Any salaried person or individual who generates an income either by doing business, by having a job, being part of an association is liable to pay the profession tax often also known as professional tax. The government of the state where the individual resides collects this particular tax and therefore, it varies from state to state. There are some states such as Chhattisgarh, Delhi, Himachal Pradesh, Haryana, etc., do not even levy the profession tax.

Anyone who belongs to the Hindu undivided family, an individual person, is the owner of any business/company/association etc. is eligible to pay it. However, as per the constitution, the maximum tax that can be collected under the profession tax scheme is Rs. 2500 per individual per financial year.

The Reason for Collecting Profession Tax

It is imperative for governments around the world to build revenue in order to maintain the federal structure of the country. Taxes, in general, play an important role in achieving that. The citizens of a country have to pay many kinds of taxes some are direct taxes while others are indirect tax. Some examples are customs duty, corporation tax, capital gains tax, income tax etc.

Profession tax is one of the key direct taxes where a significant amount of revenue is generated by a state. Most of the population in a country is covered by this tax. Depending on what the gross income of any individual and the salaried person is, the profession tax is calculated. Every month an amount is deducted from all employees’ salaries for this.

As for businesses, self-employed, individual partners, partnerships, directors of a company, the tax is deducted from the previous year’s gross turnover. Sometimes, the professional tax amount is a fixed amount which is paid regardless of the company’s turnover. There are certain states in India that levy professional tax and some states do not.

Points to be Noted by New Businesses

Anyone who is thinking of venturing into a business of their own needs to follow certain regulations and rules related to profession tax. The following are the main ones with respect to deduction of profession tax:

- They will have to apply for registration to their state tax department within 30 days of staff employment

- It is compulsory to complete the registration within 30 days of employment of staff

- The profession tax amount is deducted from the employees’ salary

- If there are more than 20 employees, the tax is to be paid within 15 days from the end of the month

- In case there are less than 20 employees, the tax is to be paid quarterly

- If anyone has more than one company or businesses, registration applications are to be sent to the respective authorities under each jurisdiction

Profession Tax in West Bengal

Those earning income in West Bengal have to pay profession tax. All individuals with a salary or a steady source of income would have to pay profession tax. For more details on the professional tax, you may visit the Official website of the Directorate of Commercial Taxes West Bengal Government. However, You can claim the profession tax payment under income tax deduction.

Article 276 of the Constitution of India states professional tax amount cannot exceed Rs. 2500. In the state of Bengal, the enrolled people are supposed to pay their taxes on or prior to July 31 every financial year. For employers, this tax is paid on a monthly basis.

West Bengal Profession Tax Payment Requisites

- For the self-employed, a certificate of enrolment is required to pay this direct tax, but they need not file any returns.

- For an employer, a certificate of registration, payment of monthly tax amount and annual filing of returns is mandatory.

Tax Slabs for Profession Tax in West Bengal

The following are the professional tax slabs and applicable monthly tax amount in West Bengal.

| Gross Income Per Month (Rs.) | Profession Tax Per Month |

| 40,001 and above | Rs. 200 |

| 25,001 to 40,000 | Rs. 150 |

| 15,001 to 25,000 | Rs. 130 |

| 10,001 to 15,000 | Rs. 110 |

| Up to 10,000 | Nil |

Enrolment Procedure for Profession Tax in West Bengal

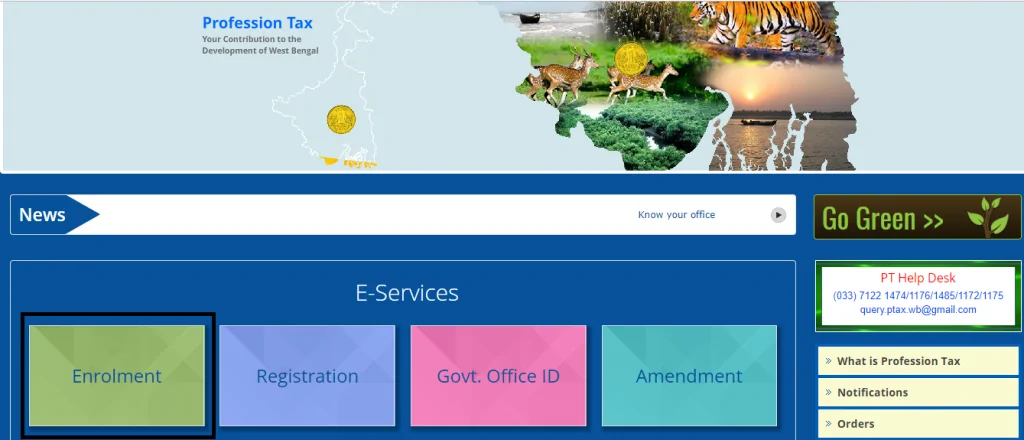

For new enrolment: Go to the Official WB Government Official Profession Tax Website.

