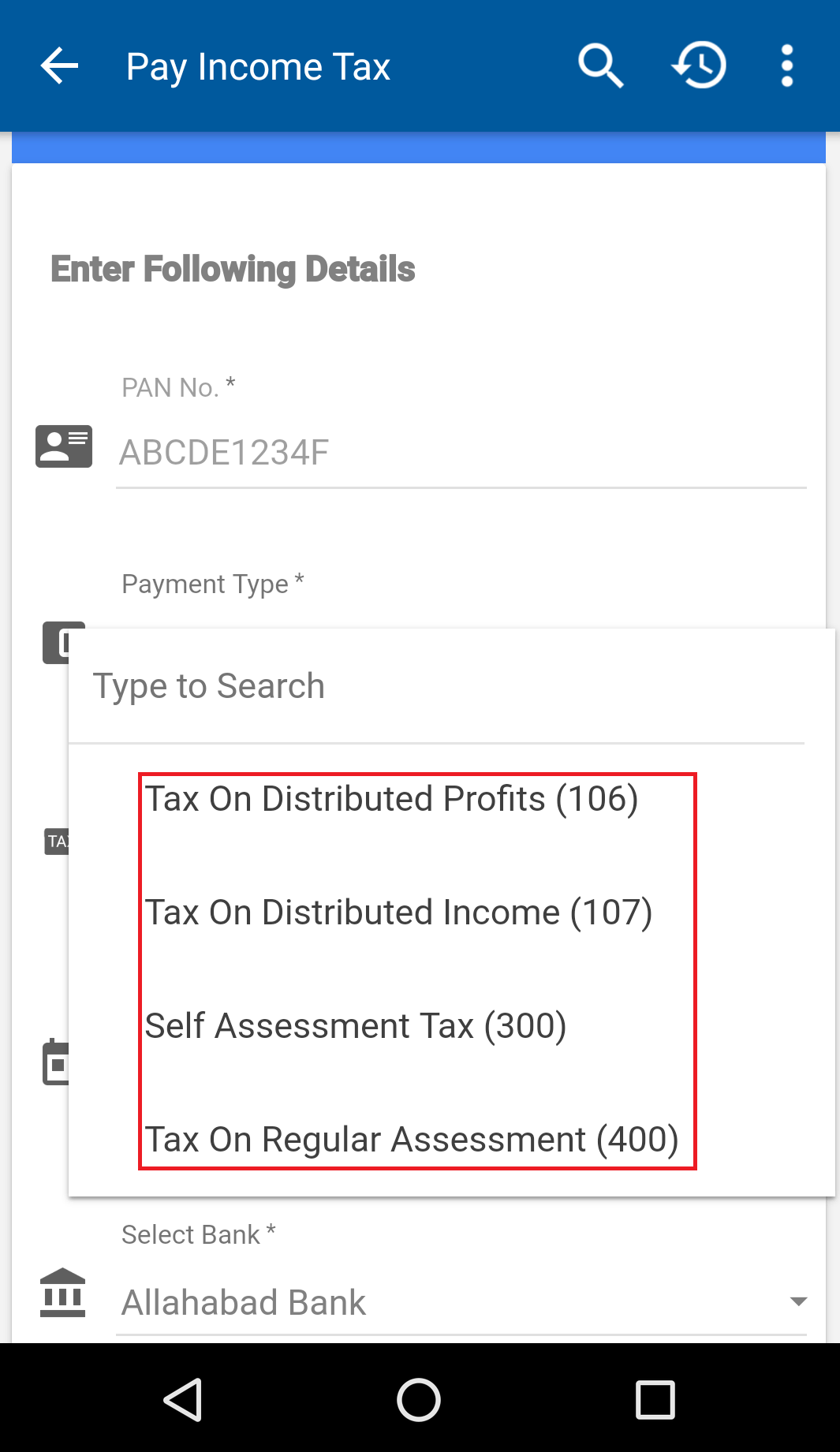

Step 2 – To pay income tax using UMANG, you need to click on the “Challan 280” tile which will direct you to a page where you can provide key details required for income tax payment:

