Utkarsh Small Finance Bank offers a wide range of savings account to its customers to cater to their financial needs. Let us have a look at the various types of Utkarsh Small Finance Bank Savings Accounts along with their features and benefits. But, before that let’s check Utkarsh Small Finance Savings Account interest rate –

Utkarsh Small Finance Bank Savings Account Interest Rate 2025

| Account Balance | Interest Rate (p.a.) |

| Balance up to Rs. 1 Lakh | 4.00% |

| Incremental balance above Rs. 1 Lakh and up to Rs. 5 Lakh | 6.25% |

| Incremental balance above Rs. 5 Lakh and up to Rs. 50 Crore | 7.50% |

| Incremental balance above Rs. 50 Crore | 7.75% |

Note: Interest rates are updated as on 9th January 2025 and are with effect from 10th Sept 2024

Types of Utkarsh Small Finance Bank Savings Accounts

Utkarsh Small Finance Bank provides different types of savings account options to cater various customer’s requirements.

| Types of Utkarsh Small Finance Bank Savings Account | Primary Features |

| Standard Savings Account |

|

| Premium Savings Account |

|

| Minor Savings Account |

|

| Salary Account |

|

| Basic Savings Bank Deposit Account (BSBDA) |

|

| Basic Savings Bank Deposit Account (Small) |

|

Standard Savings Account

Customers can avail various benefits and high returns by investing in Utkarsh Small Finance Bank Standard Savings Account. Let’s look at the various benefits offered by this account.

| Utkarsh Small Finance Bank Standard Savings Account Features & Benefits |

|

Eligibility Criteria

Anyone residing in India or a Hindu Undivided Family can apply for an Utkarsh Standard Savings Account.

Fees and Charges

| AQB Requirements | AQB Non-Maintenance Charges | |

| Metro/Urban : Rs.10,000 | Metro/Urban: Rs. 25 per Rs. 500 of shortfall, maximum Rs. 350/-for quarter | |

| Semi Urban/Rural : Rs. 5,000 | Semi Urban/Rural: Rs. 25 per Rs. 500 of shortfall, maximum Rs. 250/ for half year | |

| Debit Card | Rupay Card – Classic | |

| Card Fees | Issuance Fee (Primary Holder): Rs. 50

Annual Fee (Primary Holder): Free for first year, Rs. 50 from subsequent year |

|

| Withdrawal Limit | ATM Rs. 40,000 per day | |

| Per Transaction Limits | Rs. 20,000 (own Bank ATM), Rs. 10,000 (other Bank ATM) | |

| Shopping Limit | POS Rs. 1,00,000 per day | |

| Per Transaction Limits | POS Rs. 25,000 | |

| ATM Transactions | Unlimited Free Transactions | |

| Other ATM Card Charges | PIN Regeneration Charges – NIL (Green Pin)

Card Replacement Charges – Rs. 100 Add on charges – Rs. 100 |

|

| Service Type | Free limit | Charges Beyond Free Limit |

| Cash Deposit Transactions | Rs. 5 Lakh 10 transactions | Rs. 2.50 per Rs. 1,000 (Minimum Rs. 20) |

| Cheque book | One Free Cheque book per quarter (20 leaves) | Rs. 2 leaf |

| DD/PO transactions | Demand Drafts Payable at own Bank locations: Up to Rs. 2,000- Rs. 20 Above Rs. 2,001 – up to Rs. 10,000- Rs. 50 Above 10,000, Rs.2 – Rs. 1,000 (Min 60 & Max Rs. 1,500) Payable at locations: Re. 1 per every Rs. 1000, min Rs. 25 DD + Correspondent Bank charges Revalidation/Duplicate DD: Rs. 100 Cancellation: Rs. 100 |

|

Premium Savings Account

Utkarsh Small Finance Bank Premium Savings Account provides various benefits and services to its customers along with convenient banking, lifestyle privileges, transactional offers, etc. Let’s look at the various benefits offered by this account.

| Utkarsh Small Finance Bank Premium Savings Account Features & Benefits |

|

Eligibility Criteria

Anyone residing in India or a Hindu Undivided Family can apply for an Utkarsh Premium Savings Account.

