As per the Telangana Profession Tax Act, 1987, the Commercial Taxes Department regulated by the Telangana government is entrusted with the responsibility for collection of the profession tax due in the state.

Also Read: All You Need to Know About Profession Tax in India

Types of Profession Tax Payers

Salaried Individuals: The employers are entrusted with the responsibility of paying the profession tax on employees’ behalf after deducting it from their salary. The employees can claim for the income tax deduction on the profession tax under Section 16(iii) of the Income Tax Act, 1961.

Self-Employed: Though the same slab rate is applicable for the self-employed individuals, they need to self-deposit the profession tax. Further, they can not claim it for the tax deduction in their income tax returns.

Monthly Return Provision

Individuals registered under the profession tax are mandated to file a monthly return (Form V) to the appropriate assessing authority depicting the salaries paid and the amount of tax deducted.

The return can be submitted online as well but before 10th of every month.

Certificate of Registration and Enrollment

You need to first obtain Certificate of Registration by submitting Form I to the assessing authority. In case your place of work falls under the jurisdiction of multiple authorities, then you need to obtain the certificate separately from each of the authority.

However, in the case of Certificate of Enrollment (Form II), even you have multiple places of work, you need to submit the application to a single authority. Whiling filling in details in the form, you need to mention all the places of work including the principal workplace. The assessing authority whether having jurisdiction for single or multiple places of work shall issue you the Certificates of Enrollment for all the places including the principal place of work.

Also Read: Professional Tax in Andhra Pradesh

It should be noted that if you fail to obtain the required certificates within the stipulated time limits, the authority may impose a fine of not less than Rs.10 but not exceeding Rs. 20 for each day of delay in case of an employer and not exceeding rupees five for each day of delay in case of others.

If an assessee has filed false information while obtaining the certificates, he shall be liable to pay a penalty of not less than Rs.100 but not exceeding Rs.1,000 as decided by the assessing authority.

Online Application Procedure

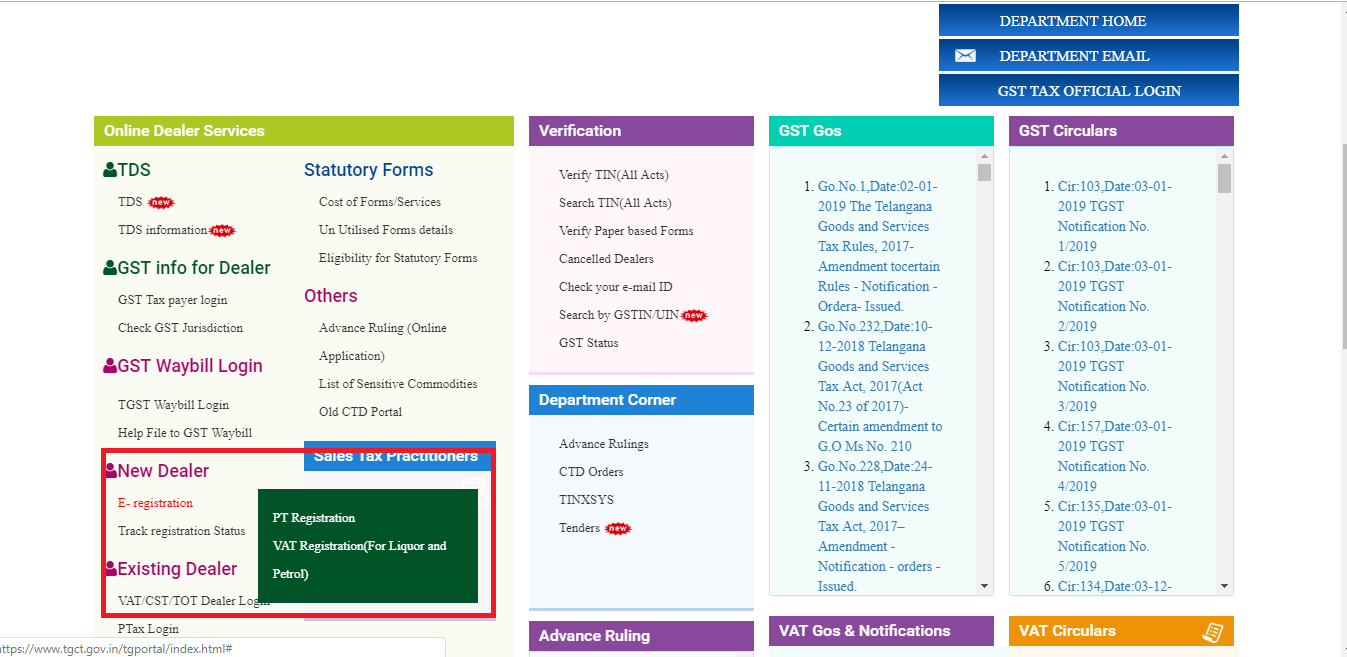

Firstly visit the official website of the commercial tax department of the Telangana government.

