Road tax in Rajasthan is governed by the Rajasthan Motor Vehicles Taxation Act, 1951. Under this act, whosoever purchases a vehicle in the state is subject to road tax. Vehicle owners in Rajasthan have to register and pay the road tax before they start using the vehicle at any public road, under the Rajasthan Motor Vehicles Taxation Act of 1951. The quantum of road tax payable by the people is also computed under this act.

When is Road Tax in Rajasthan Payable?

Whenever a person purchases any kind of motorised vehicle, he/she has to register the vehicle under the Regional Transport Office (RTO) for the road tax payment. This payment can be made annually or as lump sum for a number of years, depending on the convenience of the taxpayer. Generally, road tax has to be deposited directly with the state government in cash, but the due tax can be also be paid online through the official roadways website of the Rajasthan government.

How Road Tax calculated in Rajasthan?

In Rajasthan, the calculation of road tax depends on many factors related to the vehicle that a person owns. Key factors in this regard include type of vehicle, make and design of the vehicle, weight, seating capacity, the taxation slab within which the vehicle falls, etc. After looking into these key aspects, the road tax is calculated for a particular vehicle.

Road Tax Rates in Rajasthan

The tax to be levied from various vehicle owners in Rajasthan state are computed on types of vehicles like a two-wheeler, three-wheeler and four-wheeler (for personal use and for goods transport). Tax slab rates are decided depending on the type and slab within which the vehicle falls.

Road Tax Rate in Rajasthan for Two Wheelers

If you own a two-wheeler vehicle, applicable road tax in Rajasthan state will be computed based on the following details:

| Type of two-wheelers | Amount of tax to be paid |

| Above 500cc capacity | 10% of the cost of the vehicle |

| Between 200cc to 500cc capacity | 8% of the cost of the vehicle |

| Between 125cc to 200cc capacity | 6% of the cost of the vehicle |

| Up to 125cc capacity | 4% of the cost of the vehicle |

Road Tax Rate in Rajasthan for Three Wheelers

In case three-wheelers, the road tax rate in Rajasthan varies based on cost of vehicle chassis and the total cost of the vehicle. The following table shows details of the road tax rates in Rajasthan.

| Type of three wheelers | Amount of tax to be paid |

| If the cost of chassis is above Rs. 1.5 lakh | 5% of the cost of the vehicle |

| If the cost of the vehicle is above RS 1.5 lakh | 4% of the cost of the vehicle |

| If the cost of chassis is up to RS 1.5 lakh | 3.75% of the cost of the vehicle |

| If the cost of the vehicle is up to RS 1.5 lakh | 3% of the cost of the vehicle |

Road Tax in Rajasthan for Four Wheelers

If you have a four wheeler, which includes vehicles for personal use and for commercial use of goods/people transportation. The following are details of the road tax amount payable in Rajasthan:

| Type of four-wheeler | Amount of tax to be paid |

| Trailer or sidecar drawn by the below mentioned vehicles | 0.3% of the cost of the vehicle, to which the trailer is attached |

| Cost of the vehicle above Rs. 6 lakh | 8% of the cost of the vehicle |

| Cost of vehicle between Rs. 3 lakh to Rs 6 lakh | 6% of the cost of the vehicle |

| Cost of the vehicle up to Rs 3 lakh | 4% of the cost of the vehicle |

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Road Tax Payable for Other Vehicles in Rajasthan

Vehicles other than two wheelers, three wheelers and four-wheelers such as those used in construction and various other purposes also get registered under the Rajasthan Motor Vehicle Act. Under this act, these vehicles are also subject to payment of road tax in Rajasthan. The following are the key road tax rates payable in Rajasthan by these vehicle:

| Types of vehicles | Amount of tax to be paid |

| Construction equipment vehicles excluding the harvester which are purchased as an entire body | 6% of total cost of vehicle |

| Construction equipment vehicles excluding harvester which are being purchased as a chassis | 7.5% of total cost of vehicle |

| Cranes purchased as an entire body and vehicles fitted with equipment like fork-lifts | 8% of total cost of vehicle |

| Cranes purchased as chassis and vehicles fitted with equipment like fork-lifts | 10% of total cost of vehicle |

| Camper van purchased as an entire body | 7.5% of total cost of vehicle |

| Camper van bought as a chassis | 10% of total cost of vehicle |

| Two-wheeled or three-wheeled motor vehicles for use by invalids | 0.30% of total cost of the vehicle and it is capped at a maximum of Rs 50. |

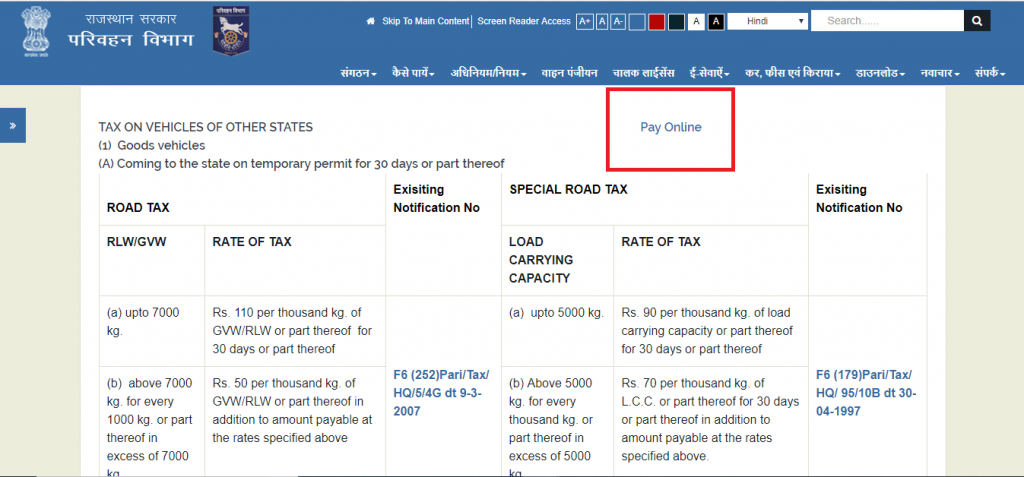

completed, a detailed receipt will be generated which can be viewed and downloaded. It is advised to print a copy of the receipt for your records. In order to pay the road tax due in Rajasthan for your vehicle, click on the “Pay Online” button as shown below:

How to pay a Road Tax in Rajasthan?

Rajasthan has an official transport department website where you can pay the amount of road tax that you owe. You can go to the portal to know the amount of road tax payable and complete the payment online. The website has a calculator where you can get the amount of road tax calculated by filling in the details like your registered contact number, vehicle type and chassis number. Once payments are completed, a detailed receipt will be generated which can be viewed and downloaded. It is advised to print a copy of the receipt for your records. In order to pay the road tax due in Rajasthan for your vehicle, click on the “Pay Online” button as shown below:

You can pay road tax in Rajasthan tax offline as well by going to tax collection centres situated at various places within the state. You can easily choose centres which are nearer and more convenient for you when paying road tax via the offline route. The tax will be computed as per the specifications of your vehicle. Once you complete the payment procedure, you will get a receipt containing details of road tax paid for your vehicle in Rajasthan state.