Unified Payments Interface (UPI) is a fund transfer platform that allows users to transfer funds in real time. Developed by NPCI, UPI allows customers to transfer and receive funds through their smartphone 24 x 7. With the advent of this technology, it has become feasible for all to transfer funds instantly, especially small amounts. Utkarsh Small Finance Bank has made provisions for its customers to use this facility through Utkarsh UPI app.

Utkarsh Small Finance Bank UPI

Utkarsh UPI is a 24×7 facility provided by the bank. Customers have to register with the bank through their smartphones to avail this facility. Once registered, they can carry out safe and secure payments instantly through mobile. However, customers of the bank have to link their mobile number with Utkarsh savings account to avail this facility. This facility is also available for customers of other banks. Let us discuss more about this facility in detail.

Features of Utkarsh Bank UPI

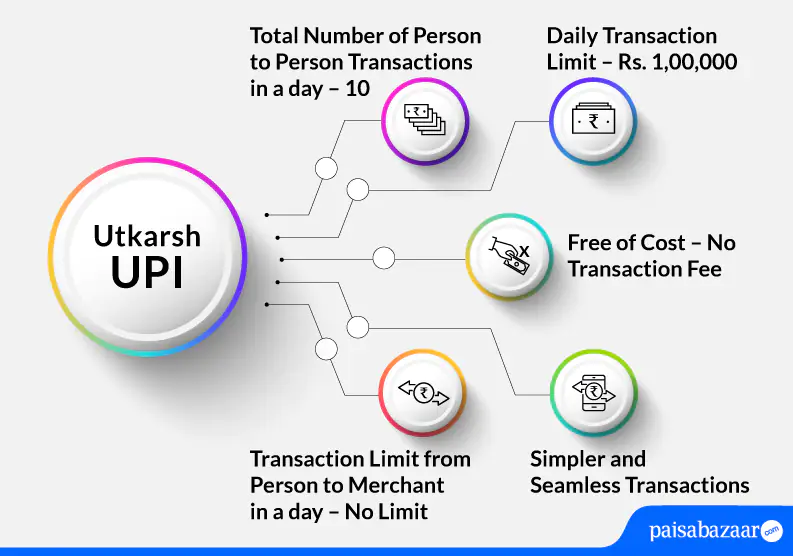

Utkarsh Small Finance Bank offers Utkarsh UPI application that is dedicated to provide UPI services. Below-mentioned are the features provided by this application:

- Provides the facility to make payments 24 x7

- The user can send, receive and collect money

- Facility to pay through QR code, UPI ID, or Account Number + IFSC in real-time

- Provides the facility of creating a Mandate

- Payments are safe and secure

- Option to download/share invoice

- Allows merchant payments

Also Read: Unified Payments Interface

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Utakrsh SFB UPI Limit

| Type of Transaction | Transaction Limit |

| Daily transaction limit person to person (pay and collect cumulative) | Rs. 1,00,000 |

| Total number of transactions person to person in a day (pay and collect cumulative) | 10 |

| Daily transaction limit person to merchant | No limit |

| Total number of transactions person to merchant in a day | No limit |

| New user | Rs. 5,000 within 24 hours |

| Number of collect requests allowed in a day for the new user | 5 |

| Number of collect requests allowed in a day for the existing user person to person | 5 |

| Daily collect limit from person to person (pay and collect cumulative) | Rs. 1,00,000 |

| Daily collect limit from person to merchant | No limit |

| IPO limit | Rs. 5,00,000 |

| For categories like Capital Markets, Collections, Insurance, Foreign Inward Remittances | Rs. 2,00,000 |

How to Register on the Utkarsh UPI App

Registering on Utkarsh UPI app is easy and quick. Following steps explain how to register on Utkarsh UPI app:

Step 1: Download and install Utkarsh UPI app from Google Play Store or Apple Store.

Step 2: Open the app and click on ‘Next’. Enter the registered mobile number with the bank and tap on ‘Register’.

Step 3: You will receive a confirmation SMS on your mobile number.

Step 4: On the next screen, enter your registered mobile number and name. Click on ‘Proceed’.

Step 5: Enter the name of your bank or choose your bank from the provided list.

Step 6: Select your account and form a UPI ID your choice or choose a UPI ID from the provided options. Tap on ‘Proceed’.

Step 7: Enter the desired 6-digit app PIN and then re-enter the same PIN to confirm. Add your valid email address or an alternative contact number. Accept terms and conditions. Click on ‘Submit’.

Step 8: Your registration will be successful.

How to Send Money using Utkarsh UPI App

Utkarsh UPI allows users to make payments through three methods: by scanning the UPI QR code, VPA, or bank transfer (IFSC). However, the easiest method to pay is by scanning the UPI QR code of the merchant. Below-mentioned process explains how one can send money using Utkarsh UPI:

Send Money through UPI QR Code

Step 1: Login to your Utkarsh UPI app by entering the application passcode.

Step 2: On the home scree, click on the ‘Pay’ icon.

Step 3: On the right side of the screen, click on the ‘QR’ tab to open the camera. Move the camera towards the UPI QR code to scan or you can also upload an existing image of the QR code from your mobile’s gallery.

Step 4: As you scan the QR code, the details of the beneficiary will be displayed on the screen. Enter the amount you wish to pay and click on ‘Submit’.

