Profession tax is a direct tax levied on all kinds of professions, trades and employment in proportion to the income of the individual. Since the profession tax falls under the ambit of the state governments as per the article 276 of the constitution, it varies from state to state. There are many states in India which do not even levy the profession tax. However, article 276 also caps the upper limit of the profession tax to Rs. 2500. Click here to find whether your resident state levies profession tax or not?

Profession tax paid by an individual is eligible for income tax deduction as per the Income Tax Act, 1961. Self-employed individuals can annually or monthly pay the profession tax on their own. But the employer deducts the tax from the salary of salaried employees. However, in order to pay the profession tax (if applicable), you need to register first and then only you can deposit it to the concerned authority.

The article provides a step by step guide for Karnataka to register and pay the profession tax online.

Karnataka

Table of Contents :

Eligibility

Individuals earning Rs.10,000 or more per month are liable to pay the professional tax in Karnataka under the Karnataka Tax on Professions, Trades, Callings and Employments Act, 1976.

If you are a salaried individual having a salary more than Rs.10,000 but less than Rs. 15000, you need to pay Rs.150 per month as a profession tax. In case your salary is more than Rs. 15,000 then you are required to pay Rs.200 per month.

If you are a legal or medical practitioner or a professional consultant then the professional tax depends on the tenure of your service. Please click here to find your professional tax in such a case.

The Karnataka government has developed a website dedicated to the professional tax named as e-Prerana. You can enrol yourself here for the professional tax payment and also pay it online. You can also go to the website for any kind of further information related to the profession tax in Karnataka.

How to enrol?

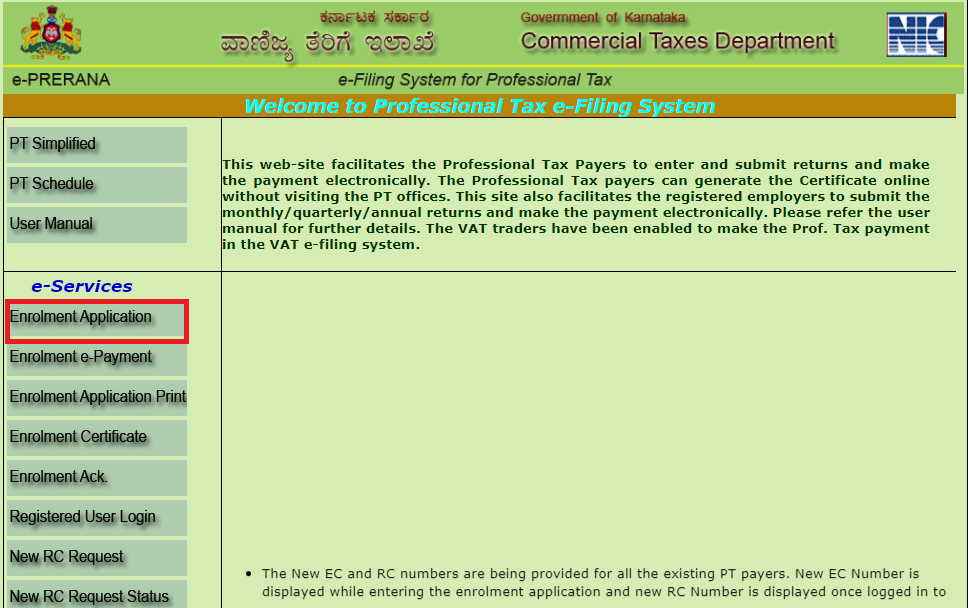

- Go to the e-Prerna Portal

- On the left sidebar, under the e-services section, please click on the ‘Enrolment Application’ option

