When the amount of taxes paid by an assessee exceeds his/her actual tax liability for a particular FY, then the Income Tax Department returns the ‘excess tax’ in the form of Income Tax refund. In case you have filed your return and are eligible for a refund, you can check your income tax refund status on the NSDL website or on the e-filing portal of the Income Tax Department. But what if your income tax refund is delayed? Read on to know the common income tax refund problems and how to solve them.

Table of Contents :

- Refund Delay due to wrong bank account details

- Income Tax refund delay due to wrong address

- Delayed tax refund due to defective ITR

- Tax Refund delayed by outstanding Income Tax demand

- Tax Refund delayed due to late ITR filing

- Delay in tax refund due to unverified ITR

- What do the different Income Tax Refund status messages mean?

- How long does it take to receive income tax refund?

Refund Delay due to wrong bank account details

The bank account details furnished at the time of ITR filing were wrong. As a result, the income tax refund cannot be credited to your bank account via ECS (Electronic Clearing System).

How to correct bank account details online?

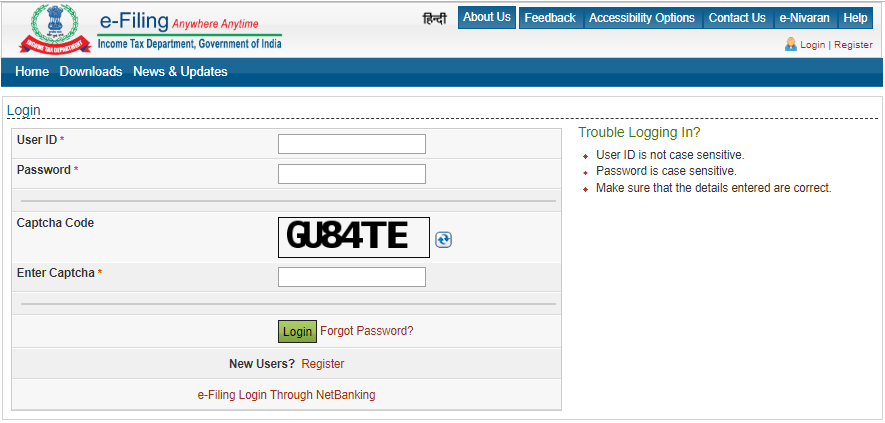

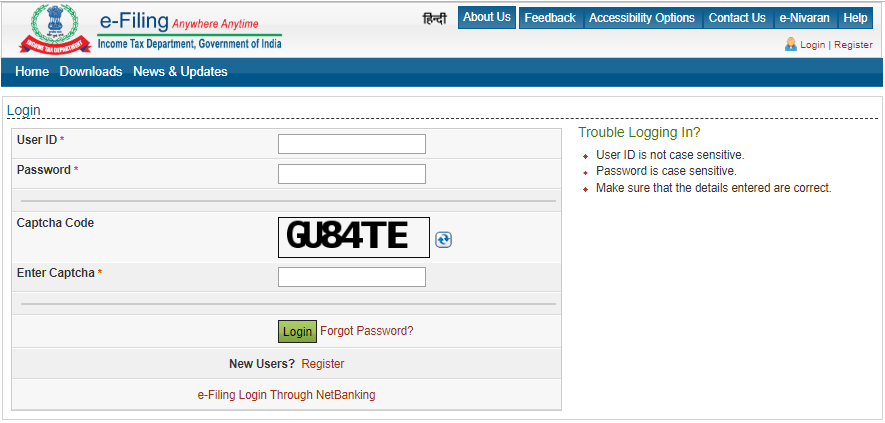

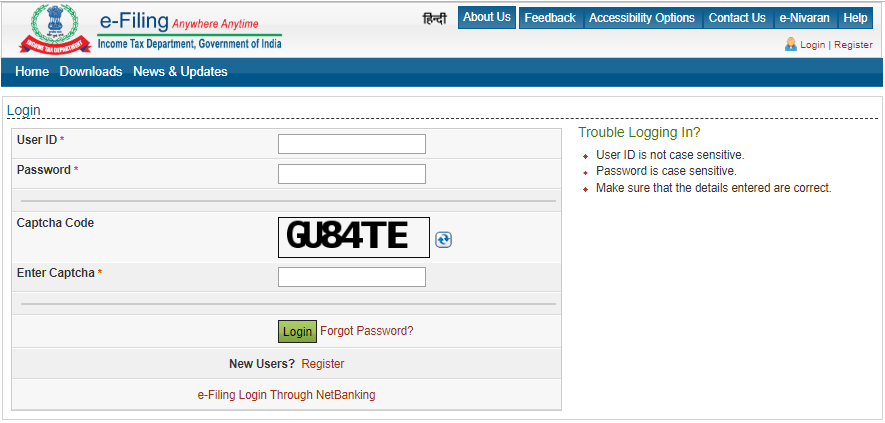

Step 1: Log on to the e-filing website of Income Tax Department.

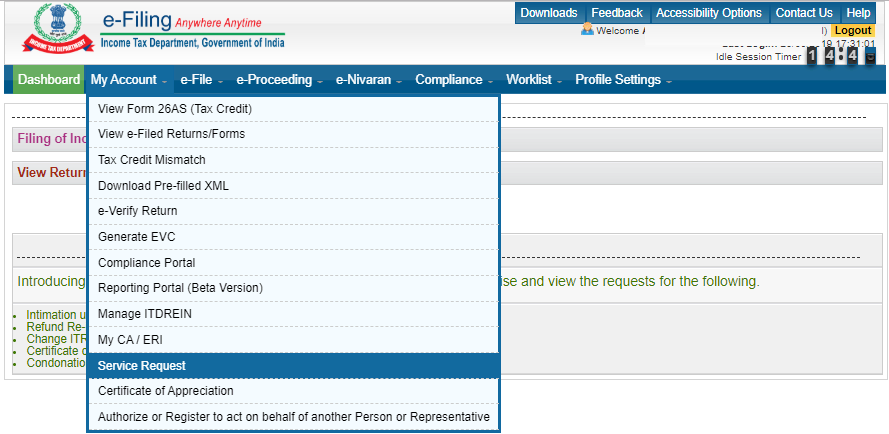

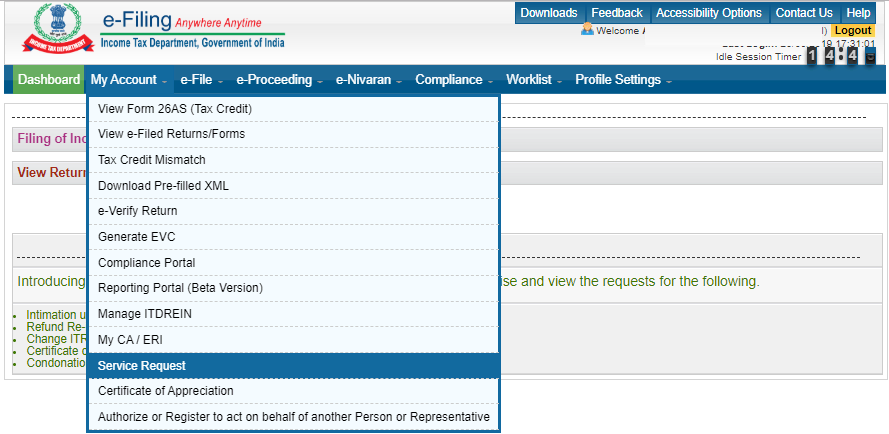

Step 2: Go to “My Account” tab and select “Service Request”.

