| Note: Citibank has been merged with Axis Bank. To know more about UPI services provided by Citibank, click here. |

Citibank, along with its internet banking and mobile banking services, provides its customers with the option to transfer inter-bank funds using the Citibank BHIM UPI mobile app. Citibank has collaborated with the BHIM app which is an initiative by NPCI (regulated by the Reserve Bank of India).

In order to transfer funds from one bank account to another bank account, it is important that first of all, you register with the Citibank BHIM UPI app. To use UPI, you require a smartphone, debit card and a safe network connection. Read on to know the steps to register, how to send money via UPI and to request funds.

What is a UPI Account?

All banks that participate in UPI allow their account holders to send and receive money through a VPA (Virtual Payment Address). This eliminates the need for entering additional bank information such as account number, IFS code, etc.

Get Free Credit Report with monthly updates. Check Now

How to Register for Citibank UPI

To register with Citibank UPI, the customer must have activated the mobile banking facility for their account. They can activate mobile banking by sending an SMS with the word “MBANK” (without the quotation marks) to 52484. The customer may also visit their respective branch for additional information.

After activating mobile banking, the customer can do the following.

- After sending the SMS, the user will receive a download link for the Citibank mobile banking application

- The customers have to use their internet banking login ID and IPIN to initiate IMPS fund transfer

- To transfer money to a recipient, you have to click on ‘One-Tine Fund Transfer’ on the home screen. Now, only a few things should be entered such as the recipient’s mobile number (mobile number registered to the customer’s account), amount to be transferred, and MMID. By clicking the ‘Confirm’ button, the money will be transferred immediately

- Customers will also get the option for setting up their UPI ID or VPA. You will also have to ensure that your mobile phone number is registered with the bank

How to Transfer Money using BHIM Citibank UPI

To use BHIM Citibank UPI app, first of all you need to install the Citi Mobile app from App Store or Google Play and register yourself there.

- Open the sidebar Menu and “Payments & Transfer” section

- Select “Transact using UPI”

- Create your Citi Virtual ID (this will be your Virtual Permanent Address to/from transfers will take place)

Follow the steps stated below for sending or receiving/requesting money using UPI:

For sending money

- Log in to your app and open the “Transact using UPI” section

- Enter the receiver’s virtual ID (also known as UPI ID)

- Add the “Amount” you want to send and “Remarks”, if any

- Enter the PIN

- Submit to complete the transaction

You will be notified once the receiver will get money. This should happen in seconds.

Another method is “Scan & Pay”. This can be used if the receiver is nearby and you have access to his/her QR code.

- Click on the “Scan & Pay” option on the home page

Make sure that the app has permission to access camera.

- Scan the QR code by simply placing your phone in front of the code

- On reading the code, you will be redirected to the payments page

- Enter the amount and remarks in the fields provided

- Enter you ATM PIN to authorize the payment

For receiving/requesting money

- Open on “Request” section from the home page of the Citi Mobile App

- Enter the UPI ID (or Virtual Permanent Address) of the person from which you are requesting money

- Enter the amount and remarks (optional) in the fields provided

- Submit the request

You will receive a notification once the sender sends you the money requested. This money will be added directly in your linked bank account.

A Good Credit Score ensures you manage Your Finances Well

Check Now

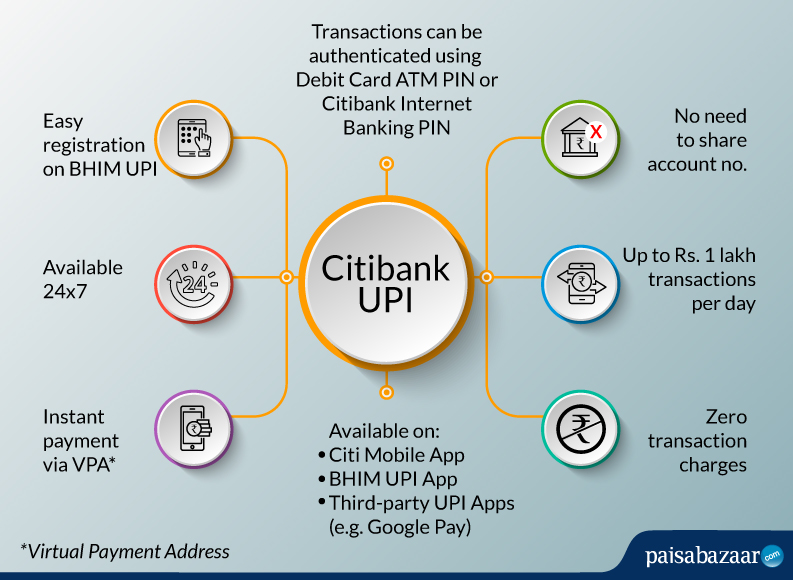

Features of Citibank UPI

The following mentioned are the key features of Citibank BHIM UPI:

- Quick transfer within seconds – Available 24×7

- Multiple bank accounts can be added in a single profile

- Complete privacy is guaranteed when transferring via Virtual Address – Only UPI ID is required to share

- Citibank BHIM UPI is available both for Citibank account holders and non-account holders as well

- The maximum fund transfer in a day through Citibank UPI – Rs. 1 lakh per day (or up to 10 transactions in a day)

Citibank UPI Customer Support

Being a new mode of payment, not every Citibank UPI customer is familiar with the concept. This is when you can take help of the Citibank customer service team. Dial the below-stated number to have your queries sorted:

1860 210 2484

A high Credit Score may help you get a credit card with better benefits. Check Now

Frequently Asked Questions (FAQs)

What do I need to use UPI for my Citibank Account?

You need 3 things to use UPI:

- A smartphone

- An active internet connection

- Citibank account linked with your mobile number

What are the timings of using UPI?

UPI services are available 24×7. This means you can send or receive money anytime, irrespective of the bank’s timing.

What are the charges for using UPI?

There are no service charges levied for transaction via UPI.

What is the maximum amount that can be transferred in a day using UPI?

UPI’s daily transaction limit – Rs. 1 lakh

Can I pay money to someone if I don’t know his/her account number?

Yes. Using UPI, you can transfer funds without adding bank account details. You only need the person’s UPI ID or Virtual Permanent Address. This is the USP of UPI transfers.

Can user stop the fund transfer through UPI once it is initiated?

No. Citibank UPI is an instant mode of fund transfer and it transfers the money instantly into the receiver’s account. In any case, customers can contact their respective branch and the Citibank UPI if the funds are transferred into wrong bank account due to errors while entering the mobile number or VPA of the receiver.