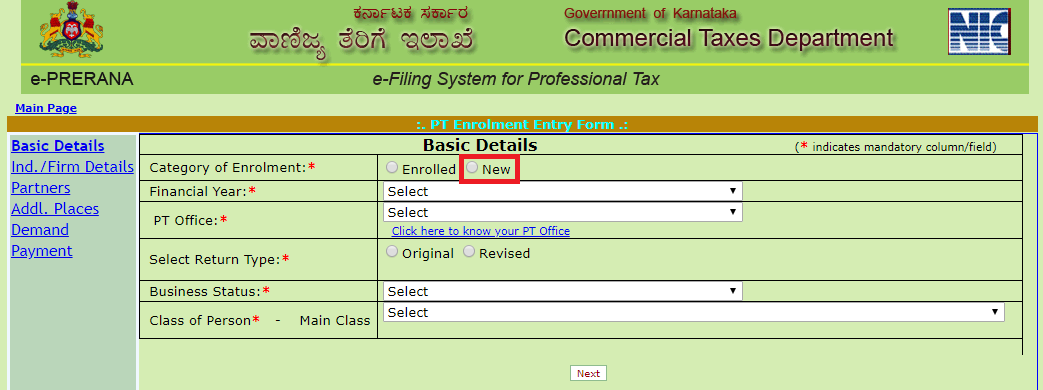

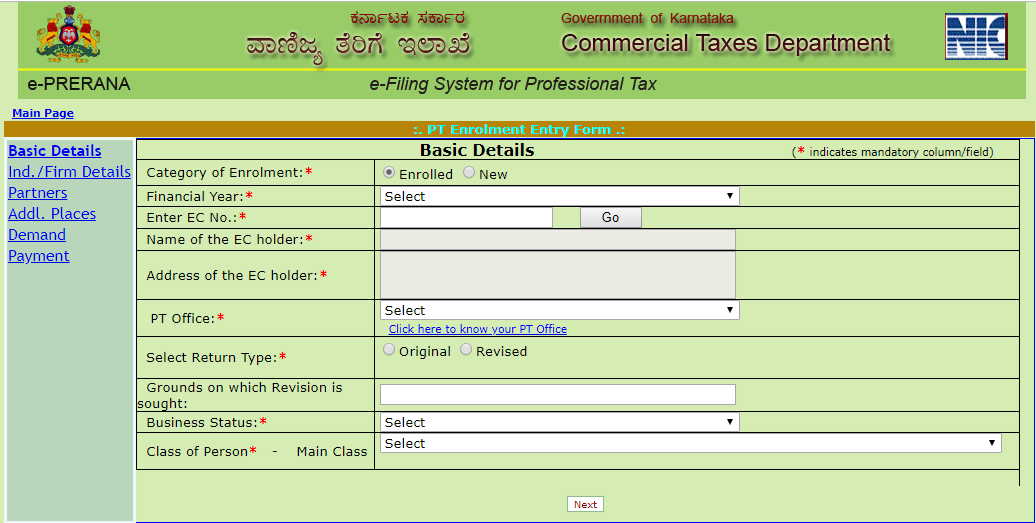

- In case you are enrolling for the first time, select ‘New’ in the category of enrolment

- Enter the required financial year for which you want to file your professional tax

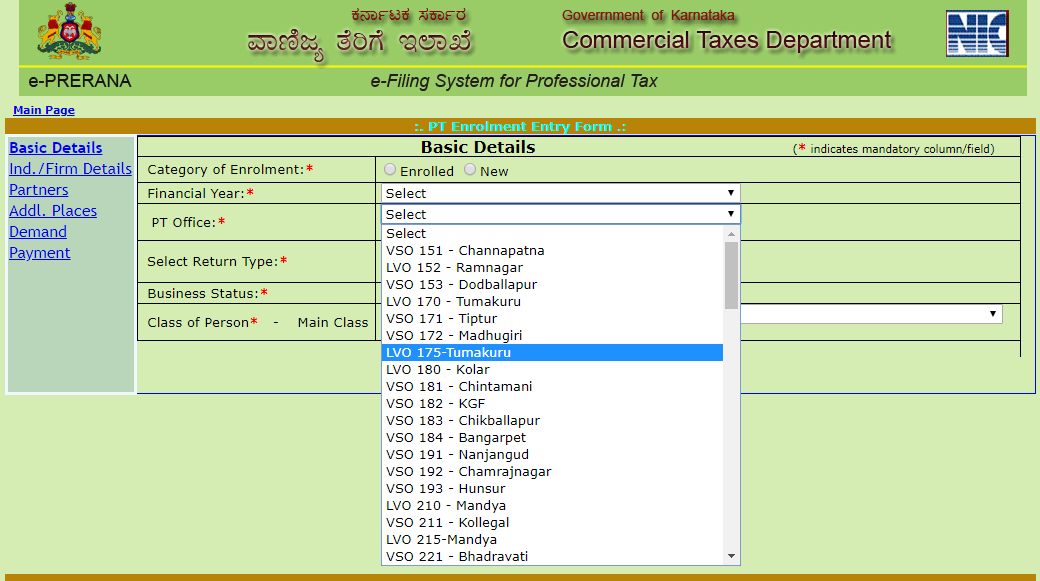

- Select your PT office on the basis of the pin code of your place of work from the drop-down menu

