Form 26AS is an important document for filing Income Tax Return (ITR). It records all the details of tax deducted for your PAN at various sources. When filing ITR, the assessee must ensure that the data entries appearing in Form 26AS match the information on the ITR.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

What is Form 26AS?

Form 26AS is an annual consolidated tax statement recording all transactions where various taxes on your income have been deducted at source like tax deducted on salary, tax deducted on fixed deposit income (if any) or tax deducted on commission income etc. Form 26AS also provides the details of tax refunds (if any) received by you from the income tax department in the financial year. The form is available online and can be accessed through the income tax website using the permanent account number of the taxpayer.

What is the significance of Form 26AS when filing ITR?

You can refer to Form 26AS to check all information related to tax deducted at source on your income. Since the data recorded in Form 26AS is already with the Income Tax Department, it becomes important that the details filed in ITR must match with details available in Form 26AS. You may receive an income tax notice in case of any discrepancy found between Form 26AS and the ITR.

A typical Form 26AS may consist of the following details:

Advance Tax

Advance tax paid by the employer on your behalf or TDS deducted on your salary will get reflected in Form 26AS. The details of the deductors such as name of the deductor or Tax Deduction Account Number (TAN) are also mentioned in Form 26AS.

TDS Deducted on Sale of Immovable Property

In case of a sale-purchase transaction of immovable property, the buyer is required to deduct TDS from the seller on the deal price. Therefore, if you have sold a property in the current financial year, the TDS deducted will be shown in your Form 26AS.

Annual Information Return (AIR)

Banks and financial institutions are required to report certain types of transactions to the Income Tax Department. This may include cash deposited in a bank, buying a house property etc. Such transactions are reported in Form 26AS under AIR (Annual Information Return) column.

Tax Refund

Apart from tax deducted from various sources of income, Form 26AS also provides details of the tax refund successfully claimed by the taxpayer in the financial year.

It should be noted that the details of Form 26AS are updated every quarter. Tax credit available in Form 26AS at the year end can be claimed while filing ITR.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

How to Download Form 26AS?

Form 26AS can be downloaded online on e-filing portal of the income tax department. However, in order to download the form, you must be registered on the e-filing portal.

Also Read: Income Tax Login: How to Register Yourself Online for ITR Filing?

In case you have already registered at the Income-tax portal, you can download Form 26AS online with the help of following instructions:

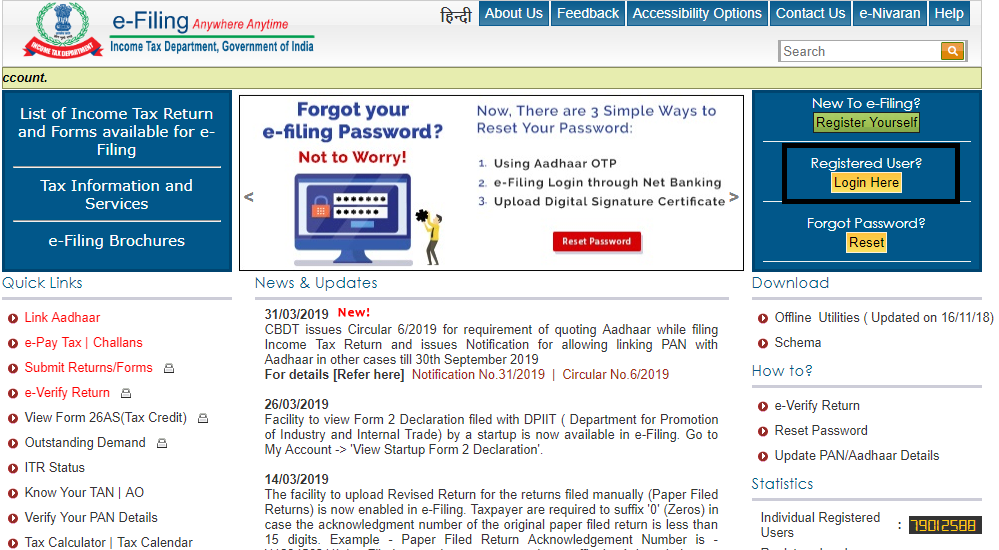

- Visit the Income Tax Department e-filing portal and login into the portal using your PAN as user-id and password.

