Goods and Services Tax (GST) is single comprehensive tax applicable for the entire nation. It has replaced a number of indirect taxes in India, including central excise duty, state VAT, additional duties of customs and entertainment tax. Two of its characteristic features are:

- It is added at every step of value addition along the supply chain. Thus, it is multistage in nature. However the cascading effect of tax is prevented by the implementation of input tax credit.

- It depends on the destination of consumption. For instance, if a good is manufactured in state A but consumed in state B, then the revenue generated through GST collection is accredited to the state of consumption (state B) and not to the state of production (state A). To compensate for the possible losses to the manufacturing-heavy states, GST compensation cess is levied.

Table of Contents :

Components of GST

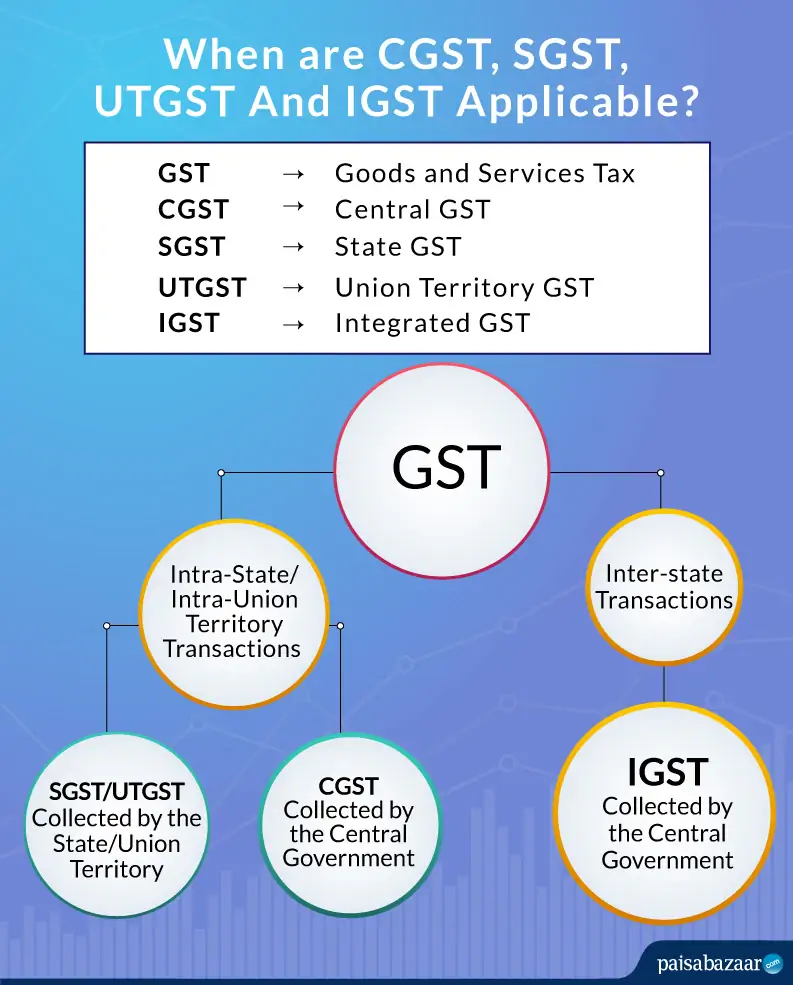

There are three components of GST, namely SGST, CGST and IGST.

- SGST/UTGST: It is collected by the individual states and union territories when the supply occurs within the same state/union territory. For example, when a good is both manufactured and sold within Gujarat, SGST will be levied by the Gujarat state.

- CGST: It is collected by the Central government in case of an intra-state transaction i.e. transaction within the same state. In the above example, CGST will be levied, in addition to SGST, by the Central government.

- IGST: IGST or Integrated GST is levied by the Central government when the location of the supplier of a good/service and the place of consumption lie in different states. The IGST so collected is subsequently divided between the State and Centre.

Why GST?

- Before the implementation of GST on 1st July, 2017, several indirect taxes were levied both by the state and the centre.

- Interstate sale of goods was taxed by the centre in the form of Central State Tax (CST).

- Different states followed different rules and regulations.

- Moreover, there were additional taxes like entertainment tax, local tax and octroi.

All this resulted in lack of uniformity in taxation and posed a barrier to interior trade within the country. It also resulted in overlapping of taxes by the Centre and state government all of which often featured different tax rates. Thus, under the earlier regimes, in many cases, tax was levied on tax, a phenomenon called ‘the cascading effect of taxes’.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Types and GST and their Applicability

The IGST collected by the centre is later distributed between the state of consumption and the central government.

How to know when SGST, CGST or IGST is applicable?

The locations of the supplier of the goods/ services and that of the consumer determine whether a combination of SGST and CGST will be applicable or only IGST.

Intra-state Transactions

For a transaction completed within the state, both SGST and CGST are levied at the time of collection. For example, if 1 tonne of coal worth Rs. 5000 is supplied by a supplier in Gujarat to a consumer in the same state, total 5% of GST will be collected by the supplier from the consumer. This 5% GST will constitute 2.5% SGST and 2.5% CGST, and will be directly diverted to the state and the centre.

Inter-state Transactions

For a transaction completed between 2 states, IGST is applicable. For example, if the coal supplier in Gujarat had sold the coal worth Rs. 5000 to a consumer in Maharashtra, IGST at the rate of 5% would have been collected. The IGST collected by the Centre is later divided between the State of consumption (i.e. Maharashtra in our example) and the Central Government.