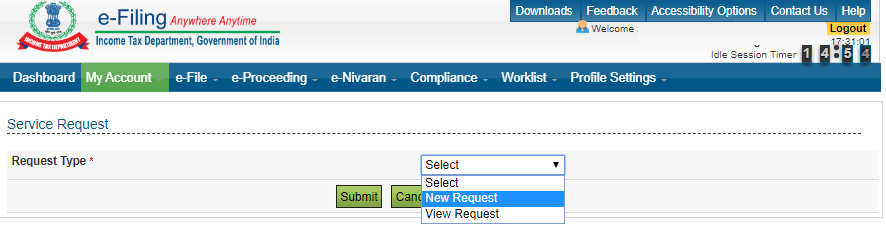

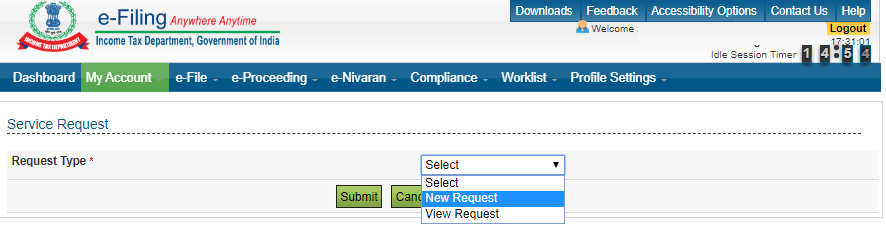

Step 3: Select “New Request” as the request type.

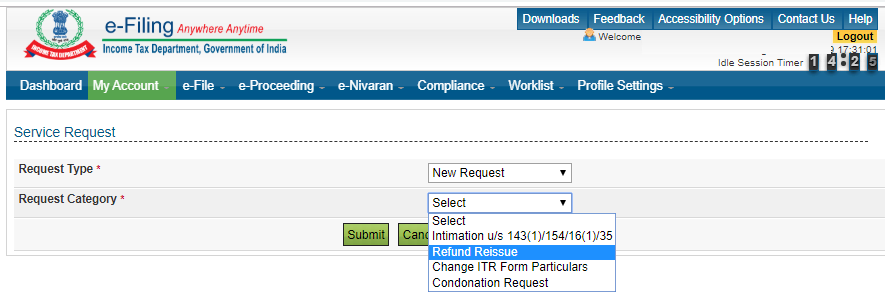

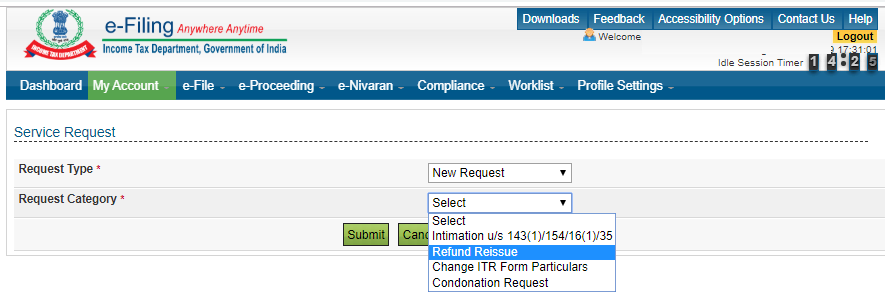

Step 4: Select “Refund Reissue” as the request category.

Step 4: Select “Refund Reissue” as the request category.

Step 5: Click submit and enter the correct/updated bank account details in the subsequent web page.

Step 5: Click submit and enter the correct/updated bank account details in the subsequent web page.

Income Tax refund delay due to wrong address

You may have entered a wrong or old address at the time of submitting your income tax refund. This can delay receiving of a refund when you select cheque as the mode of payment at the time of ITR filing.

How to correct the address for receiving refund cheque?

Step 1: Log in to the e-filing website of Income Tax Department.

Step 2: Go to the “My Account” tab and select “Service Request”

Step 3: Select “New Request” as the request type.

Step 4: Select “Refund Reissue” as the request category.

Step 5: Click “Submit” and update your address in the subsequent web page.