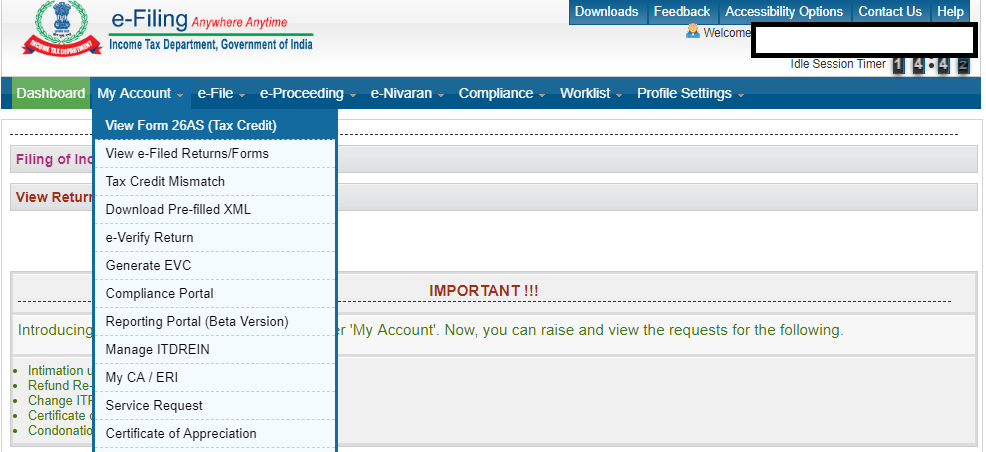

- Click on “My Account” tab and select “View Form 26AS (Tax Credit)” option.

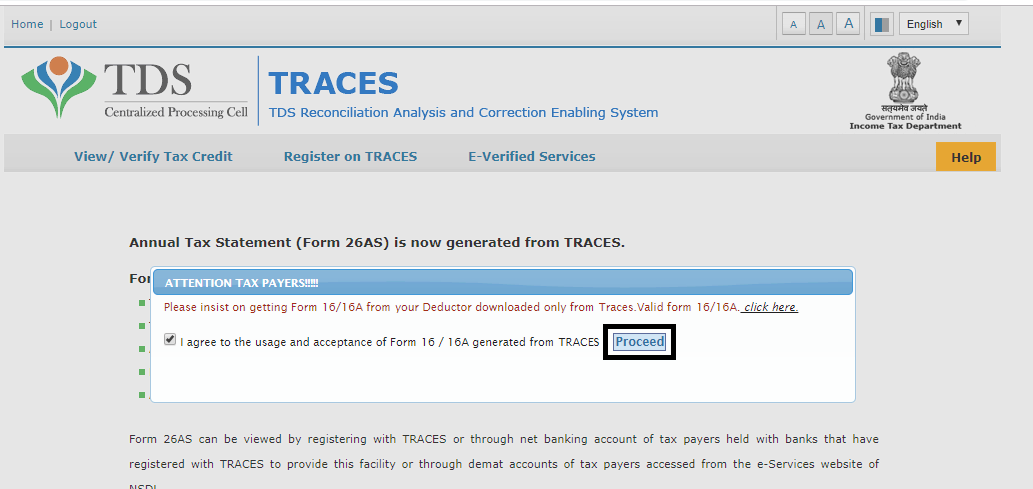

- Click on “Confirm” and you will be directed to a new page. Click on the usage and acceptance box and click on “Proceed” to .

- Congratulations! You can now view online or download Form 26AS.

What is the difference between Form 16 and Form 26AS?

Form 16 is basically a certificate issued by the employer reflecting TDS deducted and deposited with the government on net income from the salary of the employee. Form 16 thus shows details of tax deducted by the employer on the salary income only. Thus TDS deducted on income from other sources such as interest income, sale of property, etc. are not featured on Form 16.

On the other hand, Form 26AS contains records of all transactions related to tax deducted at source (TDS), tax collected at source (TCS) or tax refund claimed. Form 26AS is your tax credit statement, which shows your net tax credit balance for the fiscal.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

How does Form 26AS help in filing ITR?

If you are filing your income tax return online, Form 26AS can be a great help. Earlier, the taxpayer had to submit Form 16/16A along with the ITR. With the introduction of Form 26AS by the Income Tax Department, the need to submit Form 16/16A has been obviated.