In the left-hand bar of the home page, there is an online service section. In that section, click on ‘E-registration’ under the New Dealer sub-section and select ‘PT registration’.

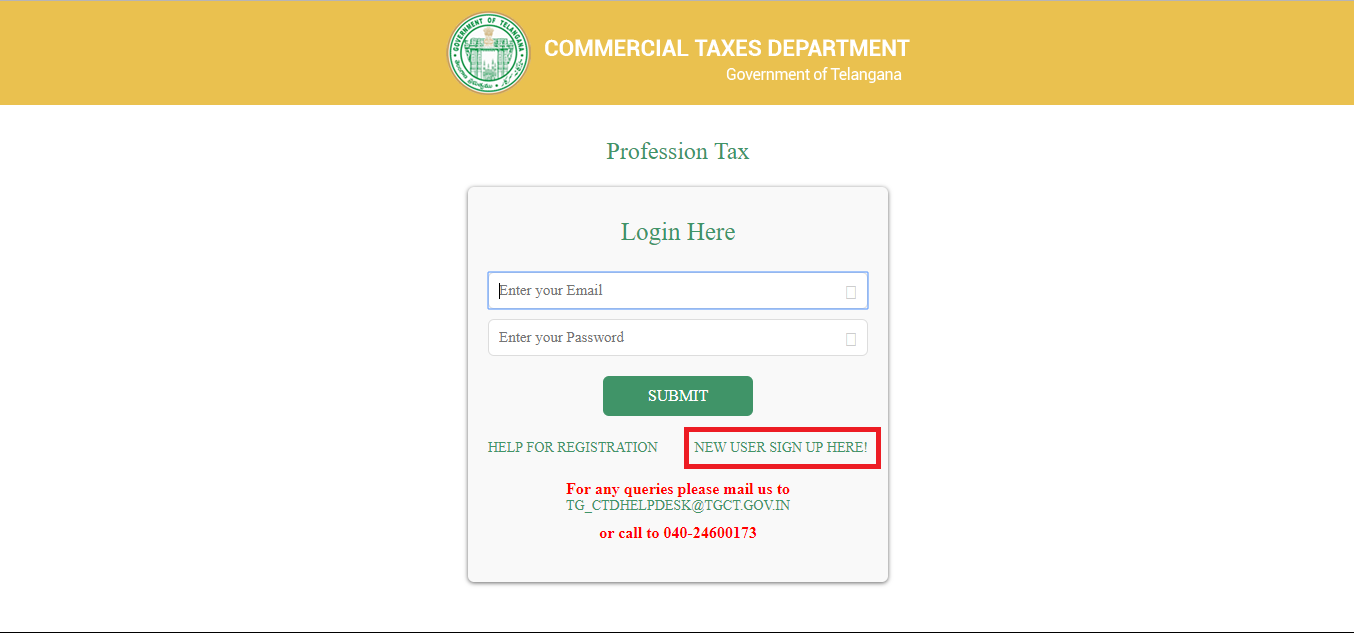

You will be directed to the login page. Since you don’t have login credentials yet, click on ‘New User Sign up here!’ option.

Now, please enter your email id and verify the detail provided. You will receive a password on the email id. Use that password to log in.

After successfully logging in, click on ‘New Registration’.

In case you have already registered with the commercial tax department of Telangana under VAT/LT/ET then you need to first select VAT/ET/LT option and just enter the TIN number and the system will populate your data. If you want to make some change in it, you can do it first and then submit the application.

However, if you are a first time user, in that case, you need to provide the required details including the name and address of the enterprise, PAN and TAN details, and contact info. After entering all the relevant details, click on ‘Next’.

The system will generate a reference number for further use.

On the next screen, enter the Owner/ Managing Director/ Managing Partner details.

Select the ‘No’ icon if you have not nominated anyone as an authorized person. Otherwise, select ‘Yes’ and enter the details of the authorized person. Click ‘Next’.