Fees and Charges

| AQB Requirements | AQB Non-Maintenance Charges | |

| Rs. 50,000 AQB or Relationship of Rs.5 lakh | NIL for first year

(From subsequent years, based on review of average balance maintained in first year) |

|

| Debit Card | Rupay Card – Classic | |

| Card Fees | Issuance Fee (Primary Holder): Rs. 250 Annual Fee (Primary Holder): Free for first year, Rs. 250 from subsequent year | |

| Withdrawal Limit | ATM Rs. 1,00,000 per day | |

| Per Transaction Limits | Rs. 20,000 (own Bank ATM)

Rs. 10,000 (other Bank ATM) |

|

| Shopping Limit | POS Rs. 1.5 lakh per day | |

| Per Transaction Limits | POS Rs. 50,000 | |

| ATM Transactions | Unlimited Free Transactions | |

| Other ATM Card Charges | PIN Regeneration Charges – NIL (Green Pin)

Card Replacement Charges – Rs. 250 Add on charges – Rs. 250 |

|

| Service Type | Free limit | Charges Beyond Free Limit |

| Cash Deposit Transactions | Rs. 20 lakh Unlimited transactions | Rs. 2.50 per Rs. 1,000 (Min. Rs. 20) |

| Cheque book | Two Free Chequebook per quarter (20 leaves) | Rs. 2 leaf |

| DD/PO transactions | Demand Drafts Payable at own Bank locations: Upto Rs. 2,000- Rs. 20 Above Rs. 2,001 up to Rs. 10,000- Rs. 50 Above Rs. 10,000, Rs.2- Rs. 1,000 (Minimum Rs. 60 and Maximum Rs. 1,500) Payable at corresponding bank locations: Re. 1 per every Rs. 1000, min Rs. 25 DD + Correspondent Bank Charges Revalidation/Duplicate DD: Rs. 100 Cancellation: Rs. 100 |

|

Minor Savings Account

The bank offers an account for children below the age of 18 years to provide a range of special banking benefits. Let’s look at the various benefits offered by this account.

|

Utkarsh Small Finance Bank Minor Savings Account Features & Benefits |

|

Eligibility Criteria

Children below 18 years of age can open a Minor Savings Account with Utkarsh Small Finance Bank.

Fees and Charges

| AQB Requirements | AQB Non-Maintenance Charges | |

| Metro/Urban : Rs. 5,000 AQB | Metro/Urban: Rs. 25 per Rs. 500/-of shortfall, Maximum Rs. 350 for quarter | |

| Semi Urban/Rural : Rs. 1,000 half yearly | Semi Urban/Rural: Rs. 25 per Rs. 500 of shortfall, Maximum Rs. 250 for half year | |

| Debit Card | Rupay Card – Classic | |

| Card Fees | Issuance Fee (Primary Holder): Rs. 50/-

Annual Fee (Primary Holder): Free for first year, Rs. 50 from subsequent year |

|

| Withdrawal Limit | ATM Rs. 5,000 per day | |

| Per Transaction Limits | Rs. 5,000 (own Bank ATM), Rs. 5,000 (other Bank ATM) | |

| Shopping Limit | POS Rs. 5,000 per day | |

| Per Transaction Limits | POS Rs. 5,000 | |

| ATM Transactions | Unlimited Free Transactions | |

| Other ATM Card Charges | PIN Regeneration Charges – NIL (Green PIN)