Delayed tax refund due to defective ITR

If you made a mistake while filing ITR, such as missed income or not mentioning all your income, your ITR will be considered defective. In this case you first need to submit a revised ITR. In case your revised filing shows that you are eligible for an income tax refund, you will receive a refund in your bank account pending verification by the assessing office.

How to submit revised return to get an income tax refund?

Step 1: Login to the e-filing portal of Income Tax website.

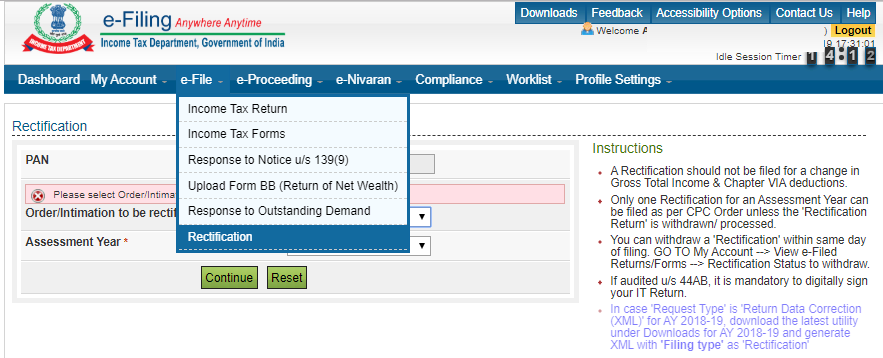

Step 2: Go to the “e-file” tab and select “Rectification”.

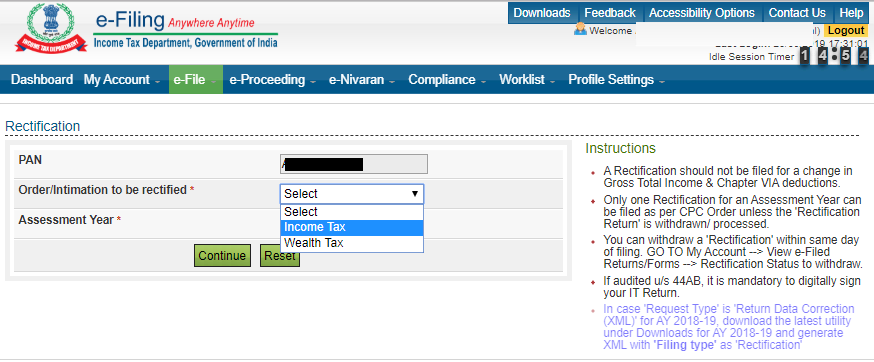

Step 3: Select “Income Tax” in Order/Intimation to be rectified.

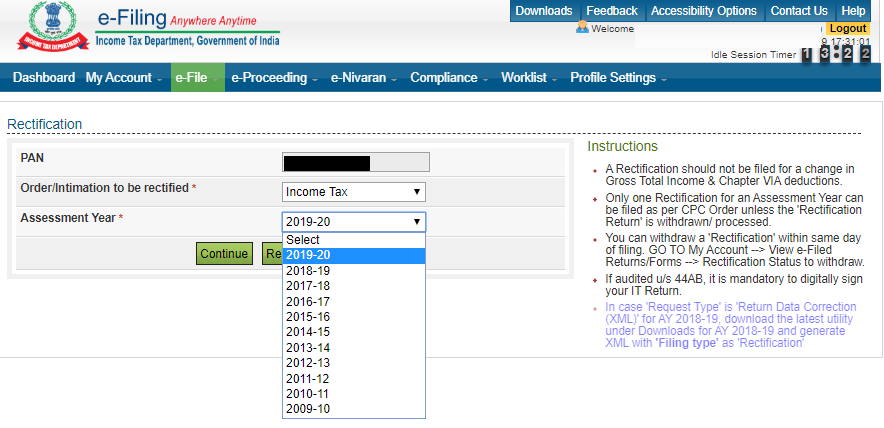

Step 4: Select the assessment year.

