Road tax in Haryana is applicable to both private as well as commercial use vehicles. The revenue thus collected is mainly used for construction of roads other than national highways that are constructed by the state government. for which they levy the road tax from the people who want to ply their vehicles on the roads.

Road tax in Haryana is levied on all vehicles that are registered under any of the Regional Transport Office (RTO) of Haryana state. The road tax computed for a vehicle is determined by a number of factors such as the type of vehicle, its size and capacity, etc. the road tax has to be paid either annually or all at once at the time of purchasing the vehicle.

Computation of Road Tax in Haryana

The road tax levied on all the vehicles in Haryana includes passenger vehicle, new vehicle or old vehicle, transport vehicle or non-transport vehicle. Computation of road tax includes other criteria as well such as the origin place of the vehicle, size of the vehicle, the weight of the vehicle, vehicle type, seating capacity, chassis type, engine type, etc. tax amount is calculated as a percentage of the cost of the vehicle. It also depends on which road tax slab the vehicle falls into. The tax imposed on the vehicle is usually valid for 15 to 20 years from date of registration of the vehicle. No interim road tax payments need to be made till the date of expiry of road tax payment.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Road tax for Two-Wheelers – Personal Vehicles

For two-wheelers, the road tax in Haryana is calculated based on various aspects such as whether the vehicle is new or old or if it has been transferred from another state.

For new vehicles:

| Price of Two-Wheeler/Weight* | Amount of road tax |

| A vehicle with cost more than Rs. 2 lakhs | 8% of the cost of the vehicle |

| The cost of the vehicle between Rs. 60,000 to Rs. 2 lakhs | 6% of the cost of the vehicle |

| The cost of the vehicle between Rs. 20,000 to Rs. 60,000 | 4% of the cost of the vehicle |

| The cost of the vehicle less than Rs. 20,000 | 2% of the cost of the vehicle |

| The moped weighing less than 90.73 kg | Rs. 150 – fixed |

Road Tax in Haryana for four-wheeler Personal Use Vehicles

The road tax calculation for four-wheeler vehicle in Haryana is as below:

| Price of the vehicle | Amount of the road tax to be imposed |

| Cars with the cost more than Rs. 20 lakhs | 9% of the cost of the vehicle |

| Cars with the cost between Rs. 10 lakhs to Rs. 20 Lakhs | 8% of the cost of the vehicle |

| Cars with the cost between Rs. 6 lakhs to Rs. 10 lakhs | 6% of the cost of the vehicle |

| Cars with the cost up to Rs. 6 lakhs | 3% of the cost of the vehicle |

*Values mentioned above is subject to private non-transport vehicles only.

Road Tax for Transport Vehicles (Goods Carriage) in Haryana

There are various sub-categories in transport vehicles too, for road tax computation. Detailed information has been tabulated below for better knowledge.

Goods vehicles registered in Haryana state

| Types of Motor vehicles | Amount of tax to be imposed |

| The weight of goods exceeding 25 tons | Rs. 24400.00 |

| The weight of goods between 16.2 tons to 25 tons | Rs. 16400.00 |

| The weight of goods between 6 tons to 16.2 tons | Rs. 10400.00 |

| The weight of goods between 1.2 tons to 16.2 tons | Rs. 7875.00 |

| The weight of goods up to 1.2 tons | Rs. 500.00 |

Goods vehicles of other states entering Haryana and plying in Haryana

| Types of motor vehicles | Amount of tax to be imposed |

| Goods carriage vehicles from any other state out of Haryana or any Union Territory, having a national permit and operating through Haryana or in Haryana | Nil |

| Goods carriage from any other state out of Haryana not holding a national permit | 30% of the annual tax due payable quarterly |

Special purpose vehicles of other states than Haryana, entering Haryana and plying through Haryana state

| Types of motor vehicle | Amount of tax to be imposed |

| Fire fighting vehicle, animal ambulance, fire tender and ambulance | Nil |

| Backhoe, loader, excavator, roller, compactor, mobile crane, motor grader, forklift truck, Dozer, self-loading concrete mixture, vehicle fitted with Rig, compressor, generator, etc., break-down van, tow truck, tower wagon, recovery vehicles, tree-trimming vehicles, mobile canteen, mobile workshop, mail carrier, cash van, x-ray van, library van, mobile clinic | Rs. 500 per day |

(Note: Value of vehicle includes all expenses or taxes paid on the vehicle purchase in India, and also the freight charges and other expenses in Indian currency for imported vehicles.)

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Above tabulated information can be used to find out in which slab your vehicle falls and what would be the amount of road tax the respective vehicle owner will have to pay. This tax can be paid online as well as offline.

How to Pay Haryana Motor Vehicle Tax Online?

For online payment of road tax in Haryana, you can visit the official website of Haryana state government transport department to complete the procedure and follow the subsequent instructions:

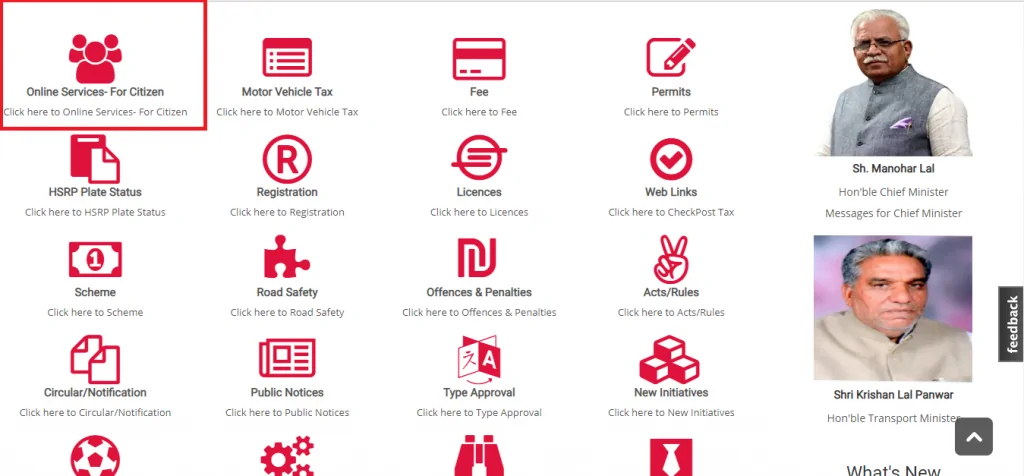

- Login to the Haryana Transport Department website and click on the ‘Online Services for Citizen’ option.

