TDS or Tax Deducted at Source is a method of paying tax in India at the point of origin of income as per the Income Tax Act, 1961. The deductor (person, organization or institution) is required to withhold an amount equal to the tax amount from the total earnings payable to the receiver or deductee. It is the responsibility of the deductor to ensure that the tax is correctly deducted and then deposited with the concerned authorities within the stipulated timelines.

Applicability of TDS in Various Forms

While it is commonly assumed that the TDS is applicable only on salary income, but it is also applicable in many other cases such as:

- Income from interest on securities and debentures

- Income from interest other than those on securities

- Income from dividends

- Income from withdrawal of EPF (Before expiry of a certain period or if amount withdrawn is beyond the limit specified)

- Payment to contractors / subcontractors / freelancers

- Winnings from horse races, lottery, crossword puzzles or any game related wins

- Insurance commission and commission on brokerage earnings

- Transfer of certain immovable property, etc.

- Income from rendering technical or professional services

- Income from royalty, etc.

Why was TDS introduced ?

As income is taxable only at the end of the financial year, hence the government has instituted the concept of TDS, in order to ensure:

- Prevention of tax evasion: This mechanism ensures that the government collects a portion of the total payable tax at the time of receiving the income itself, chances of hiding income or tax defaults are minimized significantly.

- It acts as a source of steady revenue for the government throughout the year.

- Timely collection of tax.

- Convenience for taxpayers: As the total tax payment is spread throughout the year, individuals can plan their finances better. Lump sum TDS payments in any particular month can adversely hit the financial obligations of individuals.

- Ease in filing tax returns: As the tax is automatically collected and deposited with the concerned authorities by the deductor, it becomes easier for individuals to file their returns. If there are no other sources of income for a person, once TDS has been appropriately deducted, they need not pay any additional tax during return filing.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Importance of TAN for TDS

TAN or Tax Deduction and Collection Account Number is a ten-digit alphanumeric number issued to individuals or organizations that are required to deduct or collect tax on payments made by them.

- As per Section 203A of the Income Tax Act 1961, it is mandatory for all people or organizations (liable to deduct TDS) to quote TAN details in all matters and correspondences related to TDS (such as TDS Returns, TDS Payments, Issuance of Form 16, etc.) with the Income Tax Department.

- Failure to do so will attract a penalty of ₹ 10,000.

- Banks do not accept TDS returns and payments, unless the deductor or depositor has a valid TAN.

Many a times, people assume that PAN and TAN are similar documents and can be used interchangeably. However, TAN is to be obtained separately by people, organizations or institutions that are responsible to deduct tax, even if they have a PAN. The only exception is in the case of a buyer of an immovable property. In this case, the buyer or the deductor is not required to obtain TAN and can use PAN for remitting the TDS.

How to apply for TAN

- The procedure for application of TAN is very easy and can be done online by filling up Form 49B

- Time of Deduction

- As per Section 192, tax on salary is to be deducted at the time of actual payment and not at the time of accrual of salary.

- If salary is paid in advance or arrears of salary are paid, then TDS is to be deducted at that time itself.

- For all other payments, TDS is to be collected at the time of payment or credit of income, whichever takes place before.

- Online TDS Payment

- The online TDS payment system followed the philosophy of “Any Time, Any Where”.

- This has also made the TDS administration a user friendly and transparent process and has helped minimize tax frauds.

- This is one common platform wherein the deductors, taxpayers and assessing officers have access to the same data.

With the ever-increasing number of taxpayers in the country, digitalization is one of the most important pre-requisites for a speedy, accurate and stable ecosystem.

Procedure for Online TDS Payment

With effect from 1st January 2014, all corporate and government deductors and other assesses, who are subject to compulsory audit under Section 44AB, are required to use electronic transfer to make TDS payment. To avail of this facility the taxpayer is required to have a net-banking account with an authorized bank. The list is available on the NSDL- TIN website.

Online TDS payment or e-payment is a simple and user friendly process. It can be done by following the below-mentioned steps-

- Visit the E-Payment Income Tax Department website.

