Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Get your Free Credit Report with Monthly Updates

Let’s Get Started

The entered number doesn't seem to be correct

Chapter VI A of the Income Tax Act 1961 specifies in detail the permissible deductions from the gross total income under sections 80C to 80U of the Income Tax Act. Section 80A of the Income Tax Act specifies that the amount of such deductions shall not exceed the amount of Gross Taxable Income of the assessee. Section 80DDB includes tax deductions for specified diseases for individuals and HUF. Deductions under this chapter cannot be claimed against long-term capital gains, short-term capital gains covered under section 111A, winnings from horse races or lotteries or such other income covered under section 115BB or income covered under sections 115A, 115AB, 115AC, 115AD, 115BBA and 115D.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Chapter VI A is a comprehensive chapter covering deductions in respect of various investments or payments made or expenses incurred by the assessee. Some of them are noted below:

Thus, each section covers different types of expenses or investments allowed as deductions, the conditions that need to be met to claim such deductions and the amount which can be claimed as a deduction.

Thus, for computing the net taxable income of any assessee, it is important to understand the application of deductions under Chapter VI A of the Income Tax Act 1961.

We have discussed below in detail the manner in which Section 80DDB would be applied.

Section 80DDB speaks of deductions in respect of expenses incurred for medical treatment of specified diseases or ailments for self or dependents.

Section 80DDB provides that if an individual or a HUF has incurred medical expenses for treatment of a specified disease or ailment, such expense is allowed as a deduction, subject to such conditions and capped at such amount as specified, under Section 80DDB of the Income Tax Act.

Here, the section relates to medical expenses incurred on treatment of specified diseases or ailments and should not be confused with premium paid for health insurance bought covering such diseases or ailments. The payment for health insurance is covered under Section 80D of the Income Tax Act.

Section 80DDB provides for a deduction to Individuals and HUFs for medical expenses incurred for treatment of specified diseases or ailments and should be deducted from the Gross Total Income while computing the taxable income of the assessee.

Deduction under section 80DDB can be claimed only by the person incurring the expenses. However, medical expenses can be incurred for the treatment of the following people:

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Deduction under section 80DDB is allowed for medical expenses incurred for medical treatment of specified diseases or ailments. The nature of diseases and ailments that are included for deduction under Section 80DDB is mentioned in Rule 11DD of Income Tax and the same are as follows :

| Dementia | Dystonia Musculorum Deformans |

| Chorea | Motor Neuron Disease |

| Ataxia | Aphasia |

| Parkinson’s Disease | Hemiballismus |

Thus, the section intents to cover medical treatment for major illnesses and diseases and would not cover medical expenses which are more common in nature like a cataract or a C-section.

To claim deduction under section 80DDB, it is mandatory for the assessee to provide proof of the need for treatment and proof that the treatment has been actually undertaken. Therefore, it is compulsory to obtain a prescription for such treatments from a qualified doctor.

Earlier it was required to obtain such prescriptions from doctors of government hospitals. However, the same has been relaxed with effect from AY 2016-17 and prescriptions can now be obtained from relevant specialists from private hospitals and not necessarily a doctor working with a government hospital. Rule 11DD now stands amended and the prescription can now be obtained as follows :

Thus, the prescription is required by a relevant specialist in the field of Medicine. It must be noted that all the degrees should be recognized by the Medical Council of India.

Where the treatment is undertaken in the government hospital, the prescription can be obtained from any specialist working full-time with the hospital and having a postgraduate degree in general medicine.

Also Read: Income Tax Documents/ Documents Required to File Income Tax Return

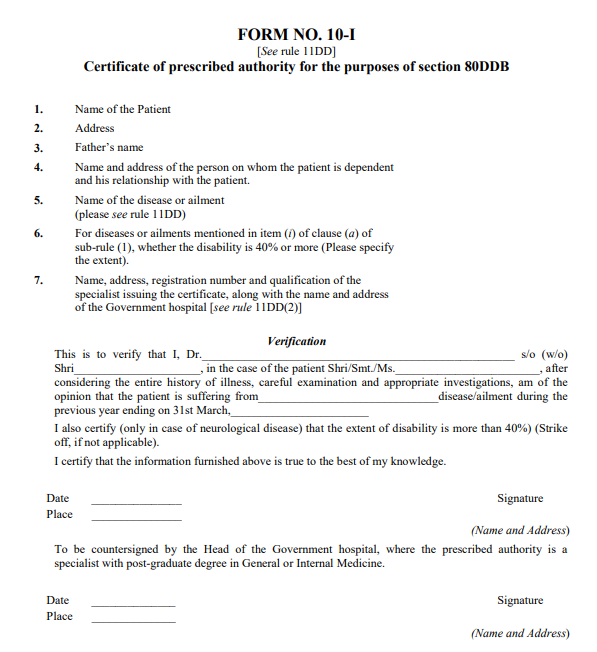

The prescription needs to be obtained from qualified doctors having relevant specializations. Earlier the prescription had to be submitted in Form 10-I, however, the same is done away with w.e.f AY 2016-17. The prescription should now specify the following:

The prescription so obtained has to be submitted by the assessee to the income tax department along with the Income Tax Return.

