UPDATE: As per the special economic package announced in view of COVID-19 outbreak, the last date to make payment without additional amount under “Vivad se Vishwas Scheme” has been extended to 31st December, 2020.

“No Dispute but Trust Scheme” or “Vivad se Vishwas Scheme” was announced by FM Nirmala Sitharaman in Union Budget 2020 to reduce the number of ongoing legal disputes in the domain of direct taxation. The scheme provides once in a lifetime opportunity to settle direct tax litigation disputes currently pending in courts without paying any interest or penalty. In the following sections we will discuss more about this scheme.

UPDATE: The Income Tax Department introduced the “Direct Tax Vivad Se Vishwas Rules, 2020” and “Direct Tax Vivad Se Vishwas Act, 2020” in March after the Union Budget announcements. Now, you can file declaration and undertaking under the scheme to avail the benefit. In the following sections we will describe key aspects of this scheme, including the procedure to file a declaration.

Table of Contents :

- What is Vivad se Vishwas Scheme?

- Why has the Vivad se Vishwas Scheme been launched?

- Who can avail the Vivad se Vishwas Scheme?

- How much will you have to pay under the Vivad se Vishwas Scheme?

- How to file declaration under Vivad se Vishwas Scheme – Step by Step Procedure

- Frequently Asked Questions (FAQs)

What is Vivad se Vishwas Scheme?

“Vivad se Vishwas Scheme” or “No Dispute but Trust Scheme” is useful for taxpayers with ongoing legal tax disputes at any level. Under this scheme, the interest and penalty associated with the disputed tax amount is completely waived off. As a result, the taxpayer has to pay only the amount of disputed tax, if the payment is made by 30th June, 2020. After this date, some additional amount has to be paid along with the tax amount.

Please note that the scheme is open till 30th June, 2020. Avail the scheme before the due date to save on the penalty and interest components applicable to the disputed income tax amount. Moreover, by availing this, you get relief from the time-consuming litigation process.

Why has the Vivad se Vishwas scheme been launched?

In the last budget, a scheme called “Sabka Vishwas” was launched to reduce the number of indirect tax cases. The scheme led to settlement of more than 1.89 lakh indirect taxation-related cases.

The new “Vivad se Vishwas” scheme has been launched with a similar goal in an attempt to reduce the number of direct tax litigation cases that are currently pending. Presently, 4.83 lakh direct tax cases are pending in several appellate forums, namely, Commissioner (Appeals), Income Tax Appellate Tribunal (ITAT), High Court and Supreme Court. It is expected that the scheme will settle a significant number of these cases.

Moreover, suitable amendments in the Income Tax Act have been proposed to enable the system of “Faceless Appeals” (e-appeals) on the lines of recently launched “Faceless Assessment” (e-assessment) to impart greater transparency, efficiency and accountability.

Who can avail the Vivad se Vishwas Scheme?

As per the Direct Tax Vivad se Vishwas Act, 2020 taxpayers can avail the benefit of this scheme under the following circumstances.

- If your appeal/ writ petition/ special leave petition filed either by you or the income tax authority was pending as on 31st January’20;

- If an order was passed by the Assessing Officer/ Commissioner (Appeals)/ Income Tax Appellate Tribunal/ High Court on or before 31st January’20 and the date for filing a petition against such an order has not expired;

- If you had filed objections before the Dispute Resolution Panel u/s 144C of the Income Tax Act and the Panel did not issue any direction on or before 31st January’20; or if the Panel issued a direction, the Assessing Officer did not pass any order on or before 31st January’20;

- If you had filed an application for revision u/s 264 of the Income Tax Act, it was pending till 31st January’20.

How much will you have to pay under the Vivad se Vishwas Scheme?

If you file a declaration under the Vivad se Vishwas Act on or before the last date as notified by the Central Government, then the amount payable will be as that depicted in the following table.

| Nature of Tax Arrear | Amount payable under the Vivad se Vishwas Act on or before 30th June, 2020 | Amount payable under the Vivad se Vishwas Act on or after 30th June 2020, but on or before the last date |

| Disputed tax + interest chargeable/ charged + penalty leviable/ levied on the disputed tax | Only the amount of the disputed tax. | Amount of disputed tax + 10% of the disputed tax.

Please note that if the 10% exceeds the sum of interest and penalty, then the excess amount will be ignored. |

| Tax + penalty or interest u/s 132 or 132A of the Income Tax Act | Amount of disputed tax + 25% of the disputed tax.

Please note that if the 25% exceeds the sum of penalty and interest, then the excess amount will be ignored. |

Amount of disputed tax + 35% of the disputed tax.

Please note that if the 35% exceeds the amount of interest and penalty, then the excess amount will be ignored. |

| Disputed interest/ penalty/ fees | 25% of the disputed interest/ penalty/ fee. | 30% of the disputed interest/ penalty/ fee. |

In case the appeal/ writ petition/ special leave petition is filed by the Income Tax authority, then the amount payable will be one-half of the amount specified in the above table depending on the nature of arrear.

