SBI Realty Home Loan: Interest rates, Eligibility, Documents, Fees & Charges

State Bank of India has launched its online platform for homebuyers- SBI Realty. SBI Realty provides home loans for the purpose to purchase a plot for construction of a dwelling unit. The construction should take place within 5 years from date the loan has been sanctioned.

How Is RuPay Card Different From Visa And Mastercard?

In an effort to promote the cause of financial inclusion in the country, the Government launched the RuPay card a few years ago. RuPay is India’s own domestic payment network developed on the lines of international payment networks like Visa, MasterCard, Discover, Diner’s Club and American Express. In a market that has been dominated thus […]

Review: Standard Chartered Platinum Rewards Credit Card

Standard Chartered Platinum Rewards Credit Card is one amongst the top rewards credit card in India, that offers you up to 5X rewards on a low annual fee of Rs. 250. To understand, if this card is a good fit for you, read on to read a detailed review of this credit card.

IndianOil Axis Bank Credit Card Review

Axis Bank in collaboration with IndianOil has launched a fuel credit card i.e. IndianOil Axis Bank Credit Card. You can get up to 4% value back on your fuel purchases at IndianOil through this card. You can also avail 1% fuel surcharge waiver. Apart from fuel, you can avail exciting offers and benefits on other categories as well such as entertainment, dining, etc. Keep reading to know more about this credit card in detail.

BPCL SBI Card Octane Review

BPCL SBI Card Octane is a fuel credit card offered in collaboration with Bharat Petroleum Corporation Ltd. (BPCL). This is a premium version of the previously launched, BPCL SBI Card. You can get a whopping 7.25% value back (including a 1% surcharge waiver) on your fuel purchases at BPCL via this card. This is an ideal option if you frequently visit BPCL outlets for fuel and are looking for an option to save money on your fuel expenses.

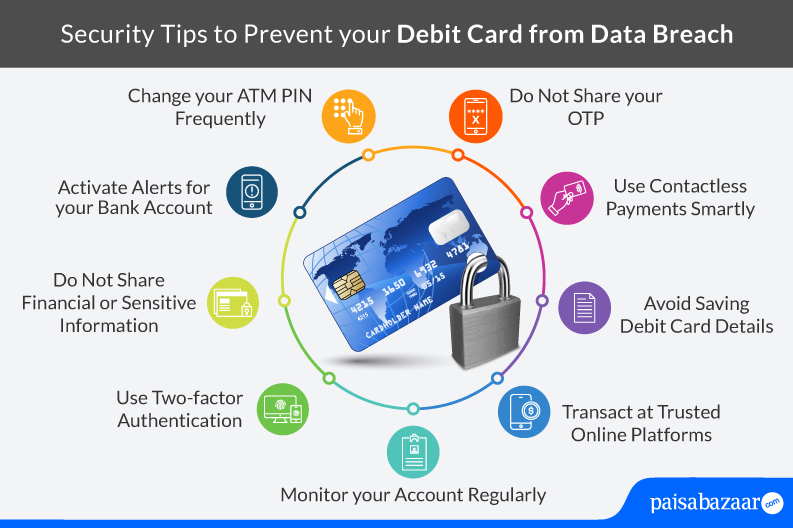

Debit Card Data Breach: Security Tips to Protect Your Account

Indian banking system is shaken by the recent massive data breach involving approximately 3.2 million debit cards. This is the biggest-ever financial data breach the country has experienced to date. Banks have received complaints from customers on fraudulent usage of their card, mainly in China and US while they were in India. Customers from 19 […]

Axis ACE Vs Flipkart Axis Bank Credit Card

Credit Card Users Spent Rs. 71,429 Crore on Online Purchases in May: RBI Data