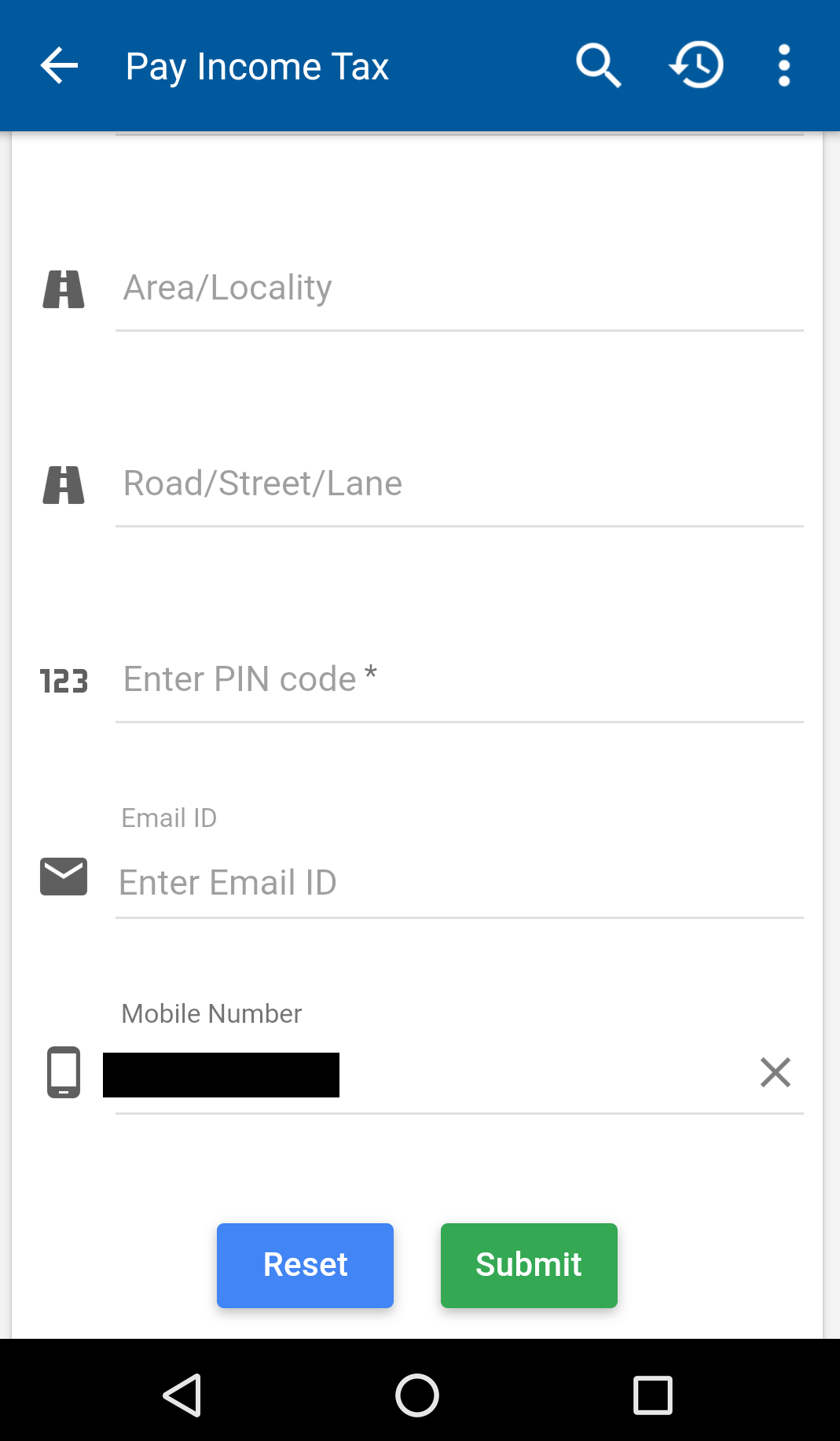

Step 3 – Fill out the key details in Challan 280 such as:

• PAN Number

• Payment Type i.e. type of tax payment being made

• Applicable Tax (Corporation Tax or Income Tax other than companies)

• Assessment Year

• Select Bank Name (for online payment/challan generation)

• Demographic details such as State, City/District, tax payer address, etc.

• Email ID of tax payer

• Mobile number (as per tax authorities/PAN records)

Note: All the fields on the Challan 280 form are not mandatory. You can choose to fill out only the mandatory fields in order to generate the challan.

