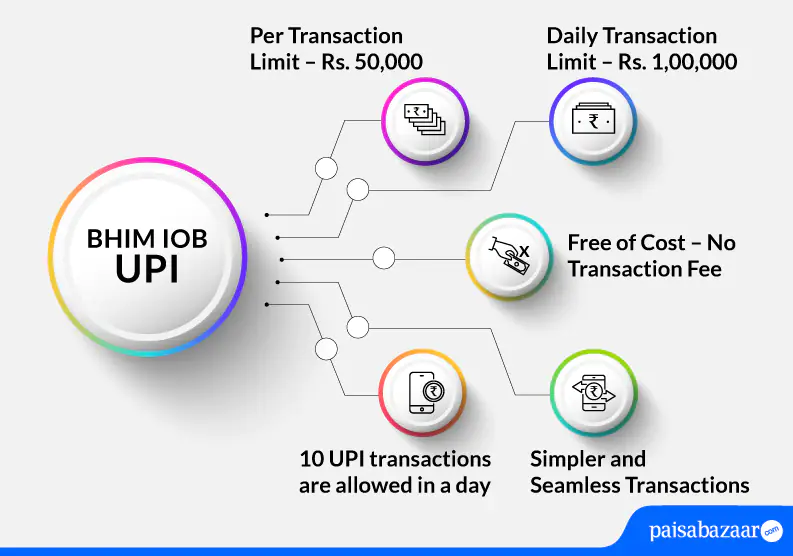

Unified Payments Interface (UPI) is a real-time payment solution that supports easy and secure fund transfers between bank accounts. This facility allows customers to link multiple bank accounts to one UPI application which makes it easier for customers to make seamless fund transfers from one place. Through UPI, payments can be done by using UPI ID, phone number, account number and IFSC or by scanning QR code. On this page, we will learn about UPI services offered by Indian Overseas Bank – BHIM IOB UPI.