- Select the challan no. ITNS 281. This challan number is to be used for depositing TDS/TCS by company or non-company deductee.

- Select the type of deductee.

- If the deductee is a person other than company, then you should select (0021) Non-Company Deductee, else you need to select (0020) Company Deductee.

- Enter your TAN details. This will be used for an online verification on the validity of the TAN.

- If TAN details are not available in the database of the Income Tax authorities, then you will not be allowed to proceed any further.

- Select the Assessment Year (AY). The Assessment Year is the year immediately following the financial year in which the income is evaluated. For example, for income earned between 1 April 2015 and 31 March 2016, the assessment year will be 2016-17.

- Enter other challan details like accounting head under which the payment is to be made. The name, address, email address and contact details of TAN holder need to be furnished.

- Select the type of the payment.

- If it is a normal payment, then select (200) TDS/TCS Payable by Taxpayer or if it is a payment against the demand raised by the I.T. Department e.g. payment of interest or late fee under section 234E then select (400) TDS/TCS Regular Assessment (Raised by I.T. Department)

- Select the nature of payment such as payment of insurance commission, rent, fees for professional services, etc.

- Also, you will need to select the bank through which the TDS will be deposited.

- On submission of the data, a confirmation screen would get displayed.

- After checking it thoroughly, you need to confirm that all the data entered in the challan has been entered correctly and true to the best of your knowledge.

- Post your confirmation, the page will be re-directed to the net-banking page of your bank.

- You are now required to login to the net banking page, using the User ID and password and make the payment.

- After a successful online TDS payment, the system displays a challan counterfoil.

- The challan contains CIN – Challan Identification Number that shows the payment details, bank name through which the e-payment has been made, Bank Branch Code (BSR) and date of tender of challan.

- The collecting bank branch transmits the details of taxes deposited by you to the “Tax Information Network” (TIN) through the Online Tax Accounting System (OLTAS).

- You can also verify the status of the challan in the ‘Challan Status Inquiry” on the NSDL – TIN website, post seven days of making the payment using the CIN.

If you face any problem at the NSDL website, you can contact the TIN Call Centre at 020 – 27218080 or write to them at tininfo@nsdl.co.in.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

TDS Certificate

After depositing the TDS with the Income Tax Department, as per Section 203, the deductor is required to issue a TDS Certificate to the person on behalf of whom the tax payment was made.

The TDS Certificate or Form 16 / Form 16A (as applicable) should be issued on an annual or quarterly basis.

Benefits of Online Payment of TDS

- Payment facility is available 24x7x365

- TDS payment can be done by the deductor as their convenience in terms of location and time

- Immediate acknowledgement of the payment

- The challan acknowledgement copies can be downloaded and saved for future reference

- Reduced charges of corruption and malpractices such as discretionary grant credit of tax deductions based on manual TDS Certificates

- Less paper translates into being environment friendly

Timelines for TDS Payment

- The due date for the payment of TDS collected by the deductor is 7th of the next month. For example, the deductor has to pay the TDS for the month of May, on or before 7th June.

- Only for the month of March, considering it is the end of the financial year, it is allowed to pay the deducted TDS on or before 30th April of that year.

- These timelines are applicable to all deductors, i.e. non-Government assesses as well as Government assesses, who deposit tax with Challan (Treasury Challan)

- For government deductors who make the TDS payment without challan, the due date for payment of TDS is the same day on which the tax amount is deducted.

- In some circumstances, the Assessing officer (AO), with prior approval from the Joint Commissioner, may allow the quarterly payment of TDS. In that case, last date of payment is 7th of the next month after end of each quarter and 30th April for the last quarter of the financial year.

TDS Filing or TDS Returns

TDS return needs to be filed by the person, organization or institutions, who have deducted tax, on a quarterly basis. As per section 201(1A), interest for delay in the payment of TDS should be paid before filing the TDS return.

There are several forms, based on the nature of deduction:

- Form 24Q: To be filled out for all the deductions made from salaries

- Form 26Q: To be filled out for all the deductions made from payments other than salaries

- Form 27Q: It is the TDS quarterly return to be filled out by the deductor for all deductions made in case of NRIs

- Form 27EQ: It is the TCS quarterly return to be filled out by the deductor

- Form 27A: This form has to be signed and accompanied by quarterly statements

The TDS returns need to be filed, on a quarterly basis and the due date for the same is 31st of the month after the end of the concerned quarter.