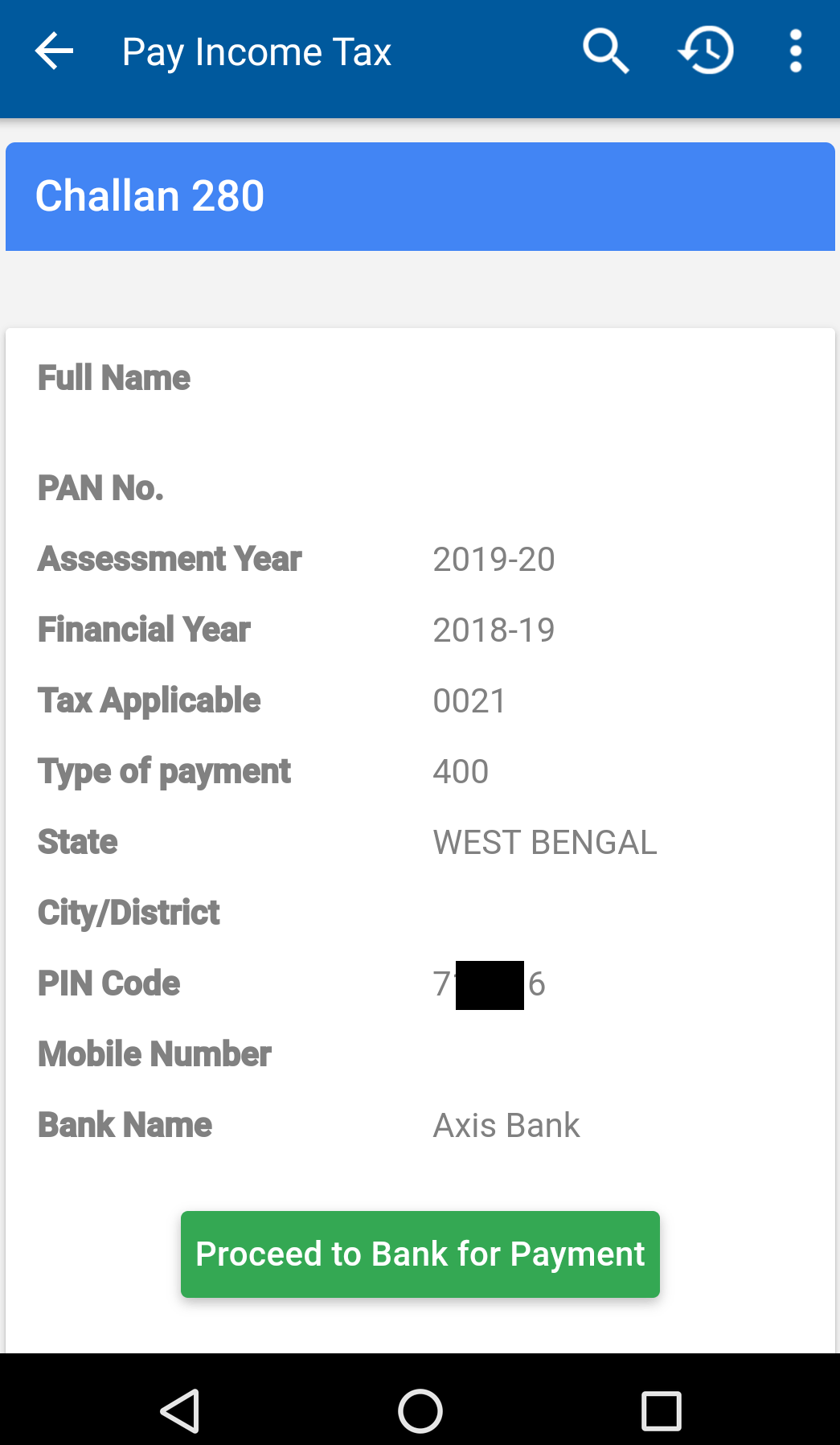

Step 4 – Once you have filled out the required fields and clicked on the submit button, you can view the final Challan 280 for payment of income tax similar to the one shown below:

By clicking on “Proceed to Bank for Payment”, you will be redirected to the Internet Banking portal of your chosen bank as shown in the challan and you can complete your income tax payment online through UMANG. Once you have completed the income tax payment online, you will receive a Challan Serial Number, Challan Tender Date and BSR code of collecting branch. Make sure you retain these details for future use.