Step 5: A confirmation screen will be displayed with all the details of the transactions. Check and confirm all the details before making the payment. Once you confirm, click on the ‘Pay’ option.

Step 6: Enter the 4-digit UPI PIN and click on the blue tick mark to proceed further. Your transaction through QR code will be successful.

Send Money through VPA

Step 1: On the screen of the app, tap on the ‘Pay’ icon.

Step 2: Tap on the ‘Beneficiary VPA’. Type the VPA of the concerned beneficiary and then click on search option. Upon doing so, details of the beneficiary will appear on the screen. (These details can be saved for making future payments). Enter the amount you wish to transfer, and then click on ‘Submit’.

Step 3: You will see a confirmation screen with all the details of the transaction. Verify the details and tap on ‘Pay’.

Step 4: Enter the 4-digit UPI PIN to make the payment.

Step 5: Your transaction will be successful.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Send Money through Bank Transfer (IFSC)

Step 1: On the home screen of the app, tap on ‘Pay’.

Step 2: Tap on ‘Account’ tab to make payment through bank account number and IFSC.

Step 3: Click on Payee and carefully fill the details of the beneficiary such as name of the payee, payee’s bank IFSC and bank account number. (Details of the beneficiary can be saved for future payments).

Step 4: Add the amount that needs to be transferred and click on ‘Submit’.

Step 5: A confirmation screen with all the details will appear in front of you. Confirm the details and tap on ‘Pay’.

Step 6: Enter the 4-digit UPI PIN to make the payment. You payment will be successful.

How to Receive/Collect Money using Utkarsh UPI

Collecting money through Utkarsh UPI is simple, secure and hassle-free. Let us discuss the process of receiving/collecting money using Utkarsh UPI:

Step 1: Log in to Utkarsh UPI app by entering the application passcode.

Step 2: On the home screen, click on the ‘Collect’ option to raise a request for money.

Step 3: On the next screen, enter the VPA of the beneficiary or choose from the added beneficiary list from whom you want to collect money. In case of a new beneficiary add details such as VPA of the beneficiary, name, amount to be collected, expiry date of the transaction and then click on ‘Submit’.

Step 4: Your collection request will be successfully raised. The concerned person will be notified about your collect request.

How to Accept Payment Request on Utkarsh UPI App

Step 1: You will receive an SMS notification on your registered mobile number whenever someone send you a payment request.

Step 2: Tap on the notification to view the details of the payment request. Enter your 6-digit app password to login.

Step 3: Upon logging in, on the screen of Utkarsh UPI app, click on the bell icon on the top right side of the screen to check the received request. The payment request will appear in the bell icon section.

Step 4: Tap on the request and check all the details to whom payment will be done.

Step 5: Upon checking and confirmation, tap on ‘Approve’.

Step 6: Enter the 4-digit UPI PIN make the payment.

Step 7: Your payment request will be accepted successfully.

Suggested Read: Utkarsh Small Finance Bank Balance Enquiry

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Utkarsh UPI Customer Care

If the customer faces any issues and wants to raise a complaint regarding UPI, he/she can follow the below-mentioned steps:

- Login to Utkarsh UPI application

- View all UPI transactions

- Select failed transaction

- Raise dispute

In case of fraudulent activity, customers can reach out to the customer care team on the mentioned toll-free numbers: 1800 208 1788/1800 123 9878. Alternatively, customers can also send an email at customercare@utkarsh.bank.

Utkarsh UPI FAQs

Q. What if I forget my UPI PIN?

Ans. In case you forget your UPI PIN, you will have to re-generate your UPI PIN. Regenerating your UPI PIN will require your debit card details. (Last 6-digits of your debit card and expiry date).

Q. If I de-register from Utkarsh UPI, do I need to register again?

Ans.. Yes. If you de-register from Utkarsh UPI, you will have to register again by following the whole process of registration.

Q. How many VPAs can I add under Utkarsh UPI?

Ans. At the max, you can add three VPAs in the Utkarsh UPI app.

Find Out – What is Virtual Payment Address in UPI

Q. Is it possible to change a default account for doing UPI transactions?

Ans. Yes. There is a possibility to change/add a default account number. Follow the mentioned steps for the same.

- Login to Utkarsh UPI application

- Tap on ‘Settings’ icon

- Tap on default account option present under ‘added account list’ to set the particular account as default account

Q. Do I need to register again for Utkarsh UPI if I change my phone/SIM?

Ans. Yes. In case you change your SIM/phone, you will have to register for Utkarsh UPI again.

Q. What does “Mandate” mean in UPI? And, what is the process to create a “Mandate” in Utkarsh UPI?

Ans. “Mandate” feature in UPI allows customers to pre-authorize a transaction for debit from the customer’s account later. The below-mentioned steps explain how one can create a “Mandate” in Utkarsh UPI:

- Login to Utkarsh UPI application

- Tap on ‘Mandate’

- Select create new

- Input the UPI ID/add UPI ID from contacts

- Enter the required details as asked and tap on ‘Submit’

Q. How can I download/share my UPI QR code in Utkarsh UPI application?

Ans. To download/share your UPI QR code in Utkarsh UPI application, go to ‘My Profile’ or VAP Management.