E-TDS Return

- All corporate deductors (w.e.f. June 1, 2003) are required to submit their TDS returns in electronic form (e-TDS return).

- From F.Y. 2004-2005 onwards, furnishing e-TDS return is also mandatory for government deductors.

- Deductors (other than government and corporate) may file TDS return in electronic or physical form.

Important Points related to TDS Returns

- CBDT has appointed NSDL e-Governance Infrastructure Limited, (NSDL e-Gov), Mumbai, as an e-TDS intermediary.

- NSDL e-Governance has established TIN Facilitation Centres (TIN-FCs) across the nation, to facilitate deductors or collectors file their e-TDS returns.

- Forms for filing TDS returns, whether electronically or physically, are the same.

- e-TDS Statements should be prepared as per the file format (Clean text ASCII File) in accordance with specifications provided by the Income Tax Department.

- To ensure ease of preparation, the government has also provided free & downloadable software (Return Preparation Utility – RPU) that has been developed by NSDL.

- There are also many third-party software vendors to whom the task of preparing e-TDS Statements can be outsourced.

- The list of the approved vendors is available on the NSDL -TIN website (www.tin-nsdl.com).

Consequences of Missing the Above Mentioned Timelines

Delay in TDS deduction

- TDS needs to be deducted by the 30th of each month and in the month of February, it should be deducted by the last day of the month.

- If the TDS is not deducted on the required due date, whether in whole or in part, then the concerned deductor is liable to pay interest, applicable at a rate of 1% per month or part thereof, from the date when it should have been deducted to the actual date of deduction.

- For instance, if the TDS Amount was to be deducted for the month of July (i.e. 30th of July), but it was actually collected on 5th August, then interest will be 2% (For the month of July and August)

Delay in TDS Payment

- If the deducted TDS is not deposited with concerned authorities by the given timeline, whether in whole or in part, as per Section 201(1A), the deductor is liable to pay an interest, applicable at a rate of 5% for every month or part thereof, from the date on which TDS was collected to the date on which such tax was actually remitted to the credit of the Government.

- Calendar month is considered in calculating interest and any fraction of a month is deemed to be a full month.

- Even a delay of one day would mean that you have to pay interest for two months.

- In case TDS is deducted in month of July and deposited on 8th of August then you have to pay interest for 2 month i.e. July and August. Total interest payable shall be 3%.

In addition to the interest clause applicable, there are additional provisions for penalty and prosecution proceedings as well.

- Penalty under Section 221

- In case the Assessing Officer is convinced that the assessee has failed to deduct tax as required, without any good and adequate reason, the defaulter is liable to imposition of penalty.

- The quantum of penalty is not to exceed the amount of tax in arrears.

- Penalty under Section 271C

- A penalty equal to the amount of tax that the deductor has failed to deduct can be imposed.

- However, such penalty can be levied only by a Joint Commissioner of Income Tax.

- Prosecution proceedings under Section 276B

- Where the deductor has failed to deposit the tax deducted at source, with the concerned government authorities, without a reasonable cause

- He/she is liable to be punished with rigorous imprisonment for not less than 3 months to 7 years and with fine.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Delay in TDS Return Filing

- As per Section 234E, in case an assessee fails to submit the TDS return within the specified due dates, they will be liable to a penalty of ₹200 per day till the time the TDS return is actually submitted.

- The penalty amount cannot exceed the total amount of TDS collected.

- This penalty is also applicable in case of furnishing Form 26QB, in case of purchase of immovable property.

Delay in filing of TDS returns for more than a year from the due date or submission with incorrect data such as TAN, Challan Number, TDS Amount etc. will attract a minimum penalty of ₹10,000 and not be more than ₹1,00,000.