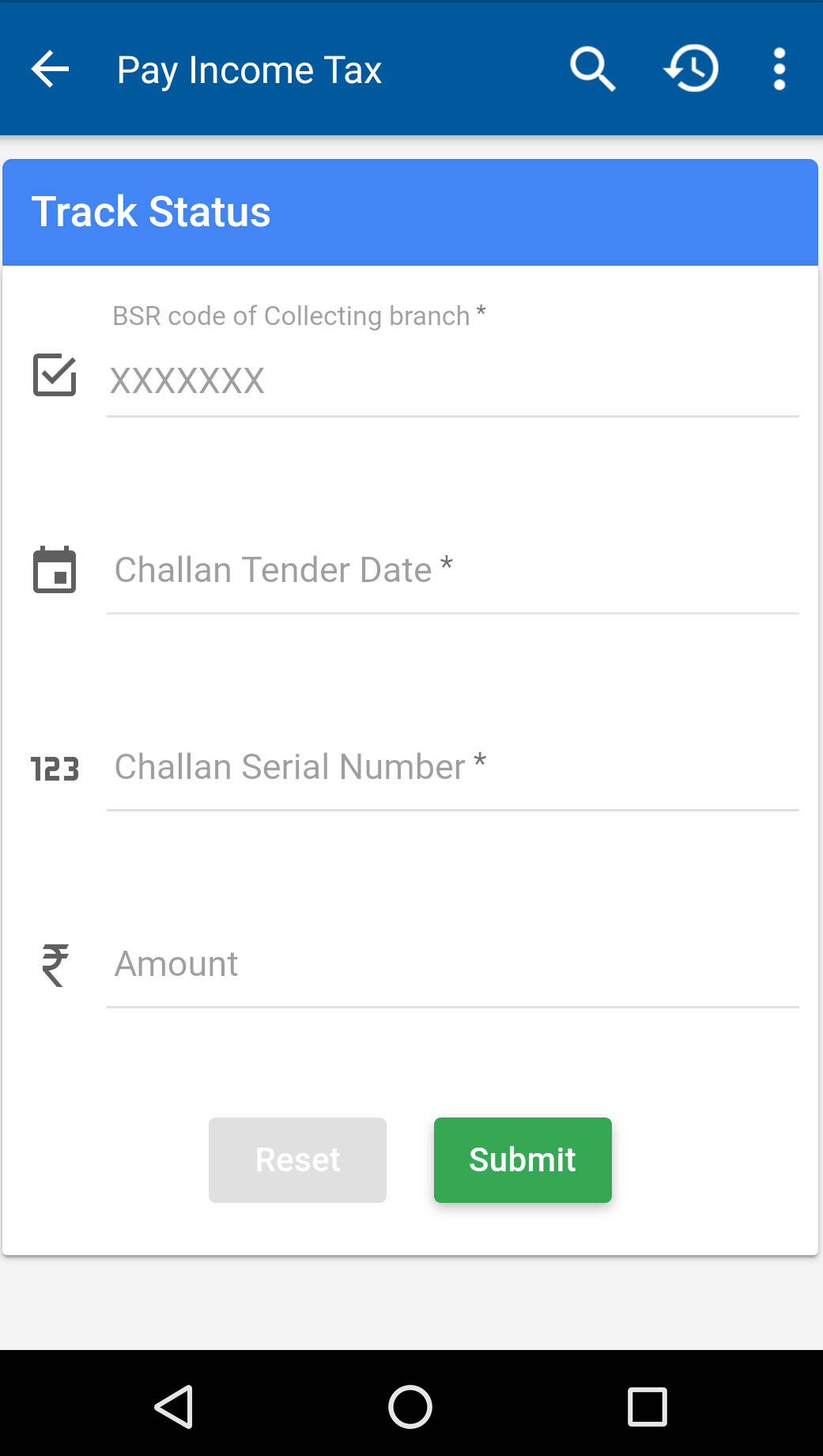

Track Challan Status on UMANG

If you have previously paid your Income Tax using the UMANG mobile app, you can use the “Track Challan Status” to know if your payment has been received by the government tax authorities. The following are the details you will need to provide to check the status of tax payment using Challan 280:

• BSR code of collecting branch (provided to taxpayer after payment of challan)

• Challan Tender Date (date on which challan was paid)

• Challan Serial Number (generated at the time of tax payment on UMANG)