Hence, for intra-state transactions, both SGST and CGST are levied. While for inter-state transactions only IGST is collected, which is later divided between the state and the centre. Notably, this does not create any difference for the consumer as the combined rate of SGST and CGST is always equal to the IGST rate. This system ensures smooth flow of taxes between the state and the centre without complicating the tax rates for the seller or the consumer.

SGST, CGST and IGST rates of some common items

| Goods | SGST | CGST | IGST |

| Household necessities like tea, coffee (except instant), edible oil, spices, and sugar. Coal, life-saving drugs and Indian Sweets are also covered under this GST slab. | 2.5% | 2.5% | 5% |

| Processed food and computers | 6% | 6% | 12% |

| Hair oil, soaps and toothpaste, capital goods and industrial intermediaries. | 9% | 9% | 18% |

| Luxury items, including premium cars consumer durables like AC and refrigerators, cigarettes, aerated drinks, and high-end motorcycles | 14% | 14% | 28% |

Input Tax Credit and GST

Let’s assume, you are a producer and GST payable on the final product is Rs. 500. However, you had already paid Rs. 300 on the purchase of raw materials, you can claim Rs. 300 as input tax credit and only pay Rs. 200 as GST at the time of supply.

Now let’s understand how input tax credit works in terms of SGST, CGST and IGST credit. It should be noted that as per the GST Act, GST Credit should be applied in the following order:

- To set off IGST liability

- To set off CGST liability

- To set off SGST liability

Suppose a manufacturer, Raj from UP sold goods worth Rs. 1 lakh to a dealer, Sumit located in UP. The dealer in turn sold the goods at Rs. 1.2 lakh to a trader, Manav in Haryana. The trader finally sold it to the end consumer, Mehak at Rs. 1.5 lakh.

The applicable GST rates on this good are SGST= 6%, CGST=6% and IGST=12%.

Transaction 1– Raj sold the goods at Rs. 1 lakh to Sumit in the same state. So, this is an intra-state transaction. SGST and CGST at the rate of 6% each will be charged.

SGST = 6% of Rs. 1 lakh = Rs. 6000 (to the state of consumption, UP)

CGST = 6% of Rs. 1 lakh = Rs. 6000 (to the centre)

Total GST payable by Raj = Rs. 12,000

Transaction 2- Sumit from UP sold the goods at Rs. 1.2 lakh to Manav from Haryana. So, this is an inter-state transaction. IGST at the rate of 12% will be charged.

IGST = 12% of Rs. 1.2 lakh = Rs. 14,400 (to the centre)

IGST Credit = Rs. 12,000

Net IGST liability for Sumit = Rs. 14,400- Rs. 12,000 = Rs. 2,400 (to the centre)

Transaction 3- Manav sold the goods at Rs. 1.5 lakh to Mehak in the same state. So, this is an intra-state transaction. SGST and CGST at the rate of 6% will be charged.

SGST= 6% of Rs. 1.5 lakh= Rs. 9000 (to the state of consumption, Haryana)

CGST= 6% of Rs. 1.5 lakh= Rs. 9000 (to the centre)

Total IGST Credit = Rs. 14,400 (as per the previous transaction)

IGST Credit to set off the IGST liability = Rs. 2400 (IGST credit balance= 14400 – 2400 = Rs. 12000)

IGST credit to set off CGST = Rs. 9000 (IGST credit balance = 12000- 9000 = Rs. 3000)

Finally, IGST credit used to set off SGST= Rs. 3000 (IGST Credit balance = 0)

Net SGST in this transaction= Rs. Rs. 9000- Rs. 3000= Rs. 6000 (to Haryana)

Final Settlement- GST is a consumption based tax. It is received by the state where the goods/services are consumed. Hence in this case, UP will receive any GST after supply of the good to the state of consumption, i.e., Haryana. The applicable GST rate will be 6% SGST received by Haryana state and 6% CGST received by the Central Government.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Thus, UP will need to transfer the SGST of Rs. 6000 (for payment of IGST) to the centre. Finally, the centre will have to transfer Rs. 3000 to Haryana (the state of consumption).

| Selling Price | Particulars | Uttar Pradesh (UP) | Haryana | Centre | |

| Transaction 1 | Rs. 1 lakh | Income (+) | (+) Rs. 6000 (SGST) | – | (+) Rs. 6000 (CGST) |

| Transaction 2 | Rs. 1.2 lakh | Income (+) | – | – | (+)Rs. 14,400 (IGST) |

| SGST Credit (–)

CGST Credit (-) |

– | – | (-) Rs. 6000

(-) Rs. 6000 |

||

| Net IGST liability | – | – | (+) Rs. 2400 | ||

| Transaction 3 | Rs. 1.5 lakh | Income (+) | – | (+) Rs. 9000 (SGST) | (+) Rs. 9000 (CGST) |

| IGST Credit (-) | – | (-) Rs. 3000 (for SGST) | (-) Rs. 2400 (for IGST liability)

(-) Rs. 9000 (for CGST) |

||

| Total | Rs. 6000 | Rs. 6000 | Rs. Rs. 6000 | ||

| Adjustment | (-) Rs. 6000 (towards the centre) | (+) Rs.3000

(from the centre) |

(+) Rs. 3000

(from UP) |

||

| Net | Rs. 0 | Rs. 9000 | Rs. 9000 |

Thus, both the centre and the state of consumption will receive SGST and CGST at the rate of 6% of the final selling price. Moreover, the state of manufacture will not receive any GST. As a result of the potential loss of revenue for manufacturing-oriented states, the GST compensation cess mechanism was introduced.

Further Reading Suggestions – GST Council Meeting Updates and GST Rates