Profession tax often referred to as professional tax is a type of direct tax that is levied on employees and people involved in various professions and trades in some key states in India. From the earnings of each employee, the company deducts an amount. Generally, the professional tax is levied by the state government and collected by the respective municipal authority. Since the profession tax is levied by the state government, the amount of tax payable tends to vary from one state to another. There are some states that do not even levy it. Individuals, Hindu undivided families and all associations/businesses/companies are liable to pay profession tax. However, the maximum amount that can be levied per person is Rs. 2500 in each financial year. Additionally, any profession tax paid is deducted from the total income tax liability of the payee.

Professional Tax in the State of Gujarat

In Gujarat, the professional tax is remitted on a quarterly basis. If the company comprises less than 20 staff members, the owner of the company or business will have to remit the amount within 15 days after the month ends. On the other hand, if the number of staff exceeds 20, the company or business can pay the professional tax on a quarterly basis. Again, it must be done inside 15 days after the end of the preceding quarter.

The rules of professional tax are framed by the state government but the tax is collected by specified municipal corporations. Online profession tax payment facility in Gujarat is currently available for the Ahmedabad Municipal Corporation and Surat Municipal Corporation. Prospective taxpayers can also access online forms for professional tax payment. The filing for return on profession tax has to be done within 15 days of the expiry of the preceding month. Businesses can even apply for annual returns.

In case of businesses having less than 20 employees, the owner can opt for annual returns. The filing of the return needs to be done within 15 days subsequent to completion of the preceding year. The final decision rests with the tax authority.

Profession Tax Pointers when starting a New Trade

While starting a new business venture, these are some of the points that need to be kept in mind with regards to professional tax. These are as follows:

- The application for registration of their employees should go to their tax department within 30 days from the date of the appointment

- It is mandatory to register all staff members in the time period of 30 days from the date they are appointed

- In case of owners of more than one business, the applications for registration have to be done with each authority separately in each jurisdiction where it falls

- All the necessary documents need to be submitted when registering for profession tax in Gujarat

Documents Required

The following is a short list of documents required for registering under profession tax rules in Gujarat –

- Proof of the date of starting the business (e.g Certificate of Incorporation)

- All records of accounts

- Details of employees

- Salary and pay slip details

- Proof of address

Registration of Profession Tax in Gujarat

The payer of professional tax has to apply for a registration certificate with the appropriate department of the state government. This registration procedure has to be finished within 30 days of employment of their staff in the organization. If the organization has more than one business, they have to submit separate application for profession tax registration for each business.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Profession Tax Slabs in Gujarat

Depending on the monthly salary, each person registered for profession tax pays a specific amount on a monthly basis. While profession tax is usually payable by the taxpayer themselves, in case of trade and companies, it is done by the employers.

| Monthly Earnings | Profession Tax Payable |

| Below Rs. 5999 | Nil |

| Rs. 6000 to Rs. 8999 | Rs. 80/month |

| Rs. 9000 to Rs. 11999 | Rs. 150/month |

| Rs 12000 and above | Rs. 200/month |

Online Profession Tax payment in Gujarat

Ahmedabad Municipal Corporation

These are the steps that you need to follow when opting for the online professional tax payment to the Municipal Corporation of Ahmedabad.

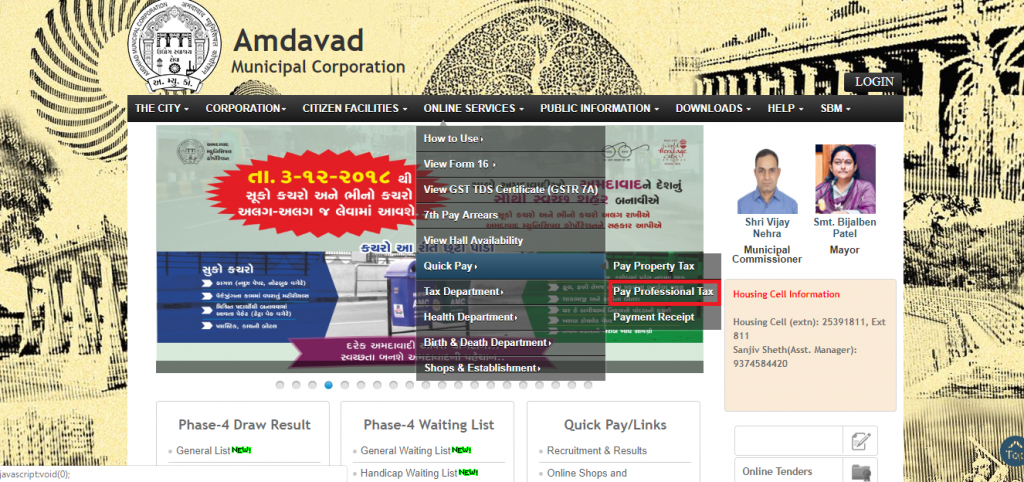

Step 1: Log in to the official website of Ahmedabad Municipal Corporation.