• Challan Amount (non-mandatory field)

Tax Payment Options Using UMANG

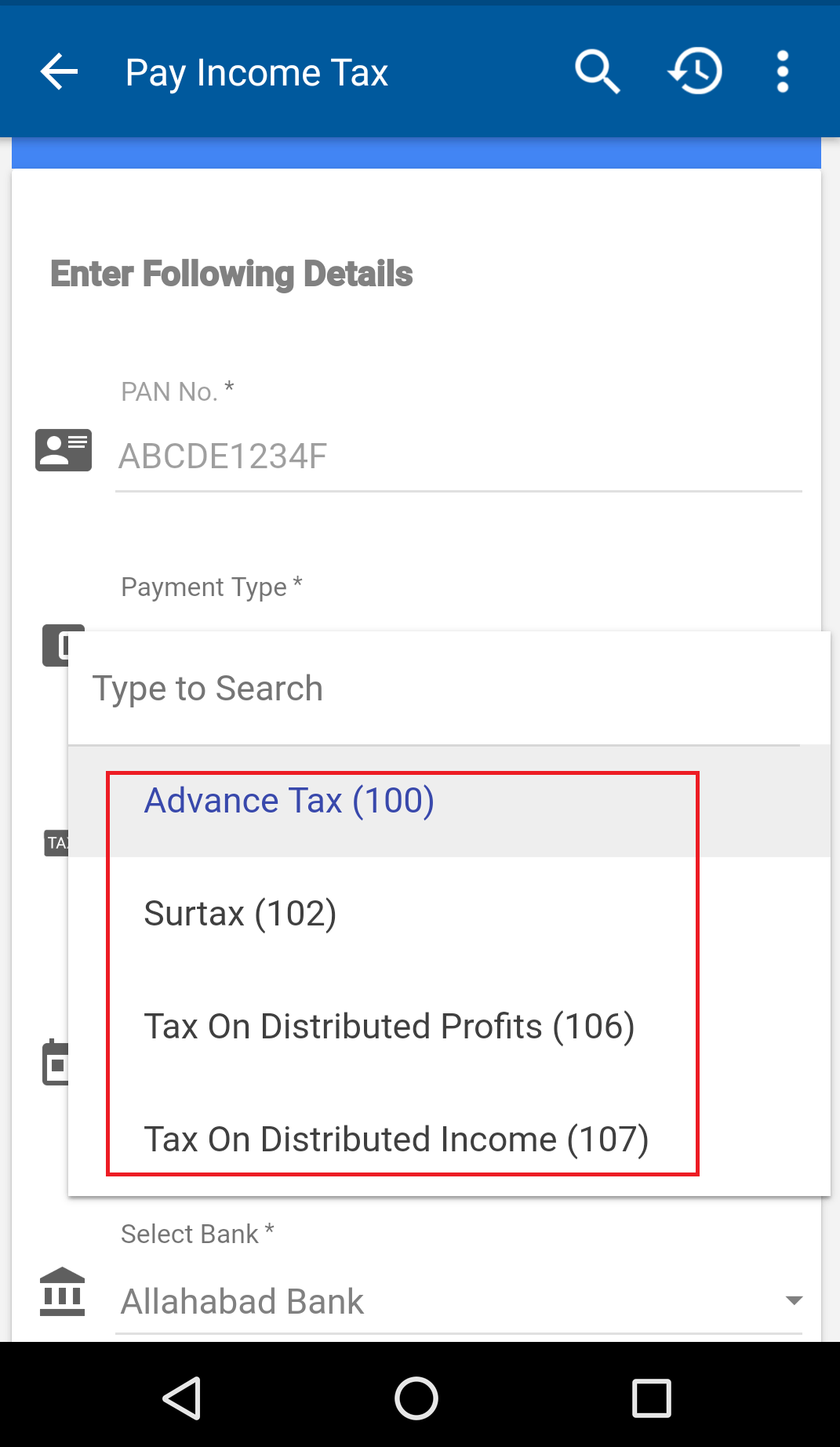

The Challan 280-based income tax payment system through UMANG allows tax payers to pay multiple types of taxes through a single platform.

The following is a short list of income tax types that can be paid using UMANG App:

• Advance Tax

• Surtax

• Tax on Distributed Profits

• Tax on Distributed Income

• Self-Assessment Tax

• Tax on Regular Assessment