Step 4: Select the assessment year.

Step 5: Click “Continue” and file your income tax return as per applicable rules.

Read more about defective ITR

Refund delayed by outstanding Income Tax demand

This happens when you have outstanding income tax demand dues payable to the IT Department in the form of penalty, interest or tax dues. In such a situation, the refund amount will be adjusted against the tax demand and any refund amount remaining will be transferred to you.

What can you do in this case?

You can check if the tax demand made by the Income Tax Department is valid. If that is the case, then your tax refund will be credited accordingly. In case you find an error with your tax demand, you can file an appeal with the appropriate authorities to request the refund.

Tax Refund delayed due to late ITR filing

If you have filed ITR after the due date (31st August 2019 for AY 2019-20) your income tax refund will be definitely delayed. The best way to avoid such a delay is to file your ITR well before the due date.

Read the ITR filing checklist to avoid late-filing penalties as well as delay in credit of refund.

Delay in tax refund due to unverified ITR

It is mandatory to verify the income tax return after filing, otherwise your ITR filing will be invalid. You can either physically verify your return by sending a printed copy of ITR-V or you can e-verify within 120 days of ITR filing.

Read more about ITR verification.

What do the different Income Tax Refund status messages mean?

Let’s understand how to interpret income tax refund status and why you might have not received the income tax refund!

| Income Tax Refund Status | Meaning | What should you do next? |

| Refund Paid | Your ITR has been processed and refund has been credited. | Check with the bank to confirm the receipt of refund. If you have not received the refund, contact your bank or State Bank of India to find out the error. |

| Refund Status Not Determined | Your ITR has not been processed yet. | Recheck the status after few days. |

| Refund Determined and sent out to Refund Banker | Refund has been accepted by the Income Tax department and refund banker has been informed | Wait for the refund to credit or contact the refund banker to know the status of your refund payment |

| Refund Unpaid/ Returned | Refund has been accepted by the Income Tax department but not yet credited. This can be due to 2 reasons. Either the bank details provided for refund credit are incorrect; or, if opted for refund through cheque, your address is incorrect. | Reason is displayed in such cases. Correct the details and request a refund reissue. |

| Demand determined | Your tax calculation does not match with that of the IT department and additional tax has to be paid. This means that you have to pay a ‘Tax Demand’ and not eligible for a Tax Refund. | Verify the information with your e-filing form to figure out the mismatch/error. If you actually find an error in your e-filing request, then make a payment to Income Tax Department within the specified timeline.

In case there is no error in your e-filing request, file a rectification along with all the supporting information and documents to justify your refund claim. |

| Rectification Processed, Refund Determined and Details sent to Refund Banker | The Rectified return has been accepted by the Income Tax department. Moreover, the refund amount has been recalculated and the refund amount has been sent to the bank for processing the payment. | Check your bank account to confirm the receipt of refund. |

| Rectification Processed and Demand Determined | Rectified return has been accepted by the Income Tax department. However, there are outstanding tax dues (tax demand) which need to be paid within a specified time. | Pay the outstanding tax/ tax demand after cross-verifying all the details within the specified time period. |

| Rectification Processed, No demand and No Refund | Rectified return has been accepted by the Income Tax department. Additionally, you are neither required to pay any additional tax nor eligible for a tax refund. | – |

| No Demand No Refund | Your tax calculation matches with that of the IT department. You are neither required to pay further tax nor eligible for a tax refund. | – |

How long does it usually take to get an income tax refund?

Time to receive income tax refund depends on a number of factors, such as the time of filing ITR, the type of ITR form you submitted, etc. As a result, there is no fixed time period by which you will receive the refund. The refund can be credited as early as a few days from the day of ITR filing to a few months from the date of ITR filing. However, those who fill ITR-1 often receive their refund sooner than those filing other ITR forms.

Read more about Income Tax Refund.