The levy, administration, collection and recovery of Income Tax in India is carried out in accordance with the Income Tax Act, 1961 and its amendments as introduced from time to time. However, till date, India has one of the lowest numbers of ITR filers when considering the number of active PAN cards in India. In order to overcome this problem and make tax filing easier for Indians from all walks of life, the Income Tax department started the (Tax Return Preparer) TRP programme under which government approved individuals are trained in helping taxpayers file their income tax returns.

Who is a Tax Return Preparer (TRP)?

A Tax Return Preparer (TRP) is an Income Tax Department-approved individual who is trained to assist taxpayers in filing their income tax returns. A TRP need not be a chartered accountant or a tax lawyer but has the skills required to help individuals file their tax returns in lieu of a nominal fee. That said, TRPs do have a key limitation – under existing rules they cannot assist in filing returns in cases where a tax audit is required or compulsory.

Duties of a Tax Return Preparer

The following is a short list of the key duties that need to be carried out by a Tax Return Preparer:

- Preparing the income tax return of a taxpayer.

- Submitting the prepared tax return to the relevant Assessing Officer or concerned agency verified by the resource centre.

- Acquiring copy of the acknowledgement received from the IT department on behalf of the taxpayer. This document acts as a proof of submission of the tax return.

- Submit a statement of particulars to the Resource Centre on or before the 7th of each month.

- Maintaining records of important details about all tax returns prepared by them during the current as well as previous assessment years.

Important Details Mentioned in Records of Tax Return Preparer

The following are details that a TRP must maintain for each and every income tax return filings they assist in:

- The Name of the Taxpayer for whom they are preparing the returns

- The Permanent Account Number (PAN) of the taxpayer

- Year of Assessment

- The total income of the assessee on whose behalf the TRP is filing ITR

- The total tax payable by the taxpayer

- The submission date of the tax return

- The acknowledgement number on the acknowledgement slip issued after ITR verification

- The jurisdiction of the Assessing Officer

- Fees charged by the TRP for various services availed under the TRP scheme

How to find a TRP using Income Tax Website

There are four ways to find a TRP:

- Get contact details of TRP by using the “Locate a TRP” link on the Official TRPS website

- Register yourself for a home visit by a Tax Return Preparer using the TRPS website.

- Call the helpline at 1800-10-23738 to get assistance from a TRP.

- Send a mail to helpdesk@trpscheme.com to get a TRP assigned to you.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Step by Step Guide to Avail Tax Return Preparer Services

The following is a step by step guide that you need to follow if you are looking to avail the services of an Income Tax Preparer (TRP) by using the “Register for Home Visit’ option:

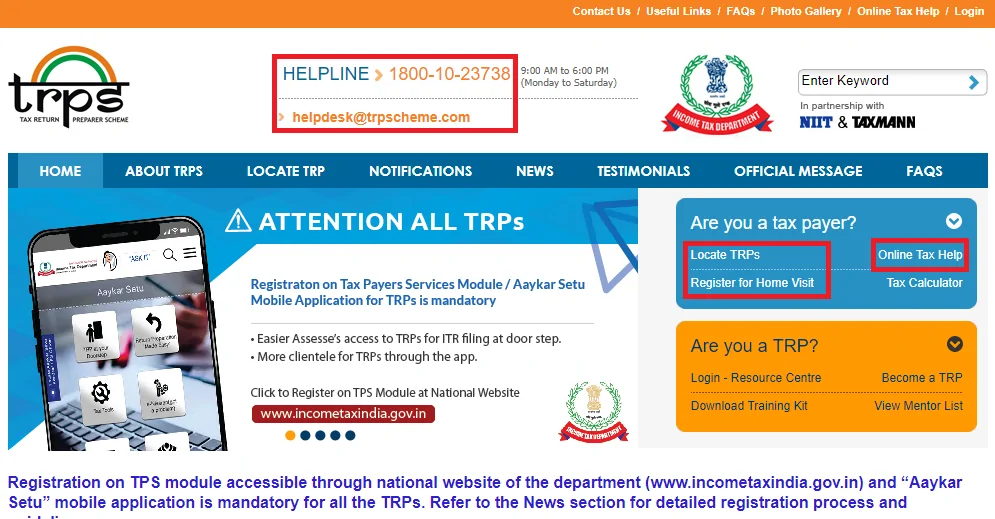

Step 1: Visit the Tax Return Preparer Scheme (TRPS) official website.

On this page, you will find the following links:

- Locate TRPs in your area using State, City, Pincode or TRP name.

- Register for Home Visit

Additionally, the toll free contact number 1800-10-23738 and email id – helpdesk@trpscheme.com are also prominently displayed on the top of this page.