How to Check TDS Payment Status

Assessees can check the TDS payment status online through the online portal of Centralized Processing Cell. Here’s how to do it :

Assessees can check the TDS payment status online through the online portal of Centralized Processing Cell. Here’s how to do it :

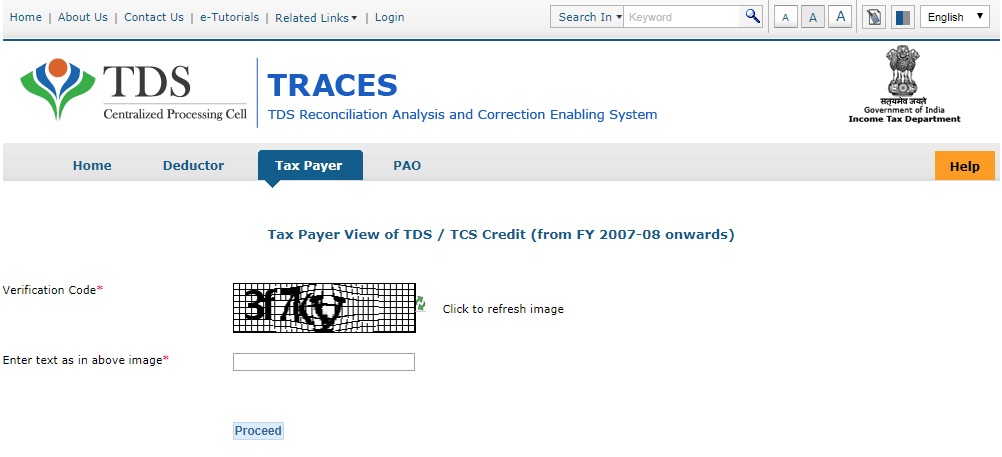

1) Visit TDS CPC website at https://www.tdscpc.gov.in/app/tapn/tdstcscredit.xhtml

2) Enter the captcha code and click on “Proceed”

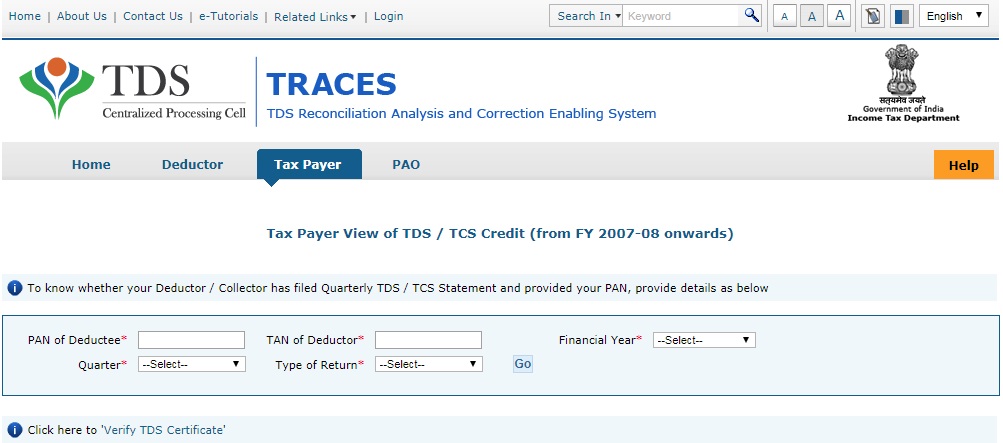

3) Enter details such as PAN of deductee, TAN of deductor, Financial Year, Quarter and Type of Return. Click on “Go” now.

4) TDS credit of the taxpayer is displayed on the screen

What are TDS Due Dates

The due date for submitting TDS for every month is mentioned in the following table :

| Deduction Month | Quarter End Date | TDS Payment Due Date | Due Date for Filing Returns |

| April | 30th June | 7th May | 31st July |

| May | 7th June | ||

| June | 7th July | ||

| July | 30th September | 7th August | 31st October |

| August | 7th September | ||

| September | 7th October | ||

| October | 31st December | 7th November | 31st January |

| November | 7th December | ||

| December | 7th January | ||

| January | 31st March | 7th February | 31st May |

| February | 7th March | ||

| March | 7th April* |

*Deductors other than government entities can make payments till 30th April.