NOTE: If you have already received a decision in your favour from the Income Tax Appellate Tribunal (not reversed by the High Court or the Supreme Court ) or from the High Court (not reversed by the Supreme Court), then the amount payable will be one-half of the amount specified in the above table.

How to file declaration under Vivad se Vishwas Scheme – Step by Step Procedure

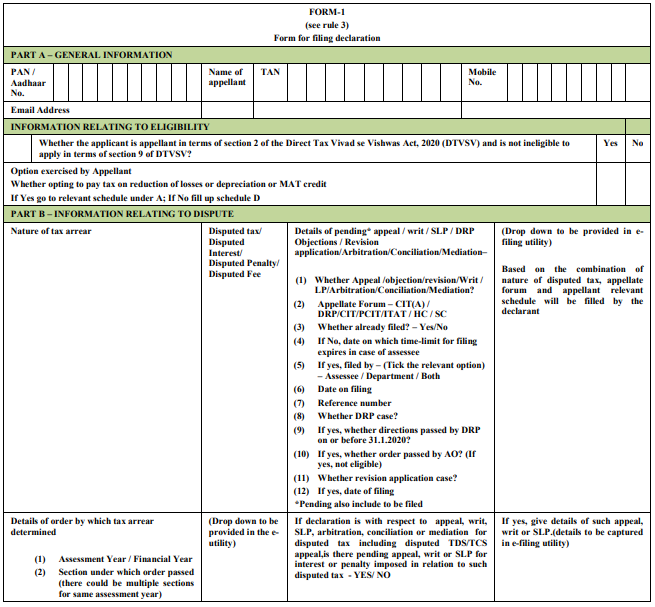

Step 1: Fill out Form 1, shown below to file a declaration to the designated authority under the Vivad se Vishwas Scheme.

Please note that upon filing the declaration in Form 1, any appeal before the Income Tax Appellate Tribunal or Commissioner (Appeals) for any disputed income/ interest/ penalty/ fee will be considered to be withdrawn from the date you receive a certificate from by the designated authority.

Step 2: If you have filed any appeal before the appellate forum or any writ petition before the High Court or the Supreme Court, then withdraw such an appeal and provide a proof for the same .

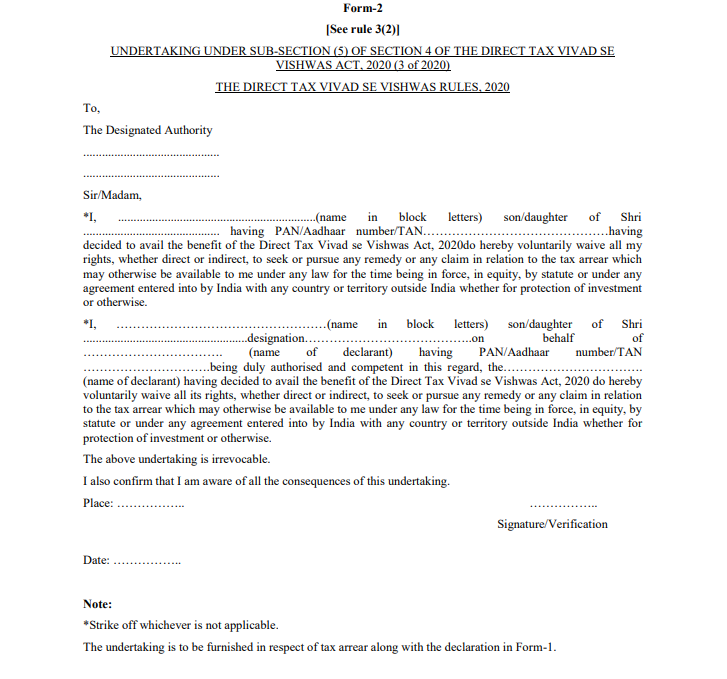

Step 3: File an undertaking giving up your right to seek any remedy or any claim with respect to the tax arrear in Form 2. Please note that Form1 and Form 2 should be verified and signed by you or by a competent person on your behalf as per Section 140 of the Income Tax Act.

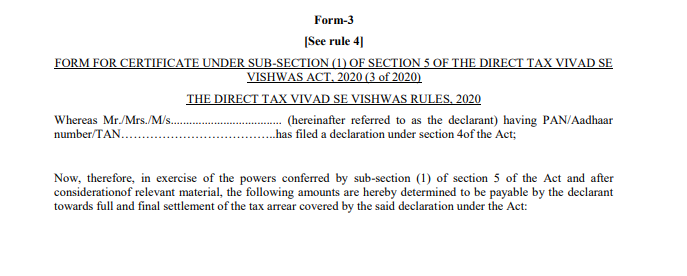

NOTE: You will receive an acknowledgement in Form 3 from the designated authority after they receive the declaration submitted by you.