Card Replacement Charges – Rs. 100 |

|

| Service Type | Free limit | Charges Beyond Free Limit |

| Cash Deposit Transactions | Rs. 5 Lakh/ 10 transactions | Rs. 2.50 per Rs. 1,000 (Min. Rs. 20/-) |

| Cheque book | One Free Chequebook per quarter (20 leaves) | Rs. 2 leaf |

| DD/PO transactions | Demand Drafts Payable at own Bank locations: Upto Rs. 2,000 – Rs. 20 Above Rs. 2,001 up to Rs. 10,000/- Rs. 50 Above Rs. 10,000- Rs. 2- Rs. 1,000 (Minimum Rs. 60 & Maximum Rs. 1,500) Payable at corresponding bank locations: Re. 1 per every Rs. 1000, minimum Rs. 25 DD + Correspondent Bank charges Revalidation/Duplicate DD: Rs. 100 Cancellation: Rs. 100 |

|

Salary Account

Utkarsh Small Finance Bank offers a salary account to its organisation and employees with easy disbursement of salaries, and a range of modern and customised investment solutions. Let’s look at the various benefits offered by this account.

| Utkarsh Small Finance Bank Salary Account Features & Benefits |

|

Eligibility Criteria

To know the eligibility of Utkarsh Small Finance Bank Salary Account, account holders need to visit the nearest bank branch.

Fees and Charges

| AQB Requirements | AQB Non-Maintenance Charges | |

| NIL | NIL | |

| Debit Card | Rupay Card – Classic | |

| Card Fees | Issuance Fee (Primary Holder): Free

Annual Fee (Primary Holder): Free |

|

| Withdrawal Limit | ATM Rs. 40,000 per day | |

| Per Transaction Limits | Rs. 20,000(own Bank ATM)

Rs. 10,000 (other Bank ATM) |

|

| Shopping Limit | POS Rs. 1,00,000 per day | |

| Per Transaction Limits | POS Rs. 25,000 | |

| ATM Transactions | Unlimited Free Transactions | |

| Other ATM Card Charges | PIN Regeneration Charges – NIL (Green Pin)

Card Replacement Charges – Rs. 100 Add-on Card Charges- Rs. 100 |

|

| Service Type | Free limit | Charges Beyond Free Limit |

| Cash Deposit Transactions | Rs. 5 Lakh/ 10 transactions | Rs. 2.50 per Rs. 1,000 (Min. Rs. 20/-) |

| Cheque book | One Free Chequebook per quarter (20 leaves) | Rs. 2 leaf |

| DD/PO transactions | Demand Drafts Payable at own Bank locations: Up to Rs. 2,000 – Rs. 20 Above Rs. 2,001 up to Rs. 10,000/- Rs. 50 Above Rs. 10,000- Rs. 2- Rs. 1,000 (Minimum Rs. 60 & Maximum Rs. 1,500) Payable at corresponding bank locations:Re. 1 per every Rs. 1000, minimum Rs. 25 DD + Correspondent Bank charges Revalidation/Duplicate DD: Free Cancellation: Free |

|

Suggested Read: 5 Best Salary Account Choices for Salaried Individuals

Basic Savings Bank Deposit Account (BSBDA)

Account holders can avail various banking features with Utkarsh Small Finance Bank Basic Savings Deposit Account. Let’s look at the various benefits offered by this account.

|

Utkarsh Bank Basic Savings Bank Deposit Account Features & Benefits |

|

Eligibility Criteria

Anyone residing in India or a Hindu Undivided Family can apply for Basic Savings Bank Deposit Account.

