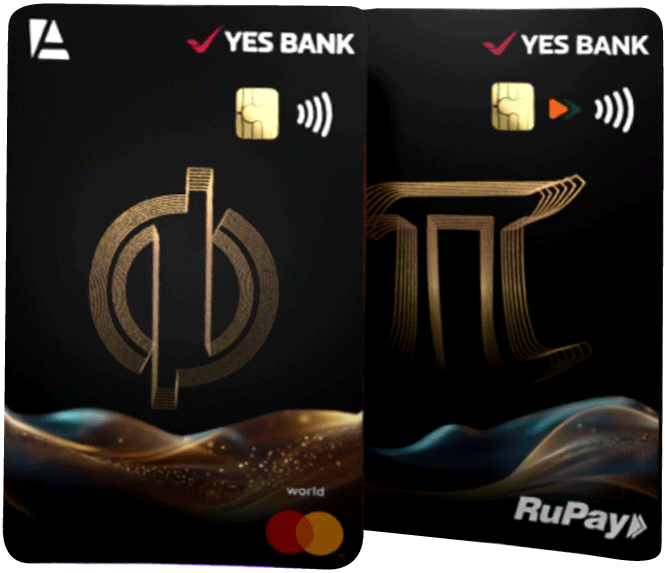

YES Bank Anq Phi Credit Card Overall Rating: ★★★ |

|

|

|

| Rewards Benefits | ★★★ (3.5/5) |

| Lounge Access | ★★ (2/5) |

| Other Benefits | ★★★ (3/5) |

Note: This card is not available on Paisabazaar.com. Content on this page is for information purpose only. To express interest in this card, please visit the Yes Bank website – Yes Bank Anq pi Credit Card & Yes Bank Anq Phi Credit Card

YES Bank Anq Phi Credit Card lets the users make both domestic and international purchases and offers up to 24 reward points on every Rs. 200 card spend. With accelerated rewards rate on key lifestyle-related spending categories, like food, dining, groceries, travel and UPI transactions, Phi and Pi credit cards come with a decent rewards program for the cardholders. However, when it comes to the rewards redemption, these cards might not fit the bill for all customers since you can only redeem your points against market-linked assets like Digital Gold and Anq Coins. These redemption options are quite different from the usual ones offered by other credit cards which generally include statement credit, product catalogue, air miles, etc.

Overall the YES Bank Anq Phi and Pi cards features and benefits give a decent value-back at a low annual fee of just Rs. 499 which can be later waived off on satisfying the condition of Rs. 1.2 lakh annual spends which is easily achievable for an average spender. This card can be a good choice for those looking for a rewards credit card with high rewards rate of the above discussed accelerated categories and those who are comfortable with the redemption options offered by the card provider.

Read further to know more about EYS Bank Anq Phi & Pi Credit Cards benefits.

| On this page |