NOTE: You will receive an acknowledgement in Form 3 from the designated authority after they receive the declaration submitted by you.

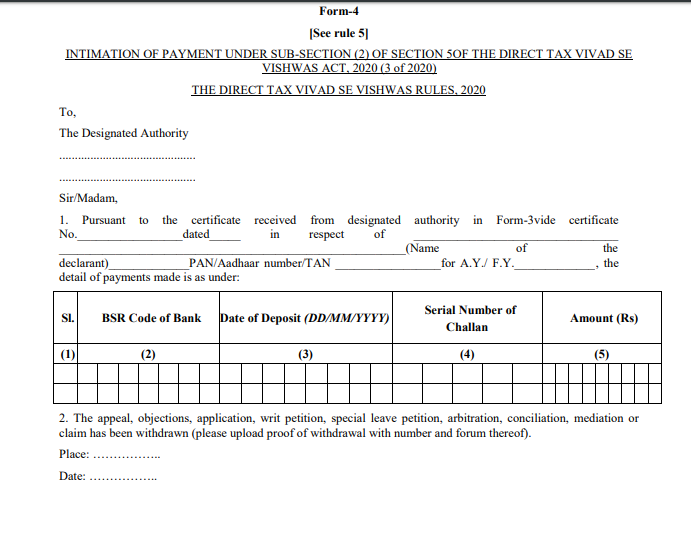

Step 4: Provide details of the payment as per the certificate received form the designated authority in Form 4. Also, provide a proof of withdrawal of appeal or objection or application or writ petition, etc in the Form.

Step 4: Provide details of the payment as per the certificate received form the designated authority in Form 4. Also, provide a proof of withdrawal of appeal or objection or application or writ petition, etc in the Form.

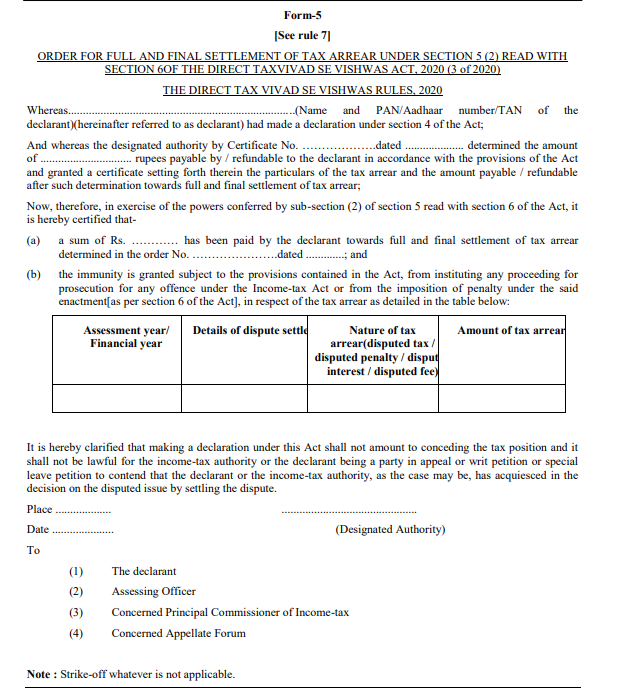

Step 5: Once you complete the payment, you will receive an order (Form 5) from the designated authority acknowledging the receipt of payment .

Thus, you can easily settle any ongoing legal tax disputes by following the above-mentioned steps under the scheme.

Thus, you can easily settle any ongoing legal tax disputes by following the above-mentioned steps under the scheme.

Frequently Asked Questions (FAQs)

Q1. What is the meaning of tax arrear?

Ans. Tax arrear refers to the amount of disputed tax, including the amount of interest and penalty, if any. Alternatively, it can also refer to the disputed amount of interest or penalty or fee, as per the provisions of the Income Tax Act.

Q2. How to submit Form 1 and Form 2 in respect of Vivad se Vishwas Scheme?

Ans. Form 1 and Form 2 should be submitted electronically under a digital signature or electronic verification code.

Q3. When will I get to know the amount payable under Vivad se Vishwas Scheme?

Ans. You will get to know the amount payable under Vivad se Vishwas Scheme within 15 days from the date of receipt of the declaration by the designated authority. The authority will electronically issue a certificate specifying the amount of tax arrear and amount payable in Form 3.

Q4. What is the last date for payment of tax arrears under Vivad se Vishwas Scheme?

Ans. A taxpayer who has filed a declaration under Vivad se Vishwas Scheme should pay the tax arrears within 15 days of receipt of the certificate (Form 3) by the designated authority.

Q5. What immunity is provided under Vivad se Vishwas Scheme?

Ans. The advantage of Vivad se Vishwas Scheme is the immunity it provides to the taxpayers. No legal proceedings can be initiated and no penalty/ interest can be charged with respect to tax arrears under this scheme.