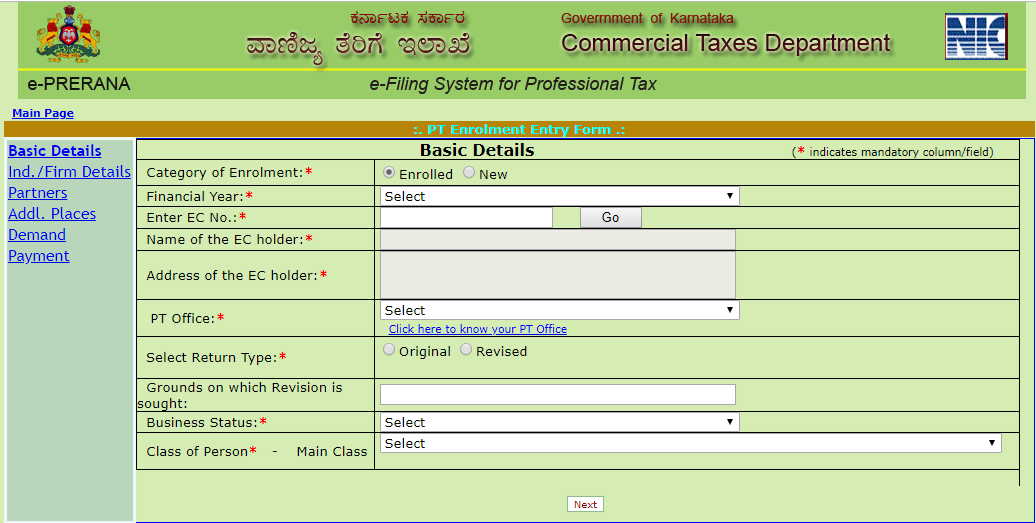

- If you have already enrolled before then select ‘Enrolled’ in the category of enrolment and fill in the required details including the EC (Enrolment Certificate) no. EC number is a 9 digit alphanumeric number allotted to an individual when he/she gets enrolled for the first time. You also get the option to revise the professional tax payment returns filed in earlier years.

- Select the business status as applicable

- Select the appropriate class of person to which you belong from the drop-down menu. After selecting the class, please select appropriate sub-class. Click on ‘Next’

- After clicking on next, you need to enter further details which include personal details like name, father’s name, date of birth, address etc. as well as firm details in which you are working or your own

- If you are having a partnership firm then the relevant details of the partners need to be entered

- After entering all these details, click on ‘Next’. A screen of additional places will be displayed. Only if you are running your business at multiple places (branches), the required details need to be entered. Click again on ‘Next’

- Now, you need to enter your tax detail as applicable. You can find the applicable tax rate to you in the PT Schedule. After entering the tax details, click on ‘Next’

- Please select the mode of payment. If you want to pay online, then select ‘e-Payment’ option, else you can select ‘Cheque/DD/Cash/Challan’ option. After selecting the mode of payment, click on ‘Submit’

- A unique number called the ‘PTN No’ is generated which you can note down for further reference

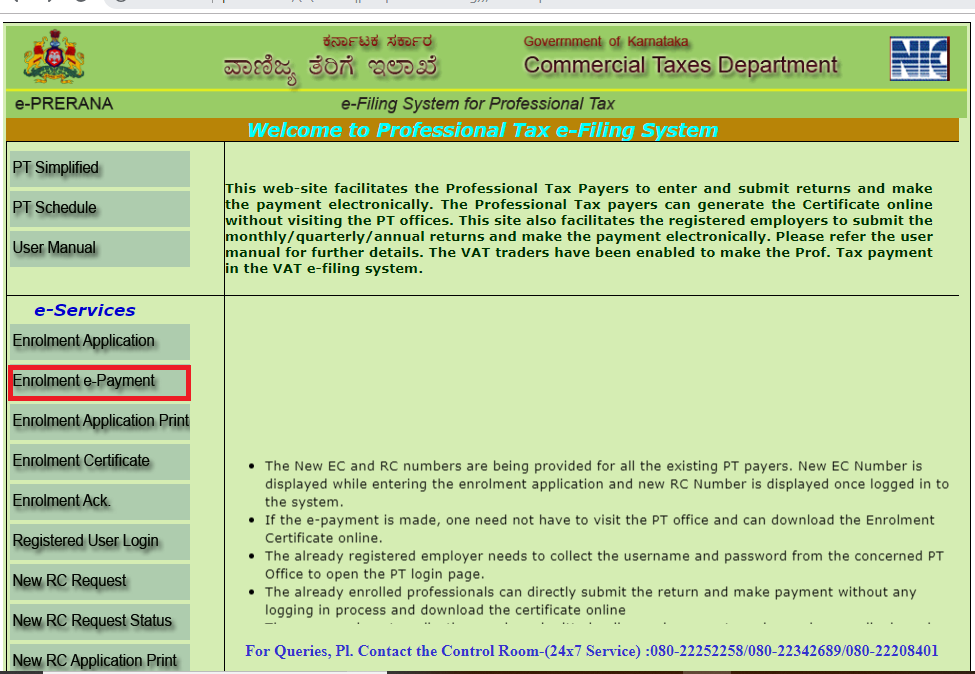

- If you had selected ‘e-payment’ option, then go to the home page by clicking here. In the left-hand bar, please click on ‘enrolment e-payment’ option under the e-services section

