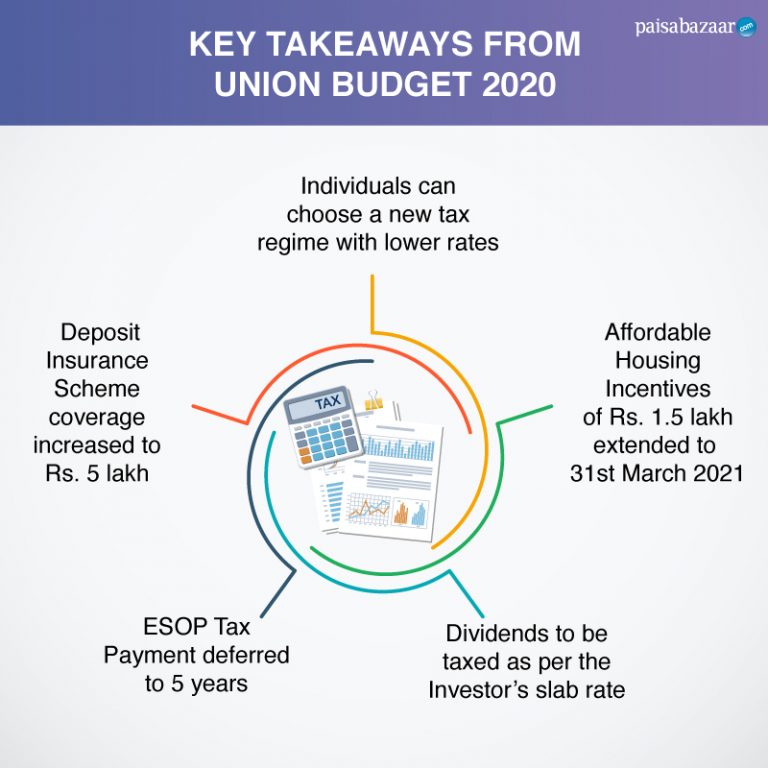

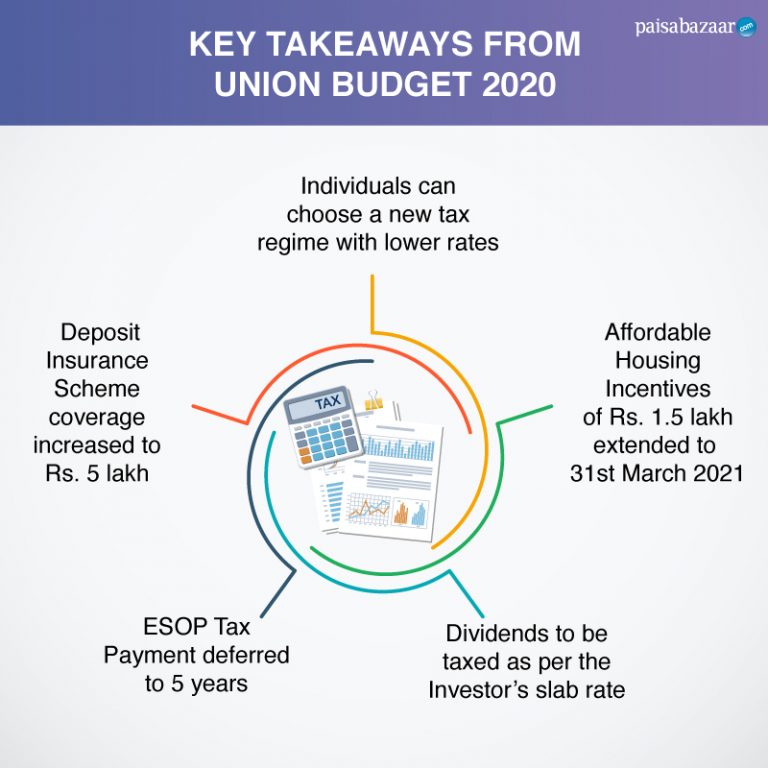

The Union Budget 2020 presented by Finance Minister Nirmala Sitharaman has proposed a number of changes that directly impact the individual tax payer. These changes which will come into effect from 1st April 2020 are as follows:

New Tax Rates Introduced in Union Budget 2020

Union Budget 2020 introduced a new Income Tax Regime, which has significantly reduced the income tax slab rates. However, the new tax regime takes away various deductions and exemptions that could be claimed earlier under the Income Tax Act, 1961. The following table compares the slab rates for the old (existing) and new direct tax regimes.

| Annual Income | New Income Tax Slab Rate | Existing Slab Rate |

| Nil to Rs. 2.5 lakh | Exempt | Exempt |

| Above Rs. 2.5 lakh to Rs. 5 lakh | 5% | 5% |

| Above Rs. 5 lakh to Rs. 7.5 lakh | 10% | 20% |

| Above Rs. 7.5 lakh to Rs. 10 lakh | 15% | |

| Above Rs. 10 lakh to Rs. 12.5 lakh | 20% | 30% |

| Above Rs. 12.5 lakh to Rs. 15 lakh | 25% | |

| Above Rs. 15 lakh | 30% |

Under the new regime, an individual investor will not be able to claim the tax deduction benefits offered under Sections and Subsections of 80C to 80U. Some other key exempted income for salaried and pensioners that will no longer form a part of the new regime are standard deduction and leave travel allowance (LTA).