The amount that can be claimed as a deduction under section 80DDB is based on the age of the person for whom the medical expense/treatment is incurred.

In case where the medical treatment expense is incurred for an individual or his dependent or a member of HUF, the amount of deduction is capped at the actual amount paid or rupees forty thousand, whichever is less.

For the purpose of this section :

Thus, the amount of deduction that can be claimed under Section 80DDB can be tabled as follows :

| Age of the Person availing Medical Treatment | Deductible Amount (Rs.) |

| Age less than 60 years | Rs.40,000 or actual expenses, whichever is less |

| Senior Citizens (Age 60 years and above) | Rs.1,00,000 or actual expenses, whichever is less |

| Very Senior Citizens (Age 80 years and above) | Rs.1,00,000 or actual expenses, whichever is less |

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Things to remember :

The amount of deduction that can be claimed under Section 80DDB should be adjusted by such amount as may be received from the insurer against a health insurance policy or as may be reimbursed by the employer.

Thus, if an assessee incurs expense on medical treatment of a specified disease or ailment of Rs. 60,000/- , then he can claim a deduction of Rs. 40,000/- under Section 80DDB. However, if the assessee has received an amount of Rs. 30,000/- from an insurance company against such expenses, then the amount of deduction that he can claim under section 80DDB stands reduced by such amount. Thus, the assessee can then claim only an amount of Rs. 10,000 /- (Rs. 40,000 less the amount received from the insurance company Rs. 30,000) under Section 80DDB.

Further, if the amount received from the insurance company against the expense of Rs. 60,000/- is Rs. 50,000/-, which is more than the permissible limit of Rs. 40,000/-, then the assessee would not be able to claim any deduction under section 80DDB. It may further be noted that in this case if the person undertaking the treatment is a senior citizen, then he can avail a deduction of Rs. 1,00,000/- (permissible deduction under section 80DDB for Senior citizen is Rs. 1,00,000 less amount received from the insurance company which is Rs. 50,000/-)

U/S 80DDB, the deduction can be claimed by any individual in respect of any expenses incurred towards the treatment of certain specified medical diseases or ailments for himself or for any of his/her dependents. Below mentioned is the format for Section 80DDB:

Form 80DDB consists of various details to be filled in order to claim the deduction. It is also called Form 10-I. Mentioned below is the process of filling the form 80DDB:

Step1: Mention the name of the applicant

Step 2: Enter the address and the applicant’s father’s name

Step 3: Mention the name of the person and the address on whom the applicant is dependent and the relationship with the applicant.

Step 4: After this, before filling the column with the name of the disease or ailment please see the Rule 11DD.

Step 5: Mention whether the disability is 40% or more for diseases and ailments.

Step 6: Enter the name, address, registration number and qualification of the specialist issuing the certificate along with the name and address of the government hospital.

Step 7: After that fill and duly sign the verification section stating the fact that the information is provided correctly.

It has been proposed in Budget 2018, to increase the deduction under section 80DDB for senior citizens for medical treatment of specified diseases. Section 80DDB provides the deduction to be made available to individuals and HUF with regard to the specified disease. It is proposed to amend the provisions of Section 80DDB to INR 1 lakh for both senior citizens as well as super senior citizens from INR 60,000 and INR 80,000 respectively.

Finance Minister Arun Jaitley while proposing Budget 2018 provided a major relief to enhance the deduction for medical treatment for seniors. From FY 2018-19, senior citizens and super senior citizens will be liable to avail the maximum deduction u/s 80DDB of INR 1,00,000 from INR 60,000 and INR 80,000 respectively. This amendment will be effective from April 1, 2019 and will accordingly be applied in the AY 2019-20 and therefore subsequent years. For Individuals or HUF, the amount proposed is INR 40,000 or the actual amount paid whichever is less.

Q. What is the 80DDB diseases limit/Section 80DDB limit?

Rs. 1 lakh is the maximum amount that can be deducted from tax for the medical treatment of a dependent who is older than 60 years of age or is a super senior citizen above 80 years of age.

Q. Can 80DDB be claimed for the mother-in-law?

The 80DDB deduction can only be claimed by an individual for medical expenses incurred for himself/herself or for a dependent. The law defines dependent as a person’s spouse, his children, parents, sisters and brothers. You can claim a tax deduction for your mother-in-law under Section 80DDB if she is dependent on your spouse.

Q. Can I claim a deduction of the maximum amount permitted under Section 80DDB income tax?

No, you can claim a deduction only for the expenses that you actually incur.

Q. Is paralysis eligible for deduction under Section 80DDB of income tax?

Yes, since paralysis is a neurological disease and neurological diseases are included in the list of specified diseases under Section 80DDB.