Now, you need to add your bank account details. The interface allows you to enter multiple bank account details, then click ‘Next’.

In case, your business is located at multiple locations, please update details of additional workplaces and click on ‘Next’ option.

After verifying the authenticity of the details entered, click on ‘Finish’.

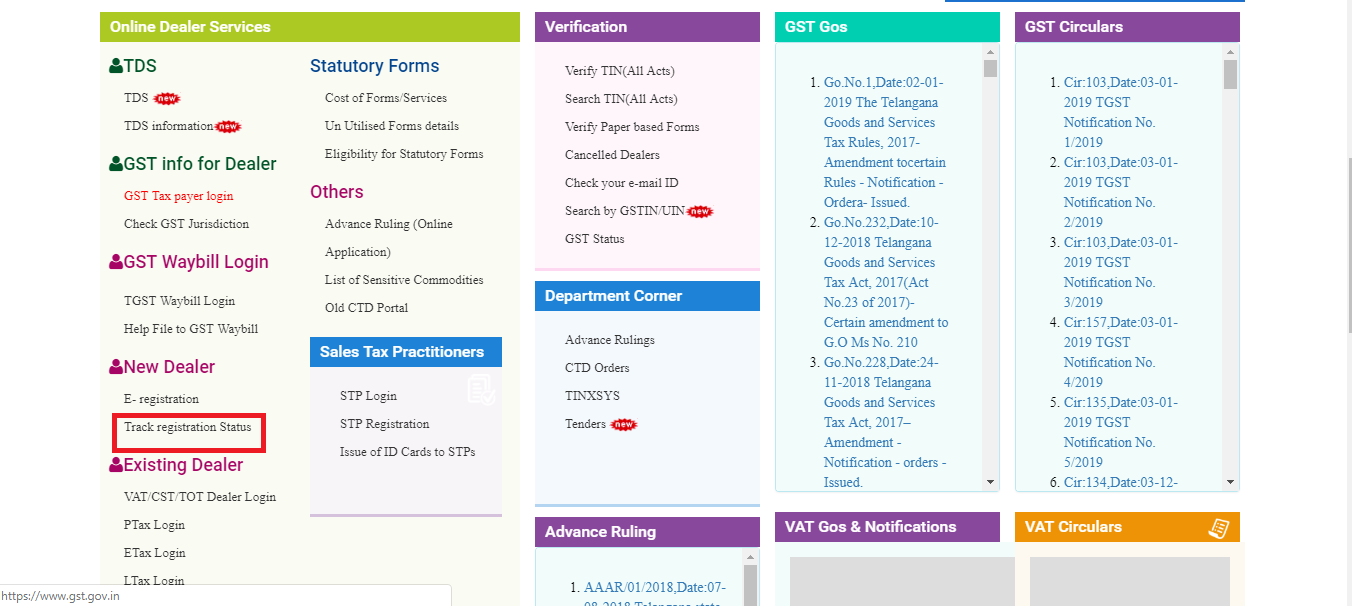

The applicant can track the status of the application for registration online. For tracking the status, go to the homepage of the commercial department website, and click on Track Registration Status under the New Dealer menu. By entering the reference number you can now the status of your application.

Issuance of Registration Certificate

Once your registration application is approved, the Registered certificate of Professional tax will be scanned and uploaded to the dealer login. The dealer can initiate all his business activities on receipt of the scanned certificate and then, the original document will be couriered or sent by RPAD to the premises of the dealer.

Telangana Profession Tax Slab Rate

Slab rates for salary and wage earners:

| Monthly Salary | Tax Payable Per Month |

| Upto Rs.15000 | Nil |

| From Rs.15,000 to Rs.20,000 | Rs.150 |

| Above Rs.20,000 | Rs.200 |

Slab rate for Professionals including Legal practitioners, Chartered Accountants, Engineers, Architects, Management Consultants, Medical Practitioners, Journalists, Medical Consultants, Dentists, Radiologists, Pathologists whose standing in the profession is:

| Up to 5 years | Nil |

| More than 5 years | Rs.2,500 per annum |

Due Date & Penalty

If an assessee fails to make payment of any amount of tax within the time specified in the notice of demand, the assessing authority may, after giving him a reasonable opportunity of making his representation, impose upon him a penalty which shall not be less than 25% but not exceeding 50% of the amount of tax due.

Note: The Telangana Profession Tax Act,1987 bars local administration from levying the profession tax. Also, the act bars the court to entertain pleas related to the profession tax disputes in the state.