Fees and Charges

| AQB Requirements | AQB Non-Maintenance Charges | |

| NIL | NIL | |

| Debit Card | Rupay Card – Classic | |

| Card Fees | Issuance Fee (Primary Holder): Free Annual Fee (Primary Holder): Free |

|

| Withdrawal Limit | ATM Rs. 10,000 per day | |

| Per Transaction Limits | Rs. 10,000(own Bank ATM) Rs. 10,000 (other Bank ATM) |

|

| Shopping Limit | POS Rs. 10,000 per day | |

| Per Transaction Limits | POS Rs. 10,000 | |

| ATM Transactions | Unlimited Free Transactions | |

| Other ATM Card Charges | PIN Regeneration Charges – NIL (Green Pin) Card Replacement Charges – Rs. 100 |

|

| Service Type | Free limit | Charges Beyond Free Limit |

| Cash Deposit Transactions | Rs. 1 Lakh/ 4 transactions | Rs. 2.50 per Rs. 1,000 (Min. Rs. 20/-) |

| Cheque book | One Free Chequebook per quarter (20 leaves) | Rs. 2 leaf |

| DD/PO transactions | Demand Drafts Payable at own Bank locations: Up to Rs. 2,000 – Rs. 20 Above Rs. 2,001 up to Rs. 10,000/- Rs. 50 Above Rs. 10,000- Rs. 2- Rs. 1,000 (Minimum Rs. 60 & Maximum Rs. 1,500) Payable at corresponding bank locations: Re. 1 per every Rs. 1000, minimum Rs. 25 DD + Correspondent Bank charges Revalidation/Duplicate DD: Rs. 100 Cancellation: Rs. 100 |

|

Basic Savings Bank Deposit Account (Small)

This account is especially for customers belonging to lower sector of the society, who do not have proper KYC documents. Let’s look at the various benefits offered by this account.

|

Utkarsh Bank Basic Savings Bank Deposit Account (Small) Features & Benefits |

|

Eligibility Criteria

Anyone residing in India or a Hindu Undivided Family can apply for Basic Savings Bank Deposit Account.

Fees and Charges

| AQB Requirements | AQB Non-Maintenance Charges | |

| NIL

(The balance at any point of time should not exceed Rs. 50,000) |

NIL | |

| Debit Card | Rupay Card- Classic | |

| Card Fees | Issuance Fee (Primary Holder): Free Annual Fee (Primary Holder): Free |

|

| Withdrawal Limit | ATM Rs.10,000 per day | |

| Per Transaction Limits | Rs. 10,000 (own Bank ATM) Rs. 10,000 (other Bank ATM) |

|

| Shopping Limit | POS Rs. 10,000 per day | |

| Per Transaction Limits | POS Rs. 10,000 | |

| ATM Transactions | Unlimited Free transactions | |

| Other ATM Card Charges | PIN Regeneration Charges – NIL (Green Pin) Card Replacement Charges – Rs. 150 |

|

| Service Type | Free limit | Charges Beyond Free Limit |

| Cash Deposit Transactions | Up to Rs. 50,000 – 4 Transactions (whichever is earlier);

The aggregate of all withdrawals and transfers in a month should not exceed Rs. 10,000.The aggregate of all credits in a financial year should not exceed Rs. 1 lakh. |

Not Applicable |

| Chequebook | Not Applicable | Not Applicable |

| DD/PO transactions | Demand Drafts Payable on own Bank locations: Up to Rs. 2,000- Rs. 20 Above Rs. 2,001 up to Rs. 10,000- Rs. 50 Payable at corresponding bank locations:Re. 1 per every Rs. 1000, min Rs. 25 DD + Correspondent Bank charges Revalidation – Free Duplicate DD:Up to Rs. 2,000- Rs. 20Above Rs. 2,001 up to Rs. 10,000- Rs. 50 Cancellation: Rs. 100 |

|

Documents required for opening Utkarsh Small Finance Bank Savings Accounts

For Individuals

- Latest passport size photograph

- Aadhaar Card

- Address and Identity proof documents

- Proof of Date of Birth of your child ( in case of Minor Savings Account)

Documents Acceptable as Proof of Identity & Address (For Domestic Individual Savings Accounts)- Opening of Accounts / Address Change / Periodic Updation of KYC (Re-KYC)

- Passport

- Driving License

- Permanent Account Number (PAN)

- Voter’s ID Card (Issued by Election Commission of India)

- Job Card by NREGA (duly signed by an officer of the State Government)

- Aadhaar Card

For Hindu Undivided Family

- PAN Card copy / Form 60 of HUF

- Declaration from the Karta

- Proof of identification and address of Karta as per documentation for individual

- Prescribed Joint Hindu Family Letter signed by all the Coparceners

Note: Customers can visit the nearest Utkarsh Small Finance Branch to know about the required documents of Salary Account.