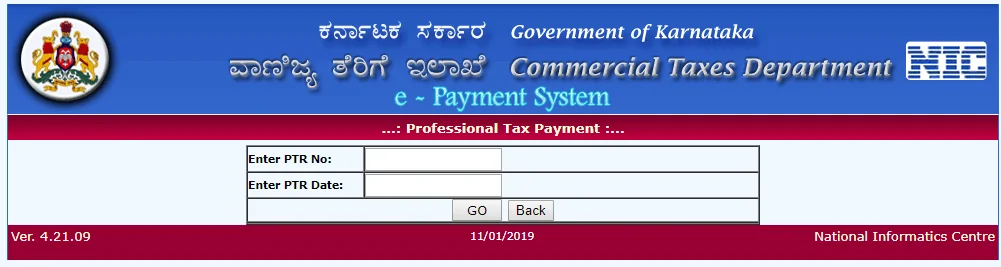

- Please enter the PTR No. and the PTR date, as required and click on ‘Go’ and make the online payment. Congratulations, you have deposited your professional tax online

- In case a person opts for the offline mode of payment like cheque or dd then you need to enter the details like the cheque number, MICR code, date and the amount. Now, click on ‘ADD’. The related details will appear on the bottom of the page. Now click on ‘Submit’ option. A ‘PRN Number’ will be generated

- Visit the jurisdictional PT office with the unique PRN number and physically submit the cheque/DD/Cash/Challan. The concerned PT Officer shall acknowledge the receipt

- Immediately after submission of the instrument like Cheque/ DD/Cash/ Challan and the same being acknowledged by the jurisdictional PTO, the person will be enabled to obtain the enrolment certificate and the acknowledgement through the web

Employer Registration

Every employer who is liable to pay the Profession Tax of his employees is mandated to obtain a certificate of registration first. Here is how an employer can get the registration certificate online.

- Go to the e-Prerana website.

- In the left-hand bar, click on the ‘New RC Request’ under the e-services section.

- Kindly fill in the basic details. Like constitution of business, business type, name of the firm, PAN, address and other such details. The legal name of the firm and the name registered in the PAN must match

- PT office depends on the location (PIN number) of your office. If you don’t know about the PT office applicable to you, please click here to know your PT office

- Enter the enrolment number of your Enrolment Certificate obtained under the provisions of the Profession Tax Act, if it is available

- If the applicant is a registered taxpayer under the Karnataka Goods and Services Tax Act, 2017, the 15 digit Goods and Services Tax Number (GSTIN) shall be entered

- If the applicant is a registered dealer under the provisions of Karnataka Sales Tax Act, 1957 (dealing in petroleum products like Petroleum Crude, Petrol, Diesel, ATF and Natural Gas) the registration number under KST and CST shall be entered

- You can verify your credentials by either providing the aadhaar card details or through the OTP sent to your mobile phone. It is not mandatory to provide the aadhaar details

- Now, you need to select your designation in the company from the drop down menu given in the ‘Status of the Applicant in the Firm’ option and upload the following documents:

- Photograph of Proprietor, Partner, Director, Authorised Person;

- Constitutions of Business: Registration of Incorporation, Deed of Partnership firm, Registration Certificate etc. as applicable;

- Proof of Principal Place of Business; and

- Bank Account Related Proof.

After uploading the documents submit the application and the computer would generate a registration certificate with a unique number. The username and password would be sent to the registered mobile number.

Note :

- Every employer registered under the Profession Tax Act is required to furnish a statement in Form 5-A every month showing the salary and wages paid by him to his employees and the amount of tax deducted by him. Such statement shall be furnished on or before 20th of succeeding month along with payment of the full amount of tax according to the statement.

- Such an employer is also required to furnish an annual return in Form 5 within 60 days of the expiry of a year.

Exemption

- No profession tax is deductible or payable by the employer for an employee who has been employed for less than 120 days.

- No profession tax can be levied on an employee who has attained 65 years of age.

- Certain categories of employees like persons having a single child, physically handicapped person, combatant member of armed forces etc. are also exempted by virtue of the notification issued by the Government subject to terms and conditions laid down in the relevant notifications.