That said, the new regime also has some benefits to offer apart from the lower taxation rate. It is expected to simplify the income tax law, and hence improve tax compliance. Moreover, the following allowances offered under Section 10(14) of the IT Act are applicable, even if you follow the new regime.

- Transport Allowance granted to a differently abled (divyang) employee for commuting between place of residence and place of duty.

- Conveyance Allowance granted to meet the travel expenditure for performing office duties.

- Any allowance granted to meet the cost of travel/tour/on transfer.

- Daily Allowance to meet the ordinary daily charges borne by an employee for being absent from his normal place of duty.

NOTE: The new tax regime is optional and you can follow the older regime as per your convenience. It is advised to calculate your total tax outgo as per both the regimes and then carefully choose the one that is lucrative for you.

Dividends to be taxed in the hands of the Investor as per slab rate

At present, dividend distribution tax (DDT) is payable on profits distributed by domestic companies at the rate of 15% plus applicable surcharge and cess under Section 115-O of the Income Tax Act, 1961. This is in addition to the tax payable by the company on its profits. Union Budget 2020 has abolished DDT so this tax burden will not be borne by companies. Rather, shareholders/unit holders will have to pay tax on the dividends earned as per their income tax slab rate. Moreover, if the income earned by investors through dividend is more than Rs. 5000 annually, TDS will be deducted at the rate of 10% on this income.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Affordable Housing Incentives extended to 31st March 2021

Currently the interest rate tax benefits of up to Rs. 1.5 lakh in addition to the Rs. 2 lakh annual benefit u/s 24b as part of the affordable housing scheme are available only till 31st March 2020. In Union Budget 2020, these incentives have been extended till 31st March 2021. In other words, the deduction will now be applicable for housing loans sanctioned on or before 31st March, 2021. This will definitely be an added positive for first time home buyers who want to be part of the affordable housing segment.

Deposit Insurance Coverage per depositor increased to Rs. 5 lakh from existing Rs. 1 lakh

Union Budget 2020 announced an increase in Deposit Insurance Coverage from Rs. 1 lakh to Rs. 5 lakh per individual. As a result your bank deposits up to Rs. 5 lakh, including both principal and interest earned across all savings accounts and fixed deposits will be insured by Deposit Insurance and Credit Guarantee Corporation (DICGC).

Limit on Exemption of Employer’s Contribution to Specified Funds

Under the existing rules of Income Tax Act following contributions made by an employer are exempted from tax:

- Employer’s contribution to the employee’s account in a recognized provident fund up to 12% of employee’s basic salary.

- Employer’s contribution made into an approved superannuation fund up to Rs. 1.5 lakh.

- Employer’s contribution towards National Pension Scheme (NPS) up to 14% of basic salary when made by Central government and up to 10% when made by any other employer.

Currently there is no combined upper limit for the three exemptions listed above. As a result, employees earning a high salary income received an undue advantage where a large portion of their income was never taxed. Thus, Union Budget 2020 has proposed a combined upper limit of Rs. 7.5 lakh per year with respect to the employer’s contribution into these specified schemes.

Introduction of “Vivad se Vishwas” Scheme to reduce direct tax litigation

The government has announced the “Vivad se Vishwas” / “No Dispute but Trust” Scheme to reduce tax litigations. Under this Scheme, if you have an ongoing legal dispute with respect to income tax, you can settle the case by paying only the amount of disputed taxes and get a complete waiver of interest and penalty provided you pay the tax dues being disputed by 31st March, 2020. However, if you pay the disputed tax amount after 31st March, 2020, you will have to pay some additional amount. Currently this scheme is available till 30th June, 2020.

ESOP Tax Payment deferred for employees of Start ups

Employee Stock Option Plans (ESOPs) often form a substantial component of the compensation provided to employees of start-ups. They allow start-ups to employ highly talented employees at a relatively lower salary. However, ESOPs are currently taxed as both perquisite on income and income from capital gains at the time of sale of these ESOPs. This results in a cash flow problem for the employees who hold the shares for a longer term. Thus to support the start-up ecosystem, government has deferred the tax payable on ESOPs for employees of eligible start-ups by 5 years or till they leave the company or when they sell their shares, whichever is the earlier.