How to Apply for Utkarsh Small Finance Bank Savings Account?

Customers can apply for Utkarsh Small Finance Bank online on the official bank’s website (by filling all the necessary details). Account holders will be required to steps mentioned below:

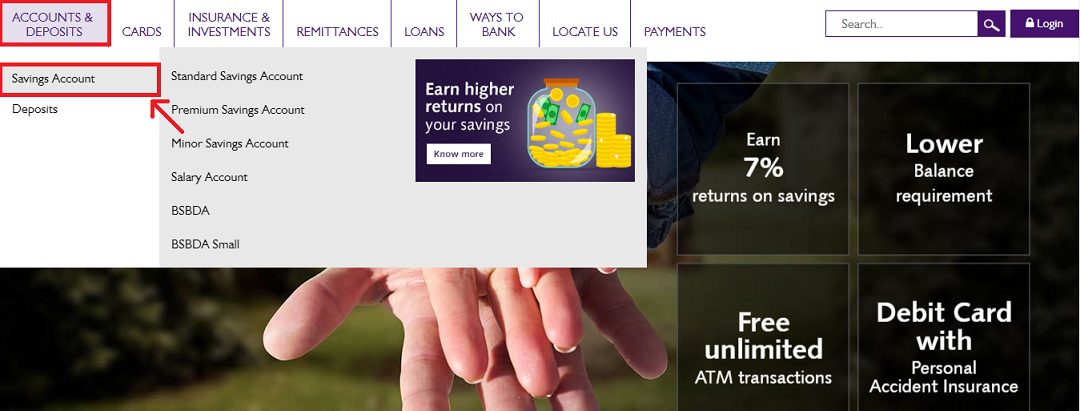

Step 1: Visit Utkarsh Small Finance Bank official website.

Step 2: Under the ‘Personal’ tab, move the cursor to ‘Accounts & Deposits’ and click on the savings account that the customer want to apply for.