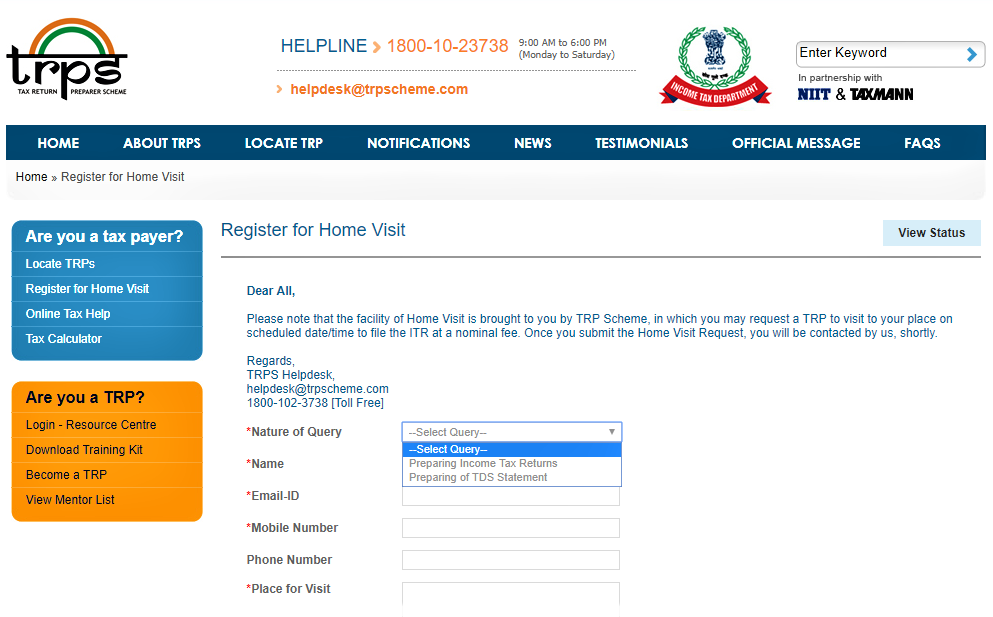

Step 2: Click on ‘Register for Home Visit’ on the right side of the page. A TRP would visit the taxpayer’s residence and assist them in preparing their tax returns. In order to get a TRP to visit you, you need to provide details such as the kind of assistance you require, the date and time you would want the TRP to visit your home, etc. You would also need to provide an alternate date and time for an appointment with a TRP in case a TRP is not available on your selected date and time. The following is a snapshot of the “Register for Home Visit Form” as available on the TRPS website:

Currently the Tax Return Preparer service can be availed for preparing TDS statement as well as for preparing Income Tax Returns.

What are the charges of TRP for ITR filing?

Tax Return Preparers (TRPs) can charge a fee and also earn a commission for the income tax returns filed by them on behalf of the taxpayer. The flat fee charged by a TRP to annual file income tax return is Rs. 250, which is payable by the income tax assessee. The commissions earned by the TRP are payable by either the Resource Center or Partner organisation as authorised by the TRP board. Here is a table that lays out the conditions and the applicable commission that can be earned by the Tax Return Preparer:

| Condition | Commission Earned the TRP |

| First Year | 3% of the tax paid by the assessee subject to a maximum of Rs.1000 |

| Second Year | 2% of the tax paid by the assessee subject to a maximum of Rs.1000 |

| Third Year | 1% of the tax paid by the assessee subject to a maximum of Rs.1000 |

Note: The fee charged by a TRP to the assessee may be lower than the Rs. 250 payable based on key terms and conditions laid down by the TRP scheme.

Who can file ITR through a Tax Return Preparer?

Individual taxpayers who require their ITR to be filed under Section 139 can file their income tax returns through a Tax Return Preparer. A Tax Return Preparer cannot prepare tax returns of the following types of taxpayers who:

- Carries out business or profession during the previous financial year which has to be audited according to Section 44AB of the Income Tax Act, 1961

- The Income Tax assessee was not an India during the applicable financial year

- Is required to file income tax return in response to a notice under Section 142(1)(i), Section 148 or Section 153A

- Needs to file a revised income tax return unless the original return was filed through the Tax Return Preparer

Get FREE Credit Report from Multiple Credit Bureaus Check Now

What are the requirements to become a TRP?

The TRP Scheme is available as a career choice for various groups of individuals including graduates. If you are also interested in enrolling in the TRP scheme, here are the eligibility requirements:

- The interested candidates must hold a bachelor’s degree from a recognised university in any of the following subjects:

- Economics (B.A. / B.Sc.)

- Law (LLB)

- Mathematics (B.A. / B.Sc.)

- Statistics (B.A. / B.Sc.)

- Commerce (B.Com.)

- The candidate’s age must be between the age of 21 to 35 years

If you match the above requirements, you can visit the Procedure to become a TRP link on the TRPS website in order to know more.