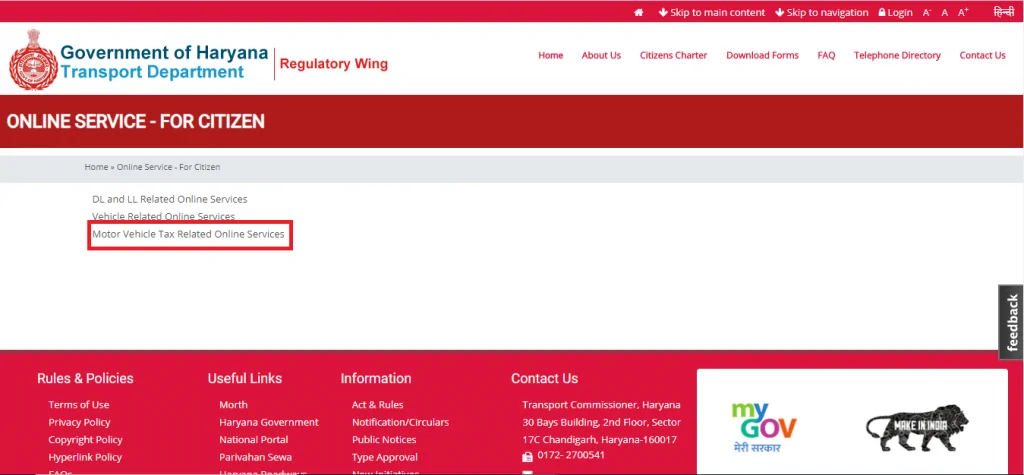

- Now, click on ‘Motor Vehicle Tax Related Online Services’ option.

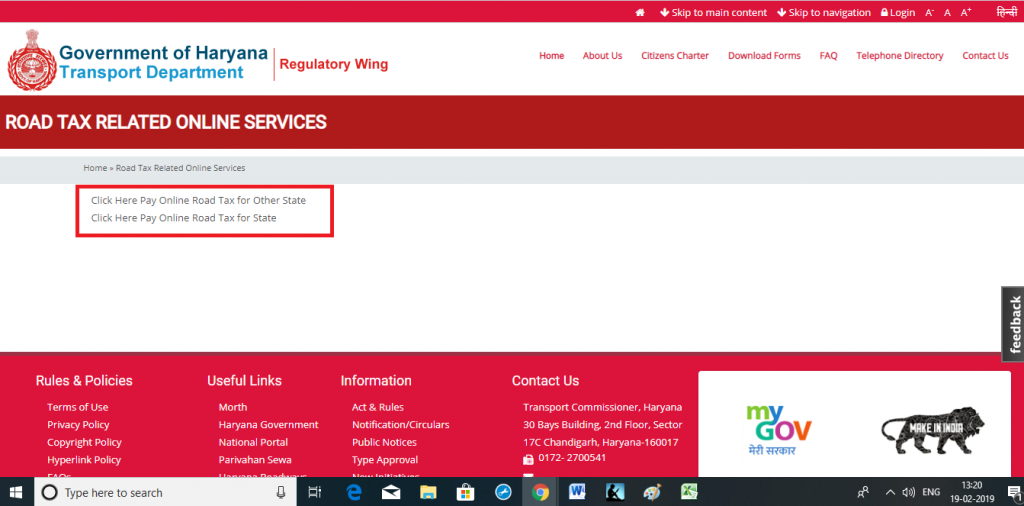

- If your vehicle is registered in a different state, then please select ‘Click Here to Pay Online Road Tax for Other State’ option.

- In case the vehicle is registered in Haryana only, then click on ‘Click Here to Pay Online Road Tax for State’ option.

- Please provide the vehicle-related details including the registration number, model number, year of purchase etc. to calculate road tax.

- You can pay the road tax online using a debit/credit card or via net banking. Once paid successfully, an online receipt will be generated. you can download and save the receipt generated online for future reference.

Offline Payment of Road Tax

- For paying the Haryana road tax offline, you can visit the Regional Transport Office to complete the procedure. You have to fill out the applicable forms and provide applicable supporting documents when making the payment. You will also get the receipt of payment once you pay the tax. You can keep the receipt for your own records.

What happens if I don’t pay road tax in Haryana?

- If a vehicle registered in Haryana is found to be in use without paying road tax, a penalty of Rs. 10,000 will be charged in case of light motor vehicles and Rs. 25,000 will be charged in case of other motor vehicles.

- If a vehicle registered in some other state is being used in Haryana without the payment of due road tax in the state of origin, a penalty of Rs. 20,000 will be charged in case of light motor vehicles and Rs.50,000 will be charged for other motor vehicles. However, out of state vehicles used as private transport are not fined provided they have valid and current tax payment receipt from their state of origin. A NOC (No Objection Certificate) may have to be obtained from the applicable RTO in such cases for use within the State of Haryana.