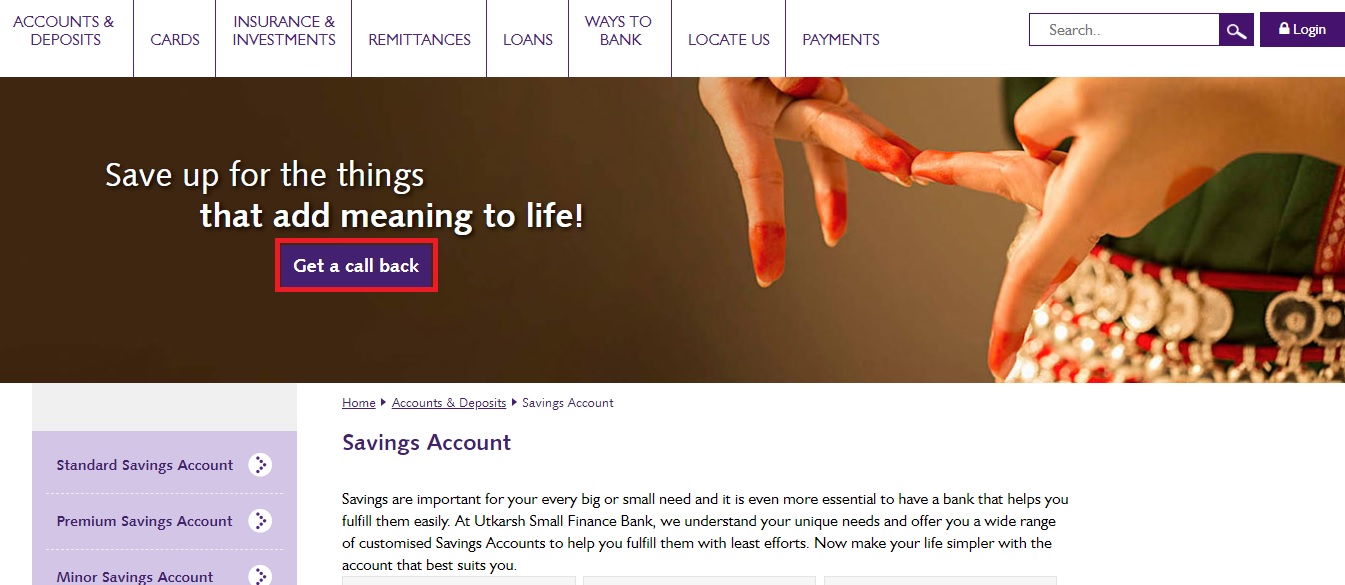

Step 3: On the savings account page, click on ‘Get a call back’.

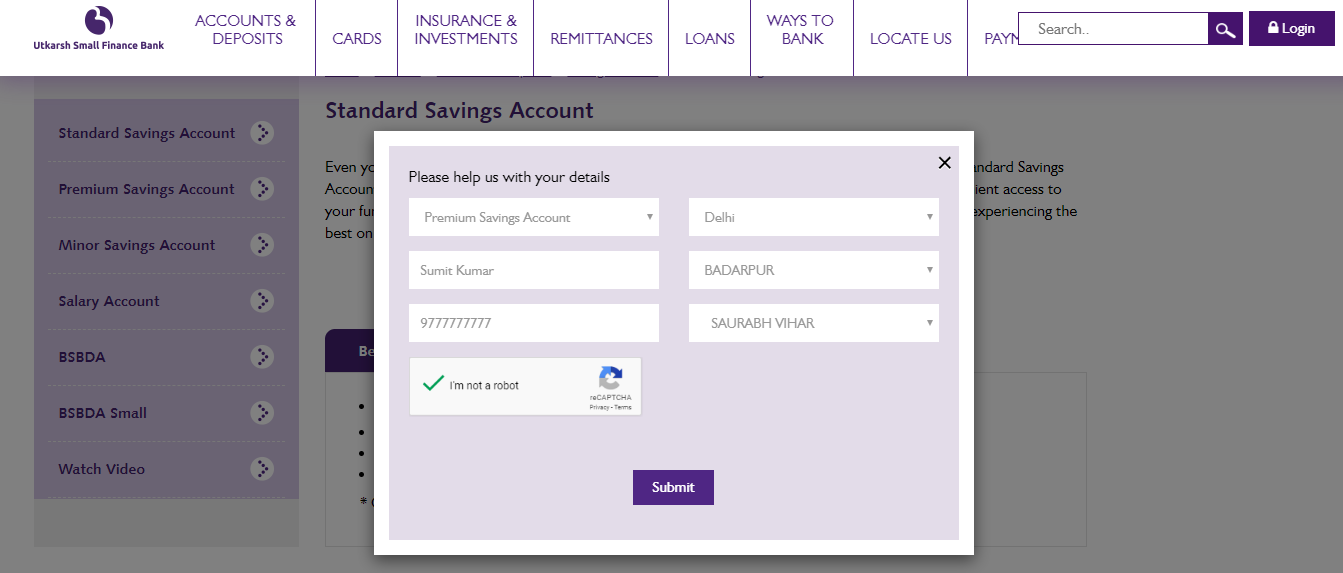

Step 4: Fill all the essential information and click on ‘Submit’.