- Under the e-services section, click the “ Enrolment” link.

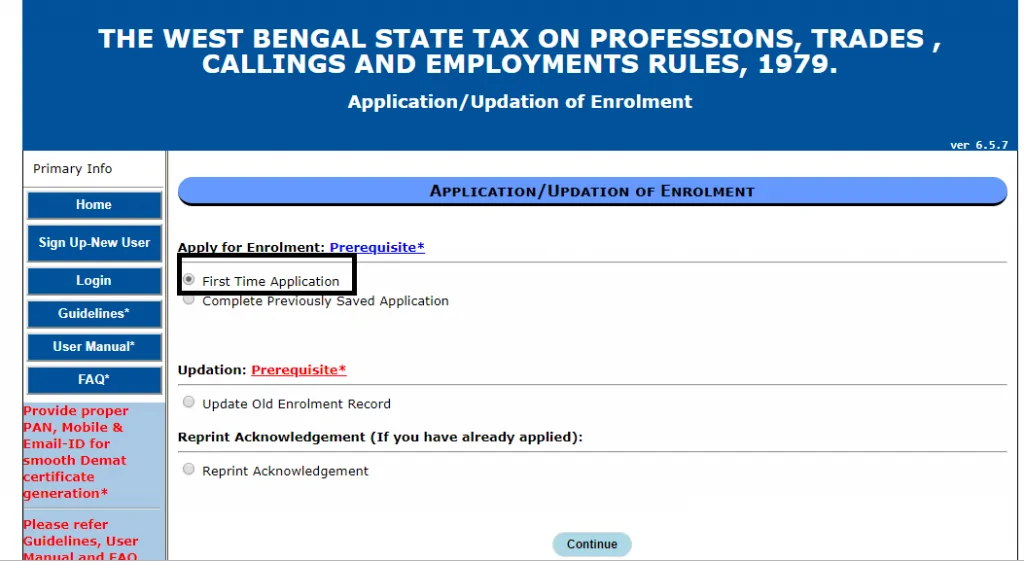

- In case of new enrolment, click on the “New” option

- Then enter the financial year for which profession tax is to be paid.

- Then select the area from the drop-down menu where your office is located.

- Fill in key personal information including details regarding personal and family details as required and click on ‘Continue’.

In case of an already enrolled individual, go to the official government website.

All you may have to do is enter your (EC) Enrolment Certificate (9-digit) number and proceed.

For firms and other categories, similar easy steps need to be followed.

Profession Tax Registration Procedure for Employers in West Bengal

When registering for employment certificate, the employer should first go to the official WB Government website for Profession Tax:

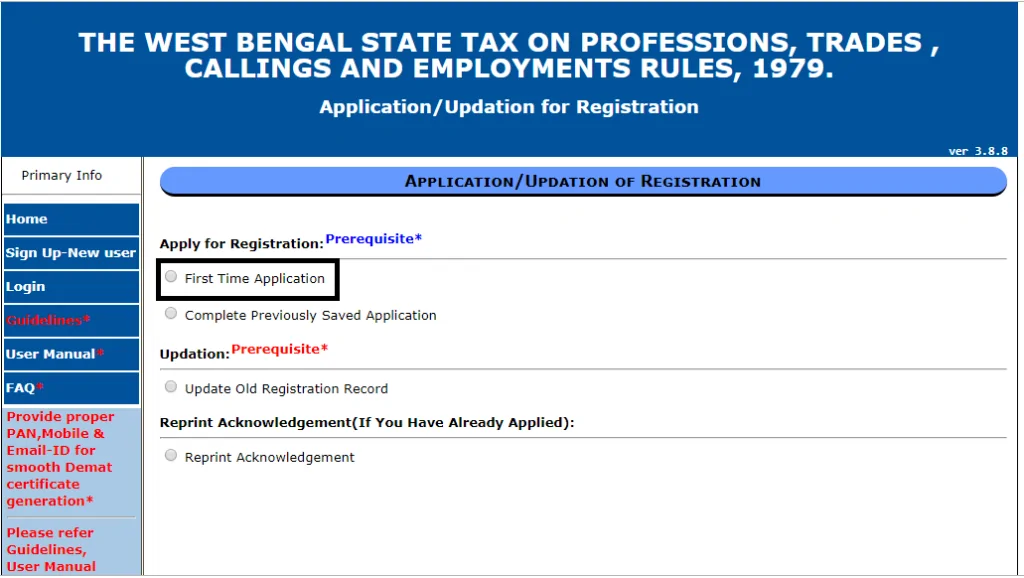

- Click on the “Registration” option in the E-Services section and then select the ‘First Time Application’ option.

- Then enter the EC number.

- Fill out other details such as PAN card number, contact details (name, address, email etc.) as required.

- Verify your credentials, if required

- Finally, select your designation in the company from the drop-down menu.

Documents for WB Professional Tax Registration

In case of an employer registering under profession tax, papers necessary for registration are:

- Proof of business start date.

- Records of accounts.

- Employee details.

- Payslip details.

- Proof of address.

How to pay West Bengal Profession Tax Online

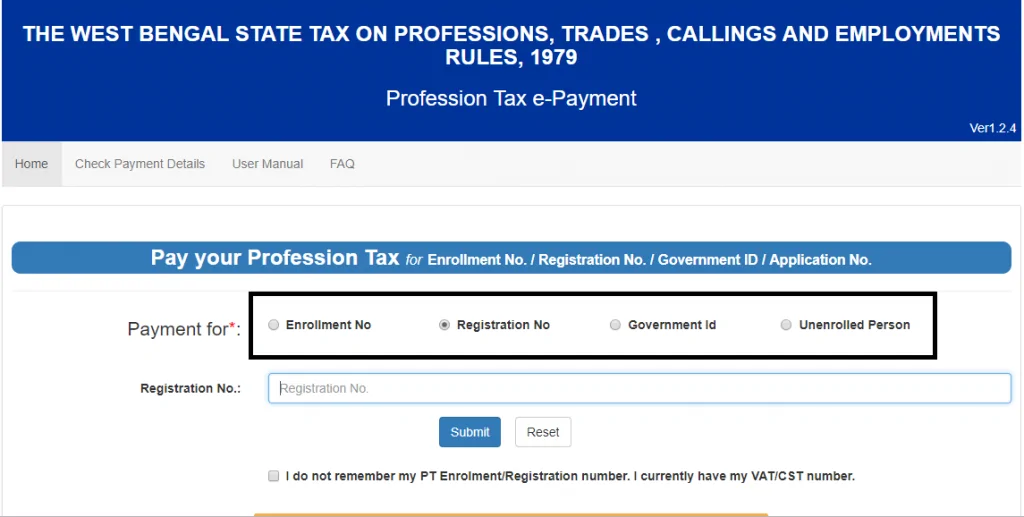

- First, you need to log in to the official website – http://wbprofessiontax.gov.in/

- Then click “e-Payment” option.

- Then select the appropriate option as shown in the image below:

- Please follow the on-screen instructions and fill in all the necessary details including EC number, PAN, etc. to complete the process

- You can pay profession tax online using your debit/credit card or through net banking.

WB Profession Tax Exempt Individuals

Certain individuals and businesses are exempted from paying profession tax. The following is a short list of individuals and businesses who are exempt from paying professional tax in West Bengal:

- Any class of people exempt through a notification issued by the State Government

- Armed forces, Air Force and Indian Navy personnel stationed in any part of West Bengal are currently exempt from paying profession tax.

- Personnel of auxiliary forces and reservists stationed in the state of West Bengal are also exempt from paying professional tax if they are receiving allowance or pay

Due Date and Late Payment Penalty for WB Profession Tax

The due date for payment of profession tax is the 21st of every month. For people whose tax liability is less than Rs. 3000, they are required to pay it quarterly. The interest rate per annum is 12% for late payment. In the case of tax liability up to 30,000 the penalty is Rs. 200. If it exceeds Rs. 30,000 then Rs. 100 is charged per each month in case of delayed payment.