Step 2: Please click “Online Services” option shown in the top menu and select “Quick Pay” option from the drop-down menu. Now click on “Pay Profession Tax”

Step 3: Now, you need to enter Profession Tax No. If you don’t have the profession tax number, you can find it on your enrollment document or profession tax payment receipt of earlier years. Click on “Search” option.

Step 4: All the details related to the PEC number holder are shown on the page. Then, you need to select the “Pay” option. Then, the user can complete the payment either using credit or debit cards or through net banking.

A successful payment transaction means you have paid the profession tax.

Surat Municipal Corporation

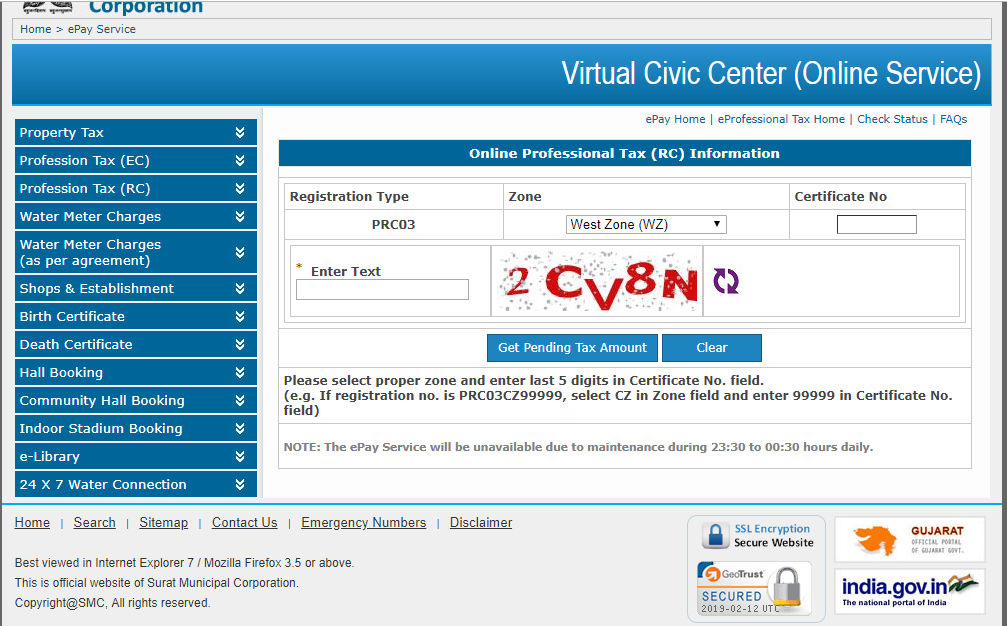

- Go to the e-pay page of the official website of the Surat Municipal Corporation.

- Now click on ‘Check & Pay Profession Tax’ shown under the Profession Tax column.

- Select your Zone from the given options and enter the certificate number. Your certificate number is the last five digits of your registration number. Let’s assume that the registration number is PRC03Z12345 then the certificate number would be 12345.

- Click on ‘Enter Pending Tax Amount’ option after entering valid captcha.

- The due profession tax will be shown on the screen. Please select the online payment option and pay the profession tax using your debit/credit card or through net banking option.

Note: The e-pay service of Surat Municipal Corporation remains unavailable between 23.30 to 00.30 hours daily for maintenance purposes.

Gujarat Profession Tax Payment Due Date and Late Payment Penalty

Please note that you need to stay up to date with the latest rules from the official government website, which is periodically updated. Currently, the rules are that if you have less than 20 employees, you need to pay the tax before 15th of the following month. But if you have more than 20 employees, you need to pay the tax before the 15th of the month subsequent to end of every quarter. Thus the dues dates for quarterly profession tax payment are 15th July (for April to June quarter), 15th Oct (for July to September quarter), 15th Jan (for October to December quarter) and 15th April (for January to March quarter). The penalty for late payment of professional tax in Gujarat is 18% per annum on the tax unpaid computed on a daily basis.