Road tax is levied by state governments on the owners of the vehicles that are registered under the Regional Transport Office (RTO) of the concerned state. When you make a purchase of any vehicle in Jharkhand, you need to register your vehicle with the Regional Transport Office and have to pay the applicable road tax in Jharkhand. The road tax to be imposed on your vehicle is computed based on various factors such as the type of the vehicle (personal or goods transport), weight and size of a vehicle, seating capacity, etc.

When should You Register your Vehicle?

The vehicle registration is mandatory before your vehicle reaches public roads. The vehicles have to be registered at the time you made the purchase of the vehicle. This tax can be paid annually or all at once as per the preference of the vehicle owner. Once you have paid the road tax, you do not have to pay the tax for till its validity expires, which is a period of around 15-20 years. In case, you shift your residence from one state to another, you will have to re-register your vehicle under the vehicle act of the respective state.

How is Road Tax Calculated?

The road tax is calculated based on various aspects. Such as type of vehicle, size of vehicle, structure or vehicle, seating capacity, engine type, etc. The computation of tax varies from state to state depending upon the details provided in the Motor Vehicles Act. Road tax in Jharkhand also differs for personal vehicles and vehicles used for goods transport. There are various slabs created for taxation of vehicles in Jharkhand depending on the unique types.

How to Pay the Road Tax to the Government?

Road tax in Jharkhand is payable either online or offline. In case of offline payments, car owners can visit the nearest Regional Transport Office. One can easily figure out the tax amount computed for your vehicle and can pay it there at the respective counter with the help of the concerned officer. Once you pay the road tax dues, you will also get a receipt as a record of your Jharkhand road tax payment. This receipt should be kept as proof of payment.

How to Pay Road Tax Online?

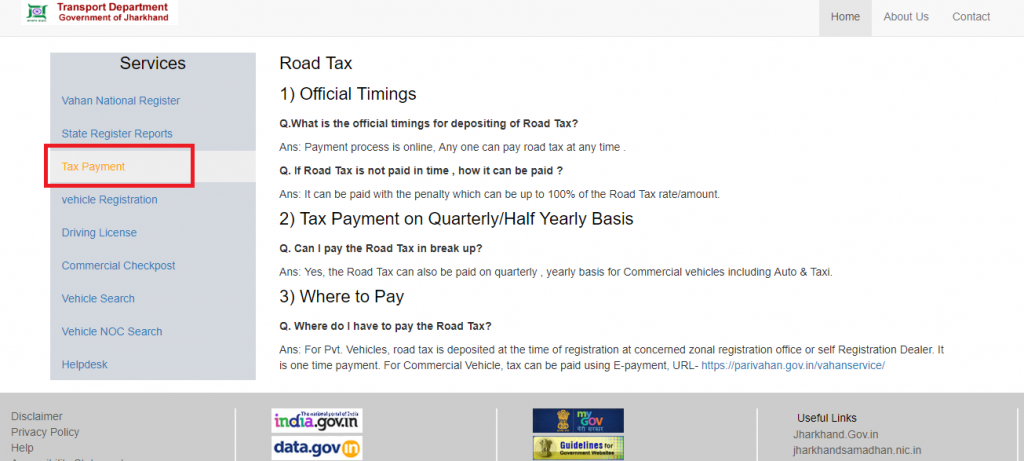

For paying the road tax online, you can visit the official Transport Department Government of Jharkhand website. On this page you will find the “Tax Payment” option:

- On the following page feed in your vehicles number in the required column and click on proceed button.

- Next, click on the ‘Pay Your Tax’ link.

- You will be redirected to the next page where you will have to feed in your mobile number and click on ‘Generate the OTP’.

- You will get a text message on your mobile with the one time password.

- Enter the OTP that you received in the column stating ‘Enter OTP’.

- Click on the tab ‘Show details’.

- You will reach a page showing all the details related to your vehicle such as tax payment history, etc.

- (Before proceeding further, make sure the details on the page are of your registered vehicle only. If not, you can redo the entire process)

- On this page, you will see a tab showing ‘Tax Mode’. Select the tax mode from there according to your convenience.

- You can select yearly (12 months) or quarterly (3 months) depending on the amount of tax you want to pay.

- The amount of road tax to be paid will be shown on the screen.

- Click on the payment button. You will be redirected to a payment gateway where you can choose the payment options.

- You can now pay the amount through net banking, credit card or the debit card.

- Once your payment is done, a receipt will be generated and flashed on the screen.

- You can download and print the receipt.

You can refer to the above information for paying the road tax in Jharkhand for your vehicle. In case of any confusion, you can visit the applicable Regional Transport Office in Jharkhand for payment of road tax offline.