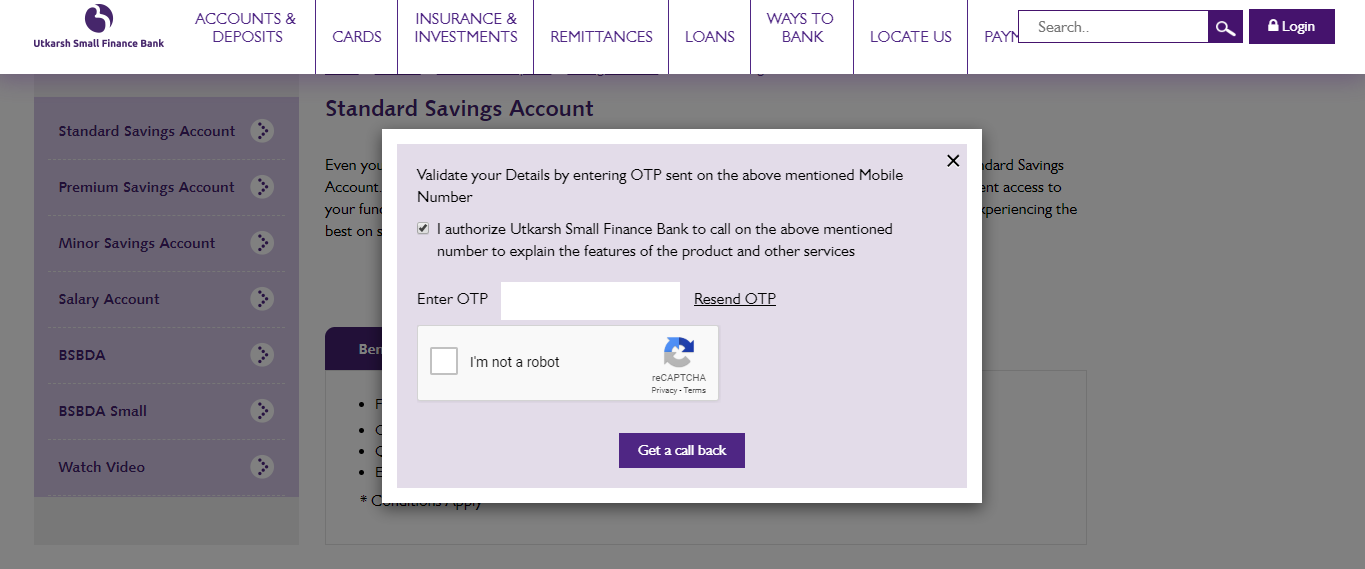

Step 5: Enter OTP to request for a call back from Utkarsh Small Finance Bank customer executive.

Alternatively, customers can apply for Utkarsh Small Finance Bank Savings Account offline by visiting the nearest branch.

Frequently Asked Questions

Q. What are the various types of savings accounts provided by Utkarsh Small Finance Bank?

A. The various types of savings accounts offered by Utkarsh Small Finance Bank are:

- Standard Savings Account

- Premium Savings Account

- Minor Savings Account

- Salary Account

- Basic Savings Bank Deposit Account(BSBDA)

- Basic Savings Bank Deposit Account(Small)

Q. Who all are eligible to open a Standard Savings Account?

A. Any resident of India or a Hindu Undivided Family can apply to open a Standard Savings Account.

Q. Which Debit Card comes along with Premium Savings Account?

A. Utkarsh Small Finance Bank Premium Savings account customers will get Platinum Debit Card along with the savings account.

Q. What is the daily transaction limit for Standard Savings Account?

A. The daily ATM withdrawal limit is Rs. 40,000 and the shopping limit is Rs. 1 lakh (POS).

Q. What are the documents required for individuals to open a Savings Account?

A. Following documents are required for individuals to open a savings account:

- Latest passport size photograph

- Aadhaar Card

- Address and Identity proof documents

- Proof of Date of Birth of your child ( in case of Minor Savings Account)

Note: The information on this page may not be updated. Kindly refer to the bank website to check the latest information.